stindig

Member

- Messages

- 450

Remember, I’m into crypto and the market is on the floor at the moment. I’m holding though, as it’s all manipulation so that the institutions, who left it too late, can get a decent entry point. Crypto is an open ledger so you can see exactly who is buying, who is selling and who is holding. The big guys are just trying (successfully) to scare retail investors out of the market

Watch any of the mainstream YouTube crypto channels. Some have really good insight into this. Have you wondered why Elon suddenly went off Bitcoin just 3 weeks after announcing that he was accepting it as payment for Tesla’s? Blackrock are his 3rd biggest investor and missed the boat on Bitcoin. It could be a coincidence…Out of interest, where did you find this perspective/background? I’m also 40% down and hodling!

That's because your inputs are wrong. You'll need to use live market data. The screen shots above are clearly stills from the movie 'contact' when they first detect alien radio signals...View attachment 87112View attachment 87113View attachment 87114I keep drawing flags but I don’t think I have the hang of it because the stocks refuse to behave

Crypto is certainly on its knees as things stand, unfortunately. Below is the daily Bitcoin/USD chart reflecting some fairly deep (short-term) technical weakness which must be overcome if there's to be any improvement. Don't think I've shown this type of chart to you guys before.Remember, I’m into crypto and the market is on the floor at the moment. I’m holding though, as it’s all manipulation so that the institutions, who left it too late, can get a decent entry point. Crypto is an open ledger so you can see exactly who is buying, who is selling and who is holding. The big guys are just trying (successfully) to scare retail investors out of the market

You have to be really careful when telling yourself stories like this in investment markets. Certainty and confidence are the enemy. Especially when you’ve made a nice narrative about a powerful enemy against a plucky good guy. Stories get you into all sorts of trouble when applied to investing.Remember, I’m into crypto and the market is on the floor at the moment. I’m holding though, as it’s all manipulation so that the institutions, who left it too late, can get a decent entry point. Crypto is an open ledger so you can see exactly who is buying, who is selling and who is holding. The big guys are just trying (successfully) to scare retail investors out of the market

I completely agree, and I do think when you look at the market cap of some yet-to-be-fully functional coins, and see that they are higher than eg Vodafone, things may be overblown. It will be interesting to revisit this in a year.You have to be really careful when telling yourself stories like this in investment markets. Certainty and confidence are the enemy. Especially when you’ve made a nice narrative about a powerful enemy against a plucky good guy. Stories get you into all sorts of trouble when applied to investing.

Hi Contigo, I can’t find CMRS. By THR do you mean Thermon Holdings or Thor Mining? The former has a P:E ratio over 400, so I’m guessing the latter?

Have u lost faith in Cardano…..u were extolling it’s virtues?Bought a bit more BTC at this level. Sold all of my small altcoins a few weeks ago and converted to BTC. Still holding some Cardano, Solana, Polkadot, Aave, Chainlink and Algorand. Planning to jump on early IDOs and sell profits into stable coins for a while.

I haven’t lost faith one bit. It’s technically the best crypto project and, although it has been live for several years, the full functionality with smart contracts is only due to launch in August this year. This will allow DeFi, NFTs and everything else, with transaction fees at a tiny fraction of Ethereum’s, and far superior speed and scalability.Have u lost faith in Cardano…..u were extolling it’s virtues?

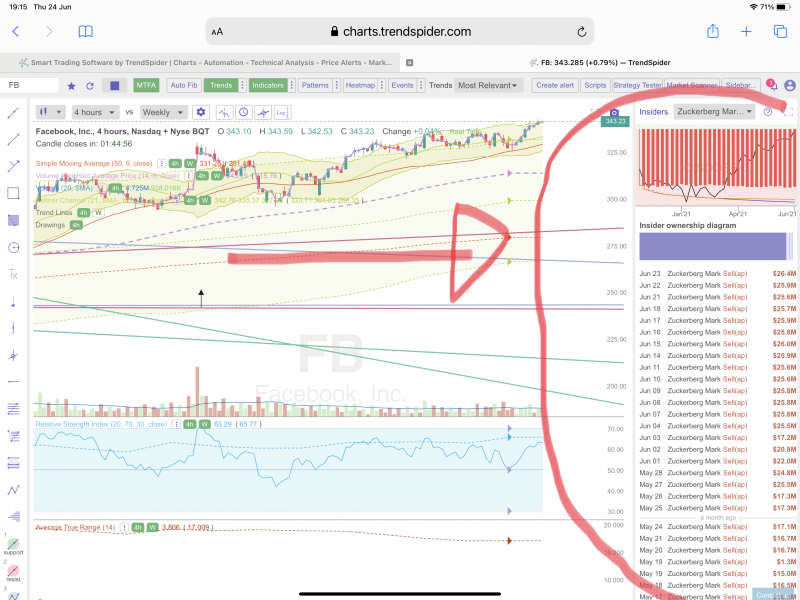

And still he sells every day without fail! Now selling $26m worth per day …Chaps,

If you’re tempted to go long Facebook, first consider Zuckerberg’s insider dealings - judging by his relentless and methodical sale of shares, he doesn’t appear to have much confidence at the moment!

View attachment 85019

I agree. I'm holding only 2 bullish swing trades at the moment (Starbucks and Unilever).Tough markets right now.