We should all K.I.S.S

Cant do that. Corona.

I could fist you. I think that's the latest guidance. Or maybe just what I'm leading with in conversation.

Helps keep social distancing too, strangely.

We should all K.I.S.S

The way it is going there will be lots of pain ahead as this is totally unprecedented in the modern age.

Watties Economic and Social Chaos Formula

Massively Overvalued Ponzi Gobal Stockmarkets

Plus

Record High Global Levels Of Outstanding Government, Corporate and Private Debt

Minus

[A daily (exponentially increasing) global Corona Virus Social health problem

Multiplied

By it’s impact on Human interaction/ mental welfare/ production/ trust in governments

Multiplied by the economic impact on

Financials, Utilities, Consumer Discretionary, Consumer Staples, Energy, Healthcare, Industrials.,Technology, Telecoms, Utilities,Real Estate

And Loan Repeyments (Government, Corporate, Individual,) ]

Equals

The End Of The Global Financial System And Our Modern Daily Lives As We Know It.

They’re gonna have to bail out everything.

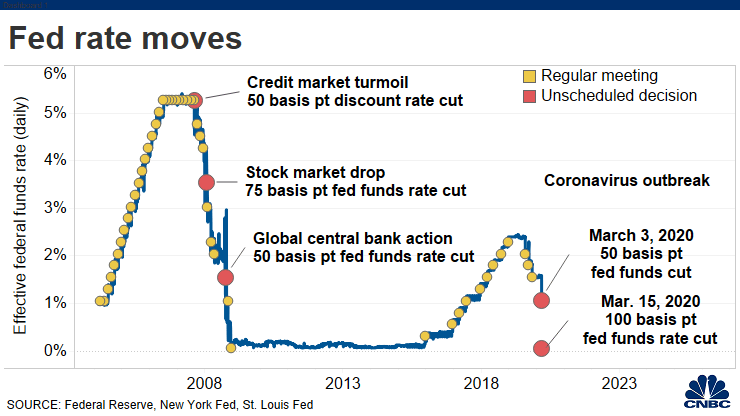

The QE and rate cut are plasters on an axe wound. The important thing they did was all the major CBs coming together to open USD swap lines - this was critical to address USD shortage.

We've alrady got a liquidity crisis.....$12 TRILLION of it...read the ZH stuff.Doesn't lower interest rates aim to increase loans and therefore investment? Therefore if so doesn't this have an impact of reducing liquidity and cash reserves from the lender? Won't that potentially cause a liquidity crisis?

This is kind of my point and a slightly worrying issue. We had a credit crunch after the 2007 horrors for different reasons. Surely this credit crunch and liquidity squeeze will be much worse.We've alrady got a liquidity crisis.....$12 TRILLION of it...read the ZH stuff.

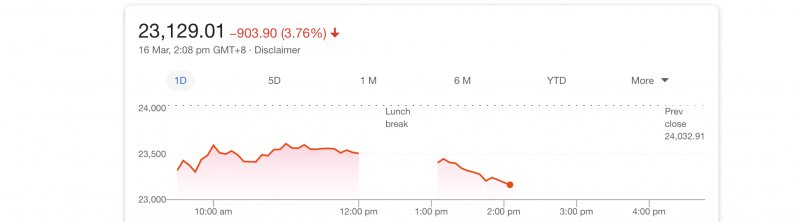

Not sure you’re gonna make it to the end of the week at this rate Catman. HSI hanging in there 24318, down nearly 4%.

View attachment 66637