With such broad and knowledgeable members that I'm sure have experience in this, this seems as good a place and thread as any to ask for opinions/advice, as its the potential recession and inflation that's got me considering changing my long term plans.

We have two rental properties, that were previously our individual homes before we bought together. We bought them in 2001 and 2004 and have been renting them out since 2007. My plan has always been to keep them for as long as possible and possibly add to the portfolio along the way for future capital growth as well as an income and maybe even into retirement.

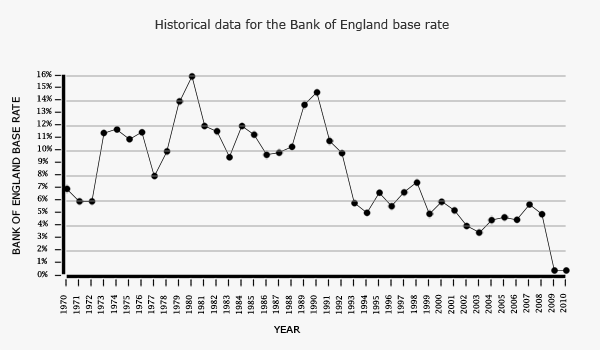

They have served us very well, and obviously have increased in value significantly in that time. Due to mortgages being so cheap throughout most of that period, it enabled us to borrow against them and get our modest 'forever' home (or at least until we downsize in later life). We have been in that for 10 years now.

I've been doing the (rough) sums, and are now at the point where at today's prices we could sell both rentals and pay off our residential mortgage, which sounds amazing, is very tempting and much earlier in life (I'm 44) than I could have ever imagined a decade ago.

The reason it was never really the plan in the past, was the maths. Due to cheap borrowing and rents climbing, having the debt of 3 mortgages didn't bother me one bit as it meant the income from the rentals was almost paying all 3 mortgages anyway, plus the bonus of capital growth.

My thoughts for possibly changing my mind -

-All 3 mortgages come out of their fixed deals at various points over the next 2 years, so obviously they won't be anywhere near as cheap on renewal.

-House prices are very likely to fall fairly hard in the near future.

- If I wanted to get back into property again, wait till they are cheap. (Sell now high, buy again low)

- Recession and cost of living crisis meaning tenants might not pay rent etc..

-Government continuously hitting landlords with new rules - hard to evict, less tax breaks, Expensive 'eco' improvements for EPC ratings etc...etc...

- If the **** really hits the fan, ww3, redundancy etc, we own our house, and that would be comforting.

Thoughts for remaining on plan -

- property has served me very well over the last 22 years and without it wouldn't be anywhere near where I am now. It 'should' continue to do well in the long term.

- We rode out the downturn in 2008 without any real problems despite going into negative equity on our previous residential home .....will this one be worse ?

- Plan to semi-retire around 55 (11 years from now) so if I ride it out, its quite likely it'll have fully recovered to at least what it is now by then.

- No hassle with having to sell two houses, sitting tenants, asking them to leave etc...

So who would like to share their opinions?

What would you do?