Overnight, DXY ($US index) has reached, and has been perfectly rejected at, the upper broadening formation trendline; the last time it touched it (and was rejected) was in Jan 2017 - first chart. I have no idea whether price will break through, or fail here - we'll just have to wait and see. DXY does not represent the performance of GBP/USD, but the performance of the dollar across a basket of the major currencies. The weakness of GBP as a currency is a different matter.

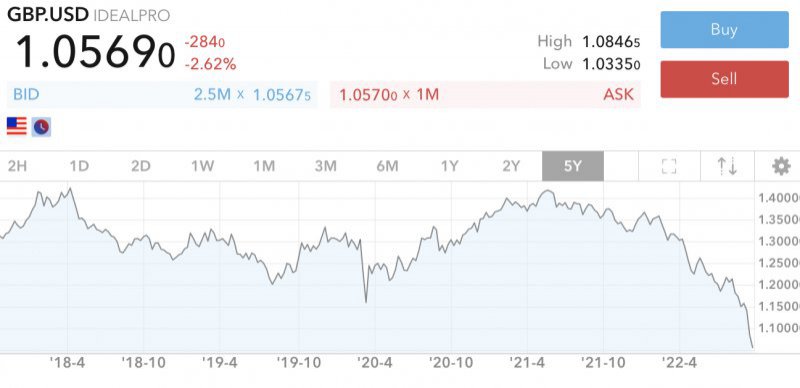

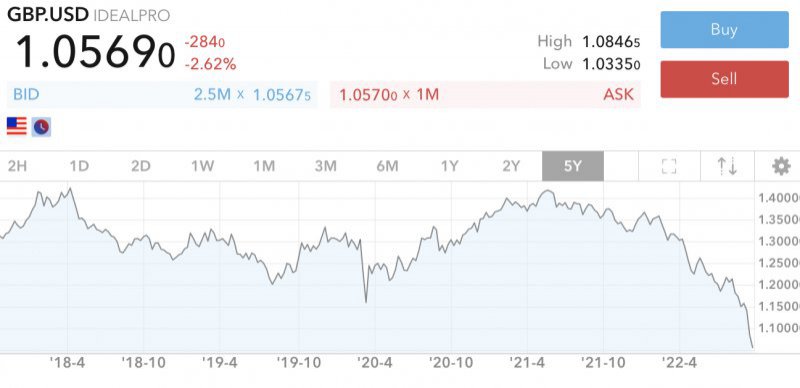

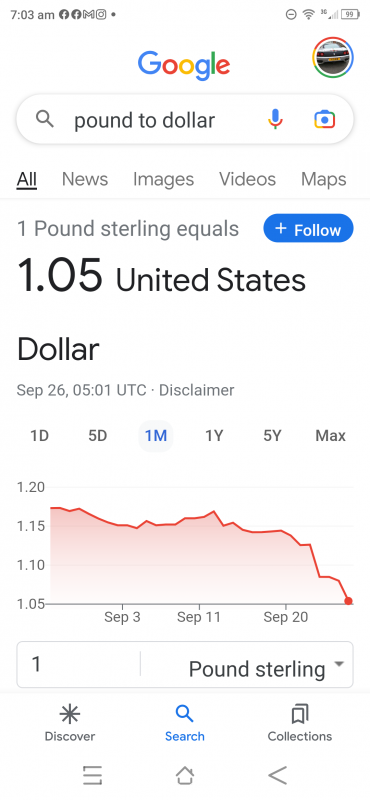

GBPUSD fell below the all-time low overnight, but has since recovered - second chart. The all-time low was the obvious target for the shorts. The question which now arises is whether, with price having been taken below the all-time low, there has been a liquidity sweep to trigger buy and sell stops, or whether this is true price discovery. We will have to watch the action a little longer before we can make that call. For now, it certainly looks pretty bleak for GBP across the board, but we need to watch that dollar too ...