Wattie

Member

- Messages

- 8,640

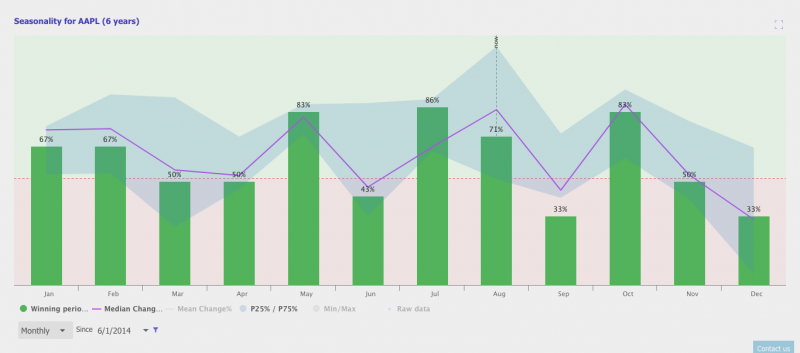

Oh yeah I’m holding the longs alright or at least most of them. Waiting for the big move up... Have some concurrent to trade, which has worked nicely recently. Just trying to remember it’s leveraged and not to over trade, need to leave enough spare cash in there to not get caught with pants down if there’s a really heavy drop...

So if we get a bounce, hopefully I can cash some out and keep the longer termers. Ta for the prediction

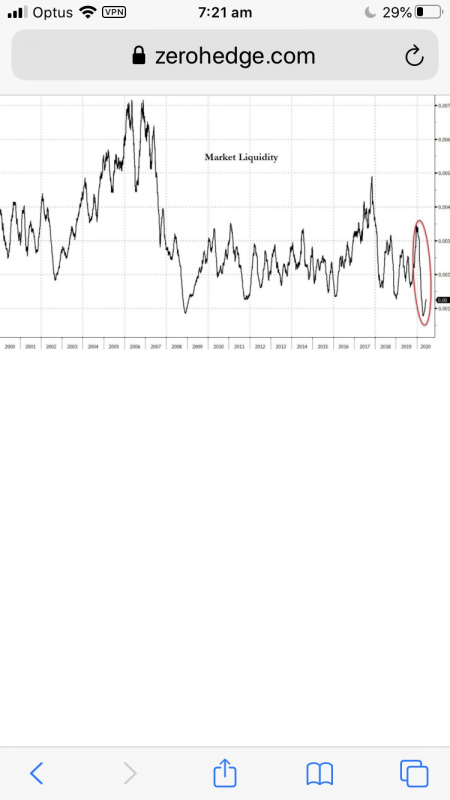

"Horrendous" Market Breadth "Stinks To High Heaven", Screams Imminent Risk-Off | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero