You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Shares to watch

- Thread starter tan55555

- Start date

Froddy

Member

- Messages

- 1,072

GTVGEOFF,

At the moment the chart is looking short-term bearish (corrective) as it retreats from its over-bought condition, but there's always the chance that buyers will come in and push the price up again soon.

Price may test the anchored VWAP from the 16th March low which (as of today) sits at 6.28 but this will move upwards each day.

It may also test the previous support/resistance at c. 5.90.

Ideally, we'd like to see a successful test of 5.90 to confirm that what was once resistance is now support, but price may simply bounce off the VWAP and then rebound before it gets there; or, of course, it may fail to hold both and fall further - we just don't know.

Two other ways to approach it are to look for a momentum shift to the upside, or a candlestick reversal pattern. I'll keep an eye on all of these and let you know if I spot anything.

One thing I can't do is guarantee that you will make any money!

At the moment the chart is looking short-term bearish (corrective) as it retreats from its over-bought condition, but there's always the chance that buyers will come in and push the price up again soon.

Price may test the anchored VWAP from the 16th March low which (as of today) sits at 6.28 but this will move upwards each day.

It may also test the previous support/resistance at c. 5.90.

Ideally, we'd like to see a successful test of 5.90 to confirm that what was once resistance is now support, but price may simply bounce off the VWAP and then rebound before it gets there; or, of course, it may fail to hold both and fall further - we just don't know.

Two other ways to approach it are to look for a momentum shift to the upside, or a candlestick reversal pattern. I'll keep an eye on all of these and let you know if I spot anything.

One thing I can't do is guarantee that you will make any money!

AT3200AC

Junior Member

- Messages

- 73

Very interesting stuff Froddy. What allows me to sleep at night is the long term position and most of my investing is based on that. If the underlying strength of the company is good and the news feed likely to be positive then you can dial out a lot of the short term stuff.GTVGEOFF,

At the moment the chart is looking short-term bearish (corrective) as it retreats from its over-bought condition, but there's always the chance that buyers will come in and push the price up again soon.

Price may test the anchored VWAP from the 16th March low which (as of today) sits at 6.28 but this will move upwards each day.

It may also test the previous support/resistance at c. 5.90.

Ideally, we'd like to see a successful test of 5.90 to confirm that what was once resistance is now support, but price may simply bounce off the VWAP and then rebound before it gets there; or, of course, it may fail to hold both and fall further - we just don't know.

Two other ways to approach it are to look for a momentum shift to the upside, or a candlestick reversal pattern. I'll keep an eye on all of these and let you know if I spot anything.

One thing I can't do is guarantee that you will make any money!

Geoff - it might be worth splitting your pot and buying in tranches averaging up or down through May. Once GGP are into June and July you have interim and quarterly reporting influencing buyers so I would want to have my holding in place by then.

As usual, do your own research and once your in stay committed until at least the last week of July. It will be at fever pitch by then with people shouting maiden resource estimate and takeover whilst quoting 25p a share.

Good luck.

Wattie

Member

- Messages

- 8,640

I just can't get my head round the recent Tesla stock price increase to levels getting towards silly levels again. The numbers just seem odd to me. Here is a recent chart of the top 10 car companies:

View attachment 68521

Tesla said it had delivered more than 367,500 cars last year - up 50% from 2018. Volkswagen delivered almost 11 million vehicles last year, while Toyota sold more than 9 million in the first 11 months of 2019. Tesla has also never made an annual profit. Even if you factor in that an average Tesla might cost 3 or 4 times the cost of an average VW or Toyota. It still doesn't remotely stack up. Am I missing something? Why is Tesla worth $100bn?

Tesla generated $24.6 billion in revenue in 2019 but still didn’t turn an annual profit — in fact, it lost $862 million in 2019. That that was better than the $1 billion loss the company posted in 2018. The company pulled down a $105 million profit in the fourth quarter, though that was boosted by the sale of $133 million worth of regulatory credits to other automakers.

An average EV/EBITDA seems to be 10-15 but Tesla's is circa 65. With many US comments suggesting many S&P company's stock seems expensive even at current levels surely Tesla is really expensive. I had them on my radar if they hit 700 so it is certainly on my radar for a short position at beyond this point. If it hits 800 then I'm in.

Some very odd accounting going on at Tesla apparently.

This yesterday-

Elon Musk tweet wipes $14bn off Tesla's value

The tweet was one of several bizarre postings, including a promise to sell his possessions.

www.bbc.com

This isn’t the first time he’s deliberately moved the share price with a tweet.

Wattie

Member

- Messages

- 8,640

Markets seem to be embracing reality over the last couple of days, will this reverse the trend.Gilead CEO live on CNBC just now. Will he talk Remdesivir up?

Gilead gets emergency FDA authorization for remdesivir to treat coronavirus, Trump says from CNBC.com

MaseratiGent

Member

- Messages

- 162

Wattie there is more to life than ZeroHedge

The FT had a great article yesterday about how central banks can print/monetise as much as they want but that addresses firms' "liqudity" but there is no way to address "solvency" which we are entering. Hertz, Virgin, et al. For they the bell tolls.

The FT had a great article yesterday about how central banks can print/monetise as much as they want but that addresses firms' "liqudity" but there is no way to address "solvency" which we are entering. Hertz, Virgin, et al. For they the bell tolls.

Wattie

Member

- Messages

- 8,640

Welcome back, where have you been?Wattie there is more to life than ZeroHedge

The FT had a great article yesterday about how central banks can print/monetise as much as they want but that addresses firms' "liqudity" but there is no way to address "solvency" which we are entering. Hertz, Virgin, et al. For they the bell tolls.

Didn’t see that, will try to search it out.

The defaults are gonna come in a surge, private, public, corporate, state, country.

Some shares to keep an eye on- according to Barrons.

Covid-19 Is Creating a Different Kind of Debt Crisis. But Some Stocks Looks Like Buys.

Covid-19 is blowing a gaping hole in the balance sheets of American corporations. It’s a big problem for stock investors who, essentially, are seeing billions in value transferred from themselves to bondholders.

Read in Barron's: https://apple.news/ABLvqtZ5gTBKXbYtdpn74Rg

Last edited:

Froddy

Member

- Messages

- 1,072

On balance, I don't think we're going down again ... just yet.Markets seem to be embracing reality over the last couple of days, will this reverse the trend.

Gilead gets emergency FDA authorization for remdesivir to treat coronavirus, Trump says from CNBC.com

Whilst the S&P has broken trendline support on its ascending wedge pattern on the daily chart (bearish sign), I don't think the market internals point to an immediate continuation.

Here's the ascending wedge breakdown:

Here are the internals:

(a) Put:call ratio - circled blue line ideally needs to cross below 0.8 to signify that the crowd has gone sufficiently long to be crucified:

(b) Skew - ideally needs to cross above 135 to signify that Big Money is getting nervous - it's not yet nervous enough:

(c) VIX - gapped up yesterday and then fell (WTF?) despite 2.65% stock market fall:

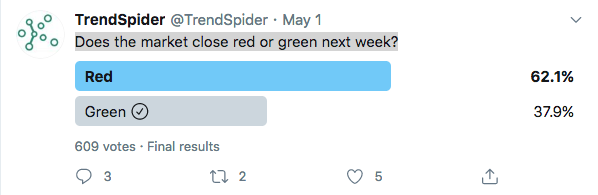

And then perhaps the most compelling evidence of all: a survey of a sample of retail (amateur) traders who represent "the crowd":

Don't fight the Fed.

Is this is a possibility?

Of course I could be completely wrong - I usually am!

Last edited:

rockits

Member

- Messages

- 9,172

I don't see how this bubble won't burst or at least deflate massively. The return to a reasonable economy is dependent on people spending. How will this happen with so much unemployment and weak, failing or failed businesses?

The US will have likely unemployment of way over 10% and it wouldn't surprise me if by the end of the issues that this hits almost 1930 depression levels of near 25%

No amount of money printing can fix this as by its nature it is surely inflationary so exacerbates the problem further.

Everyone seems to have lost the word and understanding of fundamentals. Simple effective liquid profitable business. Not debt ridden growth dependent potential businesses that never ever actually deliver in real terms.

Surely Tesla is one of the biggest that might fall or need to be bailed out or propped up. The business valuation is absurd and its ability to burn cash when sales faulter (which they will) is epic.

The US will have likely unemployment of way over 10% and it wouldn't surprise me if by the end of the issues that this hits almost 1930 depression levels of near 25%

No amount of money printing can fix this as by its nature it is surely inflationary so exacerbates the problem further.

Everyone seems to have lost the word and understanding of fundamentals. Simple effective liquid profitable business. Not debt ridden growth dependent potential businesses that never ever actually deliver in real terms.

Surely Tesla is one of the biggest that might fall or need to be bailed out or propped up. The business valuation is absurd and its ability to burn cash when sales faulter (which they will) is epic.

Froddy

Member

- Messages

- 1,072

I totally agree with you, and I'm talking very short-term (days or weeks) when I say the conditions aren't quite right for an immediate downward move. Whilst you were responding, I was editing, and I added this (theoretical) chart:I don't see how this bubble won't burst or at least deflate massively. The return to a reasonable economy is dependent on people spending. How will this happen with so much unemployment and weak, failing or failed businesses?

The US will have likely unemployment of way over 10% and it wouldn't surprise me if by the end of the issues that this hits almost 1930 depression levels of near 25%

No amount of money printing can fix this as by its nature it is surely inflationary so exacerbates the problem further.

Everyone seems to have lost the word and understanding of fundamentals. Simple effective liquid profitable business. Not debt ridden growth dependent potential businesses that never ever actually deliver in real terms.

Surely Tesla is one of the biggest that might fall or need to be bailed out or propped up. The business valuation is absurd and its ability to burn cash when sales faulter (which they will) is epic.

It's my fault for not making that clear - apologies ...

Wattie

Member

- Messages

- 8,640

Nailed it as far as I’m concerned.I don't see how this bubble won't burst or at least deflate massively. The return to a reasonable economy is dependent on people spending. How will this happen with so much unemployment and weak, failing or failed businesses?

The US will have likely unemployment of way over 10% and it wouldn't surprise me if by the end of the issues that this hits almost 1930 depression levels of near 25%

No amount of money printing can fix this as by its nature it is surely inflationary so exacerbates the problem further.

Everyone seems to have lost the word and understanding of fundamentals. Simple effective liquid profitable business. Not debt ridden growth dependent potential businesses that never ever actually deliver in real terms.

Surely Tesla is one of the biggest that might fall or need to be bailed out or propped up. The business valuation is absurd and its ability to burn cash when sales faulter (which they will) is epic.

The debt cycle is turning and there’s gonna be an awful lot of it unpaid when the fat lady sings.

rockits

Member

- Messages

- 9,172

Understood and agreed. Seems to have been a recent false recovery based.on not much. I can see a few light ups and downs for a few weeks maybe months. Maybe as the summer ends and reality hits home then maybe the expected will start to play out.I totally agree with you, and I'm talking very short-term (days or weeks) when I say the conditions aren't quite right for an immediate downward move. Whilst you were responding, I was editing, and I added this (theoretical) chart:

It's my fault for not making that clear - apologies ...

Wattie

Member

- Messages

- 8,640

Berkshire hoarding cash and sitting on the sidelines suggest it expects a downwards trajectory.

www.cnbc.com

www.cnbc.com

Asked why they ain’t buying he said “we have not done anything because we haven’t seen anything that attractive,"

With these fundamentals and valuations I can see why.

Airlines are gonna be under pressure as a result at the open.

Warren Buffett says Berkshire sold all its airline stocks because of the coronavirus

Buffett said Berkshire sold its entire stake in United, American, Southwest and Delta Airlines, worth more than $4 billion on December 31.

Asked why they ain’t buying he said “we have not done anything because we haven’t seen anything that attractive,"

With these fundamentals and valuations I can see why.

Airlines are gonna be under pressure as a result at the open.

rockits

Member

- Messages

- 9,172

Warren Buffett dumps US airline stocks, saying 'world has changed' after Covid-19

The legendary investor indicates that financial markets could still have further to fall as worldwide cases edge towards 3.5m

Wattie

Member

- Messages

- 8,640

Is this the reason stocks recovered their losses and eeked out a small gain......the market expects a lot of this to manipulate it.

www.nasdaq.com

www.nasdaq.com

U.S. Treasury expects to borrow record $3 trillion in second quarter

The U.S. Treasury Department on Monday said it plans to borrow nearly $3 trillion in the second quarter of 2020 - a record for any quarter - as the federal government contends with the impact of the coronavirus.

Froddy

Member

- Messages

- 1,072

The market won't reverse until the (short) crowd capitulates and goes long: we're not quite there yet, but it won't be long ...Is this the reason stocks recovered their losses and eeked out a small gain......the market expects a lot of this to manipulate it.

U.S. Treasury expects to borrow record $3 trillion in second quarter

The U.S. Treasury Department on Monday said it plans to borrow nearly $3 trillion in the second quarter of 2020 - a record for any quarter - as the federal government contends with the impact of the coronavirus.www.nasdaq.com

Froddy

Member

- Messages

- 1,072

Here's how it works:The market won't reverse until the (short) crowd capitulates and goes long: we're not quite there yet, but it won't be long ...

Wattie

Member

- Messages

- 8,640

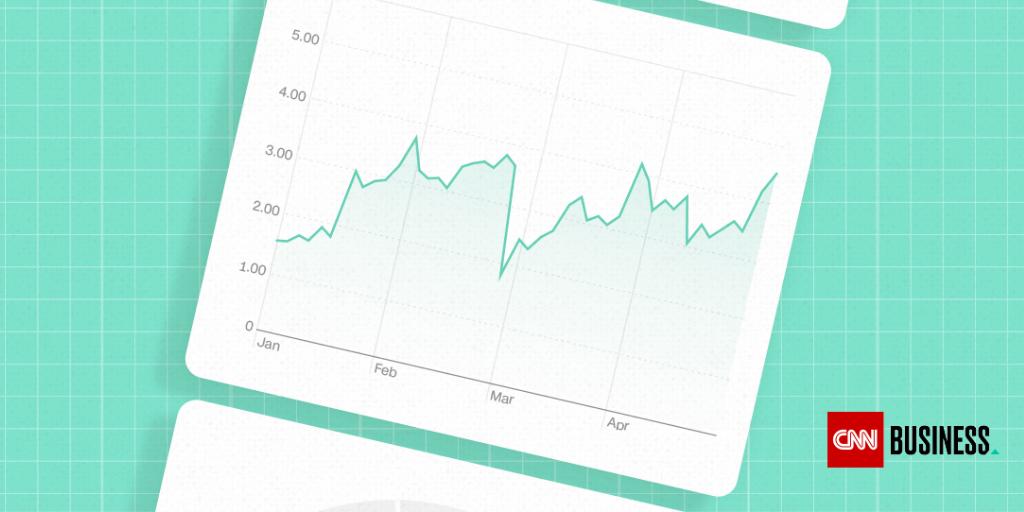

The Coronavirus stock dashboard.

edition.cnn.com

edition.cnn.com

See the stocks that are moving the most in the Covid economy

Coronavirus has taken stocks on a wild ride. Here’s how the outbreak is affecting global markets.

Froddy

Member

- Messages

- 1,072

Patience ... technicals not quite there yet.

Interestingly, the AUDJPY forex pair is looking bearish and is in a volatility squeeze. This is very important as it represents risk on/off sentiment (or used to - not sure what the rules are anymore! A fall used to mean risk off for the markets ...)

4hr chart:

Interestingly, the AUDJPY forex pair is looking bearish and is in a volatility squeeze. This is very important as it represents risk on/off sentiment (or used to - not sure what the rules are anymore! A fall used to mean risk off for the markets ...)

4hr chart:

Last edited: