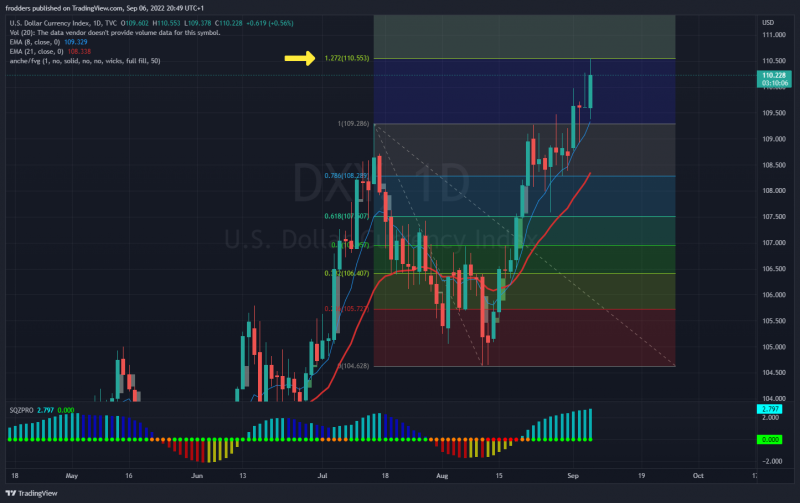

Hi Wattie I think the probabilities favour a

short-term DXY retracement/fall towards those FVGs, but I can’t say when that will happen - it could take days, or it could take weeks. These are extraordinary times and, frankly, anything could happen! There’s evidence elsewhere to support a correction (see earlier posts) including bearish RSI divergence, price being too far from the mean (price always reverts to the mean), and price rejection at the 1.272 Fib extension of the prior swing. A classic scenario would be a push higher, and then a failure at the highs before the retracement begins (a “double top”), potentially with another liquidity grab (also knows as a “fake out”) to trap the bulls. A weakening DXY would obviously mean a strengthening GBP/USD.

Unsurprisingly, there are also FVGs to be filled to the upside on the GBP/USD daily chart (marked below)

View attachment 106009

With GBP, it’s important to look at the bigger picture - it’s approaching its all-time low on the yearly chart (below). Is 1.052 on the cards? Note the increased volume in recent years which

may be suggestive of accumulation for a move higher in future years. Who knows?!

View attachment 106011