Froddy

Member

- Messages

- 1,072

Now that you put it that way, Wattie, you're spot on!1.2%’s a beating?

Nearly 7% in 30 days.......what are equities at?

Flog me all day long!

Now that you put it that way, Wattie, you're spot on!1.2%’s a beating?

Nearly 7% in 30 days.......what are equities at?

Flog me all day long!

Is that an intentional pun?Now that you put it that way, Wattie, you're spot on!

Very good! ....Is that an intentional pun?

OMG, by the way I don't understand 95% of this but I know it isn't good.I can't underline this enough: the markets are today broken. I never saw this in the Crisis and I was at the epicentre running a £1bn book in credit (bond & derivative) trading. We had gapped pricing etc., yes. But for the top 3 investment banks to not bid US Treasuries - this is beyond belief. US Treasuries are the bedrock and basis of the entire financial system. If it persists for a few days we aren't talking low/high we are talking sticks and stones. What the Fed did today cannot be contextualized on previous market behaviour.

It's like fearing 20 people won't turn up to a house party and inviting every major football clubs' supporters to ensure the house is full. This is very, very, very bad as I said before...

MG, thanks for explaining something in a way even I can understand! Top man.There is an extreme need for USD despite the Fed effectively offering unlimited USD as of yesterday. This points to extreme dislocations far removed from what equities are demonstrating. Notably in cross currency swaps where e.g. a European EUR based corporate borrows in USD but fixes this cost over 5ys in EUR using cross currency swaps. When there are massive market moves the margin calls become huge on such derivatives yet they underpin much of global corporate non-native currency borrowing. Basically everyone bought USD assets and funded it in EUR, GBP or something else. Now (as an analogy) repayment day has come early and everyone needs USD. Cable (GBP/USD) has gone from 1.30 to 1.23 in days for this reason.

I dont understand a lot of it but I know enough that its many many magnitudes worse than the GFC if it hits the fan........They will always seemingly fashion a way or create a way to prop it up somehow.

1.2%’s a beating?

Nearly 7% in 30 days.......what are equities at?

Flog me all day long!

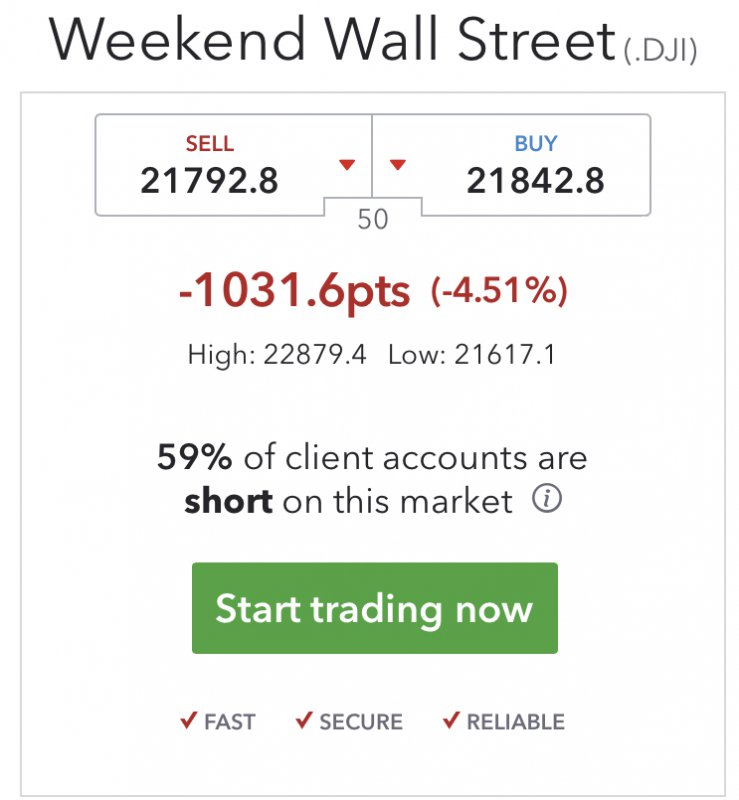

View attachment 66729

Can I suggest those interested in this stuff start listening to this American chap. He sometimes goes a bit “excitable annoying American” but he knows his stuff. He’s been pretty much spot on re this fraud for years.

Re my comments above on the systemic issues he explains them here. Worth a watch

Oh, he’s a Maserati Ghibli driver too- I pm’d him to join.

Interesting read

Market Crash. Is It Over, Or Is It The "Revenant" | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

The Aftermath - Surveying The Wreckage From Last Week's Market-nado | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Interesting read

Market Crash. Is It Over, Or Is It The "Revenant" | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Fear not, Lozcb, HM Govt has a plan!Im ony 4'6" wattie , bit above my head all that , so basically we were having our regular monthly tickle , someone caught a fecking cold who spread it around , the accountant got it and has gone off sick with the petty cash tin , and all we have left for the weekend is whats in our pockets

Is that in stilettos?Im ony 4'6" wattie , bit above my head all that , so basically we were having our regular monthly tickle , someone caught a fecking cold who spread it around , the accountant got it and has gone off sick with the petty cash tin , and all we have left for the weekend is whats in our pockets

As this deteriorates I expect the Fed to seek permission from Congress to buy Corporate bonds and equities.They will always seemingly fashion a way or create a way to prop it up somehow.

I've been banging the same drum all my life about saving a bit, having a decent rainy day fund both in the business and personally. So by sacrifice, choice and design we have enough set aside in the business and personally to weather a storm for at least a year.

Nothing clever, just not spending every penny earnt. However as we know many are on the edge every day and don't have enough to get to the end of next week let alone the end of the month. I have sympathy for many but on the flip side no sympathy for the rest.

We have had businesses and personal finances over leveraged by far too many multiples for far too long. If a squeeze really starts it could potentially get very messy very quickly.

You could see 720's and the like dropping like stones and much further. Anything that is a luxury and not a necessity could be hit and hit hard. Must be a ton of businesses wide open to be hit hard.

When you start getting people scrambling for liquidity then assets will need to be sold. If the market becomes saturated there will be a scramble as sellers try to find a buyer which will be thin on the ground of course.

Anyone with lots of cash could hoover up a ton of bargains of all sorts potentially. Also possibly at silly silly prices. The likes of WBAC/BCA won't have enough cash to buy all the cars that will need selling. They potentially could go pop themselves.

The car leases may be OK but if any car is a luxury and not needed it will go. Then a further glut of cars on the market going nowhere fast.

The govt and the majority of the population have created a poor highly leveraged society and the openness for this to be obliterated and quickly is worrying.

I guess our small business with very low overheads, ongoing revenues and so much potential for remote IT Support/Services is not a bad place to be. There are certainly.many worse places for sure.

We could implode into depression and beyond a simple recession quite quickly if we are not careful. The Corona Virus will not be the cause but merely a trigger or catalyst. The house of cards is all there ready to fall and has been for some time. Just needs a strong wind or a decent vibration and the precarious construction is severely at risk of tumbling down.

I genuinely hope this doesn't happen and I hope we learn our lessons but I fear we won't. As we found when we were kids.....sometimes you can't be told and need to find out yourself.....the hard way!