That's the whole point - the banks cannot kill crypto because it is decentralised and nobody owns it. India has tried to ban crypto recently but failed. Indeed all of the large investment banks have recently launched Bitcoin trusts. Even the US is about to launch its first BTC ETF.

The crypto market is a strange mixture of different types of coins. Bitcoin is solely a store of value - like gold. Then there are real utility coins like Cardano, which recently gave identity (via mobile crypto wallet) to 5 millions kids in Ethiopia. It will allow micropayments at virtually no cost and will effectively become a world-computer hosting decentralised applications catering for digital payments, investing, digital identity, supply chain tracking, gaming and just about anything else you can think of. Then there is the world of decentralised finance - coins such as AAAVE and Compound, which have $42BN locked in (doubled since Jan this year) and give typical returns of 8-30% pa. Banks have been ripping us off for years but crypto allows us to benefit from the real investment profits.

Personally, I don't get the whole digital art concept, but there is no doubt that NFTs will be huge, with musicians being payed reliably and computer games able to swap and sell inventory that they have won, in the real world. IBM is now turning its patents into NFTs to be stored securely on the blockchain.

Coins like 'Synthetix' allow digital representations of real world assets such as oil or gold, and tie the coin to the real world value of the asset. The only issue I see with this is that, if you can then stake the coin to earn 8% interest, why would you invest in the real world asset? So investment in the real asset will reduce, the asset value will go down, which will then be reflected in the synthetic coin value = downward spiral.

Stablecoins mimic the value of currencies - typically the USD, but can be staked to provide liquidity and will earn better interest than anything from the establishment.

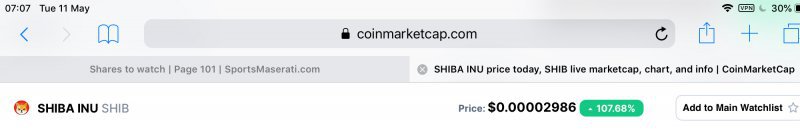

And finally, there are the joke coins that have no utility whatsoever, but can be pumped by the public in the short term.

Overall, the crypto world has huge merit and will eventually become mainstream, but is currently very immature and is absolutely riddled with scams, so whatever you do, be careful.