Froddy

Member

- Messages

- 1,072

This 30 min chart of the FTSE may be of interest (I know some of you have traded it previously):

Last edited:

Mmmmnnnn, not for the first time. I’ll point out.Not fixated at all, just observing you seem extraordinarily keen to promote the views of a blog run by a Bulgarian trader found guilty of insider trading, and with proven links to the Russian political machine that, on both counts, would just love to see the financial markets crash. Oh, and guess what, also has an overwhelming bias towards gold investment.

First rule of....

30 million unemployed in the worlds “greatest”

Mmmmnnnn, not for the first time. I’ll point out.

Convicted criminal-Lagarde.

(https://www.theguardian.com/world/2...ce-despite-guilty-verdict-in-negligence-trial)

Feck off RWC13, you’re way out you’re depth.

Who’s your pension scheme with?

Coronavirus: ECB expands response to provide liquidity backstop for eurozone

The ECB said that it would lower interest rates on a facility that essentially provides cheap loans to eurozone banks.uk.finance.yahoo.com

You live in Portugal don’t you?

Yeah...I've got one of those to...uncut!Diamonds ...............if you know your stuff buy rough uncut , as good a hedge as gold will be

Not north of Watford are they....my palace in Cumbria was only x4 my annual income...bargains still to be had up here!It's simple, house prices need to come down to reflect earnings. For many years up until 2000 it was like house prices were on average three to four times an annual salary. Now they are as much as 20 times! Something has to give.

Mmmmnnnn, not for the first time. I’ll point out.

Convicted criminal-Lagarde.

(https://www.theguardian.com/world/2...ce-despite-guilty-verdict-in-negligence-trial)

Feck off RWC13, you’re way out you’re depth.

Who’s your pension scheme with?

Coronavirus: ECB expands response to provide liquidity backstop for eurozone

The ECB said that it would lower interest rates on a facility that essentially provides cheap loans to eurozone banks.uk.finance.yahoo.com

You live in Portugal don’t you?

I remember a time back in 2002 when I was involved in a business closure. No guarantee of a job afterwards so I was incentivised to stay on to help close the business down. Cut a long story short, I recieved a £50k payout... give or take for the privilege. A kings ransom to me at that time. Not really knowing much about investments then, my old MD said to put it into gold. It was $282 per ounce at the time. Because I had a young family, I decided to play it safe and put into a University fund for my 2 lads in the future. Looking back it is the biggest regret of my life!! Just imagine what could have been.....I would have thought you guys would have been more interested in the GBP or Eur prices- which hit all time highs last week.

Maybe RWC13 will finally get the message, doubt it.

Latest from Bullion Vault here.

Made for the Breaking

from Adrian Ash

Director of Research, BullionVault

IMAGINE buying 4 grams of gold for just £7.29 per gram...

...a mere €10.65 for Euro investors...

...equal to just $425 per Troy ounce in US Dollars.

That was how much BullionVault's first public customer paid in mid-April 2005...

...testing our service with what turned out to be a small deposit, before transferring more cash to buy more gold.

That looks a very smart move today.

Compared to 15 years ago, the yellow metal has now risen 4 times over in US Dollar terms...

...5 times higher in the Euro...

...and a massive 7 times higher for UK investors and savers.

BullionVault has meantime become the No.1 service for private investors wanting to own securely stored precious metals...

...enabling more than 83,000 people from 175 countries to enjoy the savings, security and deep liquidity of the professional bullion market from as little as 1 gram at a time.

We were supposed to be hosting a small party this coming Thursday to mark BullionVault's 15th birthday.

But no one outside West London can get anywhere near Hammersmith, we can't meet or greet each other anyway, and no one feels much like celebrating.

Postponing our party 'til happier times, we will have make do with a team-chat on Zoom...gawping no doubt at the choice of wallpaper and junk piled up in each other's spare rooms.

Gold also keeps raising eyebrows.

Last week it marked St.George's Day by topping €1600 an ounce for Euro investors...

...and it topped £1400 an ounce for UK investors...

...a massive 20% higher for 2020 so far.

Too much, too fast? Or way too much across far too long?

The best-performing asset of the 21st Century so far, gold has outrun stock markets across the world since April 2005.

New York's Dow Jones Industrial Average, for instance, has lost almost half its valuewhen you price it in gold.

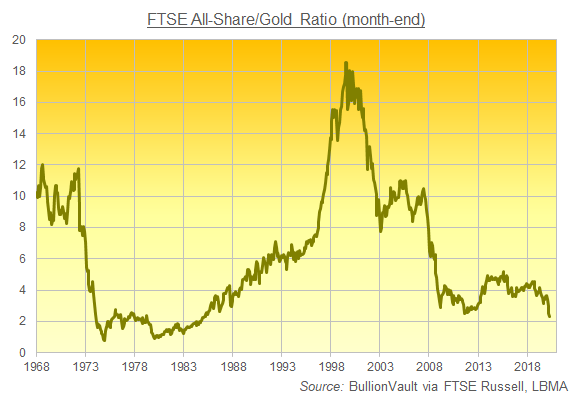

And as our chart shows, gold has really crushed the value of UK equities...

...squashing the price of the FTSE All Share index by four-fifths.

Clearly, any new investor buying gold today will wish they bought sooner.

Some of those already in gold might think it's time to get out.

I mean, how much lower can the stock market drop when priced in gold?

Isn't this time to swap back...selling metal and buying shares?

Very possibly, yes.

Dividing one by the other, the FTSE All-Share index has sunk from 8.6 ounces of gold in April 2005 to just 2.3 ounces today.

Put another way, gold has become nearly 4 times more valuable in terms of listed corporate assets.

So if you sold shares and bought gold in April 2005, then good for you. Because you can now buy almost 4 times as much UK equity with your metal.

But what if you miss the final move? What if the UK stock market sinks to its record low against gold...

...dropping to just 0.75 ounces...

...as it did amid the Oil Crisis collapse of 1973-74...?

That would see gold rise almost 3-fold further in terms of UK equity.

And from there, nothing says the historic low can't blow out either.

I mean, just look at oil.

Priced in cash, US crude oil actually went negative last week.

Yes, producers were paying people to take the stuff away, albeit for a few hours.

Partly that was because of how the futures market works. But mostly it was because crude oil is highly useful, vital indeed to our commercial and economic life.

And that life is on pause right now.

Hence the collapse in oil demand. Hence the glut of crude...the lack of spare storagespace...and the dozens of massive tankers floating off Southern California, stock full of oil with nowhere to go.

Gold, in contrast, is pretty much useless for anything but storing wealth. And while London and Zurich's vaults are also filling up, that's because people actually want and are buying the stuff...not because they are refusing it. Quite the opposite.

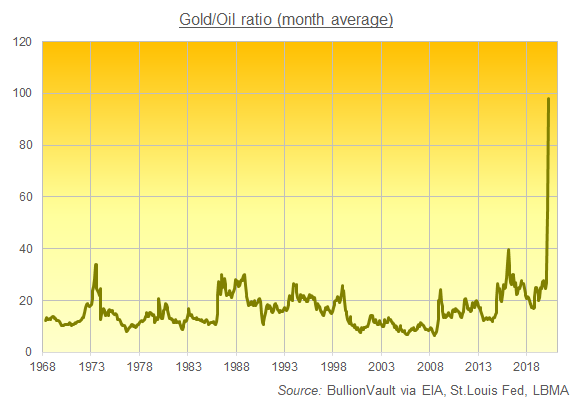

Tracking this move from useful to useless, how many barrels of crude oil could you get for 1 ounce of gold?

Prior to March 2020, the Gold/Oil Ratio averaged 14 barrels per ounce. Over the last 5 decades or so, it moved between 7 at gold's lowest to 40 at its dearest.

Then all of a sudden it jumped to new highs. Last month it averaged 55...

...and so far in April the Gold/Oil ratio stands at 98.

Last Monday's negative values confuse things a bit. But all-time highs and lows exist to be broken.

Who ever thought crude oil would go negative? Who ever imagined a catastrophe quite like Covid-19...?

BullionVault wasn't built on any such foresight. Not specifically. But bad things do happen, awful and terrible things which...besides destroying livelihoods and lives...can leave savers poorer by crushing the value of what they've put aside.

That's why, back in 2005, it simply seemed that adding a little gold to your investments looked a wise move. We think it still does.

Because by spreading your risk...and by rebalancing your assets every so often...you don't have to try so hard to guess what the future will bring.

{C9168569513852463451422966443019}

Gold (spot) has broken rising wedge support.An update for the gold bugs - it's getting very close to a breakout/breakdown now on the 4hr chart - expect action soon as price is squeezed out of this 4hr triangle (which is itself at the top of a daily wedge):

I'd be inclined to sit tight - FTSE futures are in freefall today (30 min chart):Are there any shares to watch on this thread?

This has been the pattern with GGP. Solid rise in anticipation of results then short term investors taking profit. Nothing wrong with that. Hoping history repeats and we see a solid rise towards 15p through June and July before next quarterlies. Then it’s maiden resource estimate and possible buy out. I hope to top slice through the next results and will probably hold 50% in the hope of a buy out. Greatland are a solid outfit.Further great survey results at Havieron today:

Investegate |Greatland Gold PLC Announcements | Greatland Gold PLC: Further Outstanding Drill Results at Havieron

Investegate announcements from Greatland Gold PLC, Further Outstanding Drill Results at Havieronwww.investegate.co.uk

Doesn't seem too have impacted GGP share price

Hopefully the University fund did well too. Hindsight’s the greatest investing tool of all time.I remember a time back in 2002 when I was involved in a business closure. No guarantee of a job afterwards so I was incentivised to stay on to help close the business down. Cut a long story short, I recieved a £50k payout... give or take for the privilege. A kings ransom to me at that time. Not really knowing much about investments then, my old MD said to put it into gold. It was $282 per ounce at the time. Because I had a young family, I decided to play it safe and put into a University fund for my 2 lads in the future. Looking back it is the biggest regret of my life!! Just imagine what could have been.....

There sure are, go back a few pages.Are there any shares to watch on this thread?

You did the right thing! Imagine if you'd lost that money and denied your boys the gift of education? There's no price on that, and you have bestowed immeasurable wealth upon them.I remember a time back in 2002 when I was involved in a business closure. No guarantee of a job afterwards so I was incentivised to stay on to help close the business down. Cut a long story short, I recieved a £50k payout... give or take for the privilege. A kings ransom to me at that time. Not really knowing much about investments then, my old MD said to put it into gold. It was $282 per ounce at the time. Because I had a young family, I decided to play it safe and put into a University fund for my 2 lads in the future. Looking back it is the biggest regret of my life!! Just imagine what could have been.....

Good call to wait re the Gold downside Froddy.Gold (spot) has broken rising wedge support.

Daily chart

4hr chart:

Christ almighty who ever expected to get independent financial advice from an IFA? Predominately O Level in Economics advice on how to invest for the long term ever seen. At least that means you have seen the light but that does not mean that the contra argument is always right. Markets will recover in time and many of us here have the ability to manage our wealth in a way that does not involve having to collect a corral of others to help substantiate our front running ideals. Look after yourself but wind back on the tertiary website quoting shite.

If u haven’t sacked your IFA or Discretionary Wealth Manager.

You’re stupid.

Yes, it looks like profit-taking to me - the price movement is very organised and normal - notice how closely price respects the Fibonacci levels.This has been the pattern with GGP. Solid rise in anticipation of results then short term investors taking profit. Nothing wrong with that. Hoping history repeats and we see a solid rise towards 15p through June and July before next quarterlies. Then it’s maiden resource estimate and possible buy out. I hope to top slice through the next results and will probably hold 50% in the hope of a buy out. Greatland are a solid outfit.

Yes, it looks like profit-taking to me - the price movement is very organised and normal - notice how closely price respects the Fibonacci levels.

Yesterday the stock painted a bearish engulfing candle on the daily chart, and a correction will be confirmed if price closes lower today.

@GTVGEOFF hope you're watching and waiting for that possible re-test of 6 so you can get back in??

Thanks for thinking of me, yes been saying to myself should have stayed in, no regrets, I am now looking to get back in, if you could give hint at what level I would be extremely grateful, but understand if you don't want that pressure.

Take care all

T