Wattie

Member

- Messages

- 8,640

Bloomberg - Are you a robot?

www.bloomberg.com

Will the Fed rescue everyone.......it would appear so and that is going to involve unimaginable levels of cash.

Well, there's no evidence whatsoever that beyond push stock prices into bubble territory- that QE aids the economy.......but that's presently in turbo trillions mode by every central bank.Can't see it happening. We have seen negative rates do little and/or don't work so see no reason why it might happen in the UK or US.

I think we both know negative rates will achieve little and QE in various guises is the strongest method they have at the moment.Well, there's no evidence whatsoever that beyond push stock prices into bubble territory- that QE aids the economy.......but that's presently in turbo trillions mode by every central bank.

As the Ponzi runs out of cash, they'll need to find ever more extreme means to force cash into the game. -ve rates is one way.

Well, debts already an issue. That why they chuck Trillions more at it whenever it threatens to collapse.I think we both know negative rates will achieve little and QE in various guises is the strongest method they have at the moment.

There seems to be various potentrial methods touted to literally make the debts disappear (temporarily) but obviously all are a fudge and lies or sweeping under a carpet for a while. It is just a case of when it will rear it's ugly head again.

I guess it is just like rubbish. We have been burrying it in landfill for years. It hasn't caused an issue and resurfaced yet but it will. I suspect not for quite some years though.

I wonder how and where they could bury the debt and how long it would take before it resurfaced then became an issue?

I think BRH (Braveheart Investment Group) is worth backing. It is one of the possible Covid winners because working on an aptamer test which could be a game changer. For me the security comes from their other interests including owning 50% of the company who supply the NHS with alcogel hand sanitizer. This has skyrocketed in both demand and price. Once business is allowed to re-open everyone will be buying this in industrial quantities.

Of course I could be wrong, but can see this being £2 before too long, seems undervalued at 35p.

[/QUOTE

Bloomberg - Are you a robot?

www.bloomberg.com

Will the Fed rescue everyone.......it would appear so and that is going to involve unimaginable levels of cash.

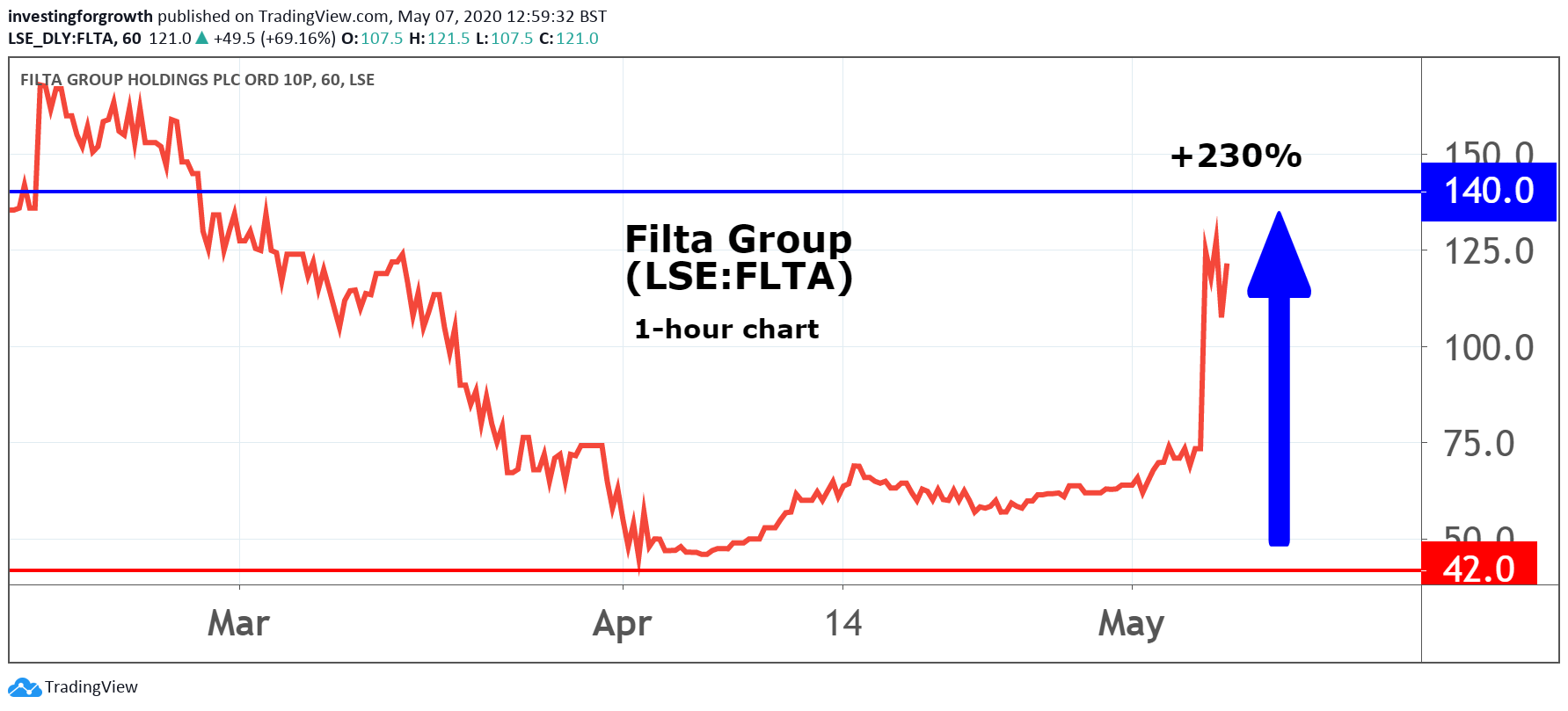

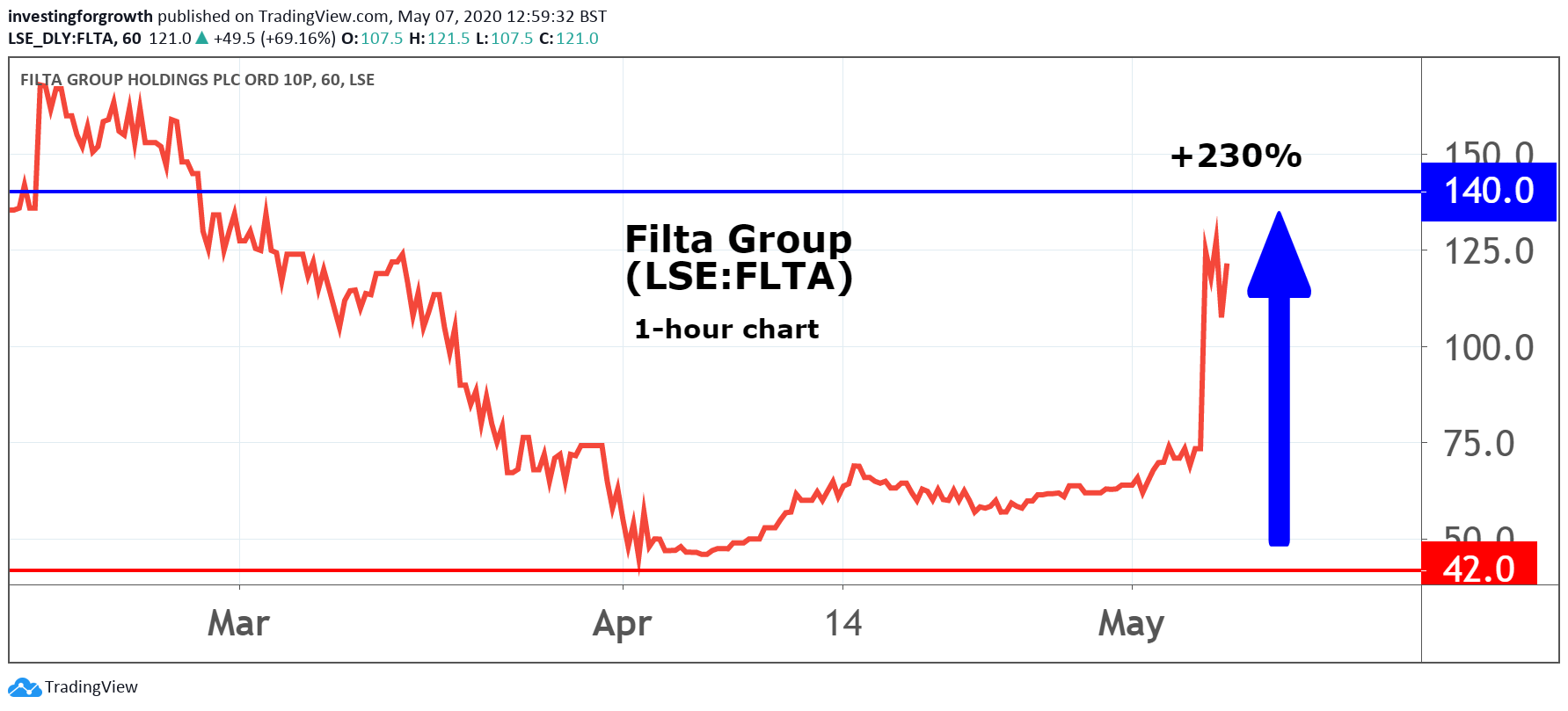

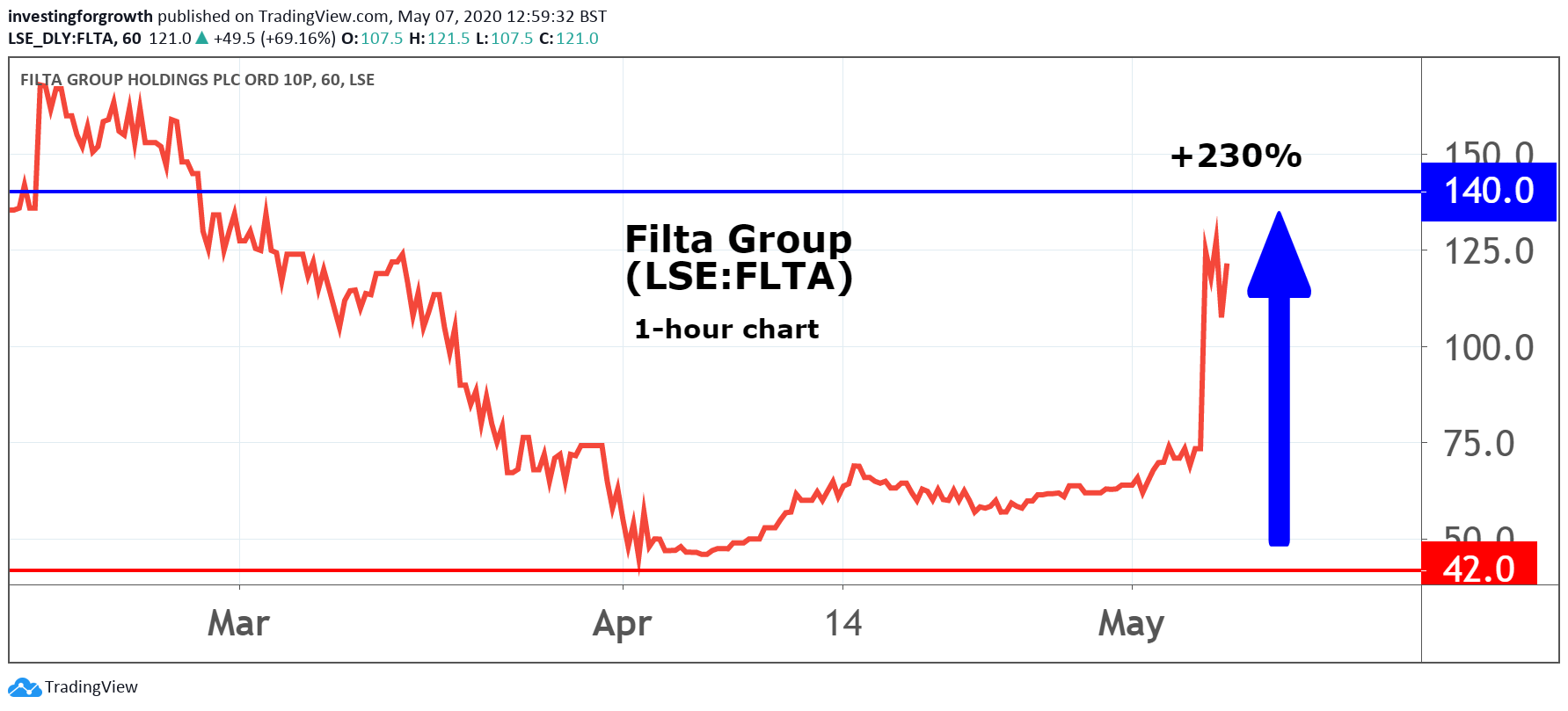

Nice spot Wattie, unfortunately the markets are closed here today as it's a bank holidayfirm Filta (LSE:FLTA), whose latest venture is a laboratory-tested sanitising solution for use in restaurants, bars, shops, offices as well as healthcare facilities. It not only kills all viruses in minutes, it leaves behind a mono-molecular layer that bonds to the surface and protects for up to 30 days.

As well as the UK launch of FiltaShield, the Rugby-based company is also supplying and managing temperature screening devices so that its customers can screen up to 30 people per second for a fever. The devices are installed at the entrances of buildings.

Having seen shares tumble in recent weeks due to the closure of restaurants and bars in the UK and North America, today's update fired up the AIM-listed stock in spectacular fashion. Shares, which traded at 159p in February, doubled in the opening minutes of trade today and are around 60% higher at 115p this lunchtime, recouping a chunk of its coronavirus losses. They had changed hands for as much as 140p earlier.

firm Filta (LSE:FLTA), whose latest venture is a laboratory-tested sanitising solution for use in restaurants, bars, shops, offices as well as healthcare facilities. It not only kills all viruses in minutes, it leaves behind a mono-molecular layer that bonds to the surface and protects for up to 30 days.

As well as the UK launch of FiltaShield, the Rugby-based company is also supplying and managing temperature screening devices so that its customers can screen up to 30 people per second for a fever. The devices are installed at the entrances of buildings.

Having seen shares tumble in recent weeks due to the closure of restaurants and bars in the UK and North America, today's update fired up the AIM-listed stock in spectacular fashion. Shares, which traded at 159p in February, doubled in the opening minutes of trade today and are around 60% higher at 115p this lunchtime, recouping a chunk of its coronavirus losses. They had changed hands for as much as 140p earlier.

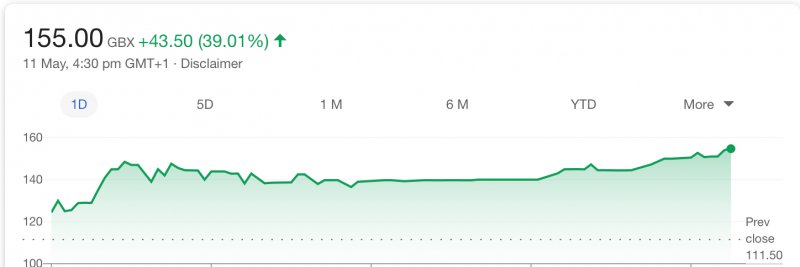

Hit 160 at peak today but closed out at 130. Its a swingy one..

I not familiar so can’t assist soz.What are peoples thoughts on ESL? I've been eying these since they began trading again but they have been erratic at best so always bottled it. Up to 14 at one point. They began trading again at 5 and are hovering around 6 at the moment.

Surely business is good for them at the moment but I guess my concern is that with 200m of debt, some of it charged with 18% interest, is it just too much for them to survive.

Won't buy bars, as he says if they spike then it's a hard sell. Coins all the way for me. Loving them! Canadian Maple are just different level quality.Interesting, points.

I’d add- silver is far more volatile.

Not for the faint hearted, whereas gold is steady eddy.

Central banks don’t buy silver.

Coins- massive premiums for pretty pictures imo. What u want is the metal. Buy the most expensive bar from the most reputable dealer that u can afford.

personally I have bars, Not coins but you pays your money you takes your choice

hard sell?Won't buy bars, as he says if they spike then it's a hard sell. Coins all the way for me. Loving them! Canadian Maple are just different level quality.