Froddy

Member

- Messages

- 1,072

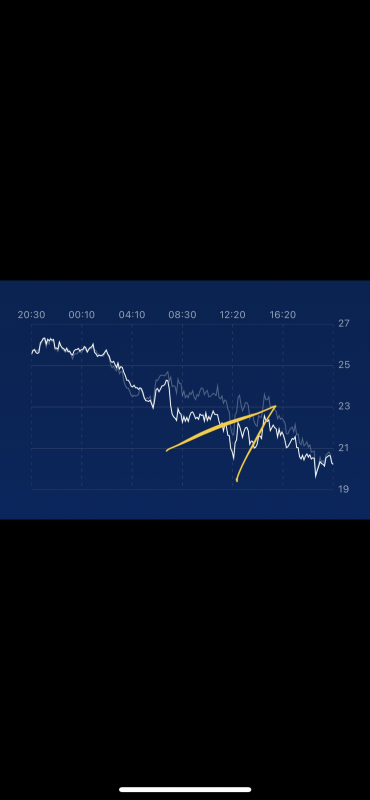

Absolutely beautiful AUD/USD 4 hour chart ...

Textbook broadening formation:

www.tradingview.com

www.tradingview.com

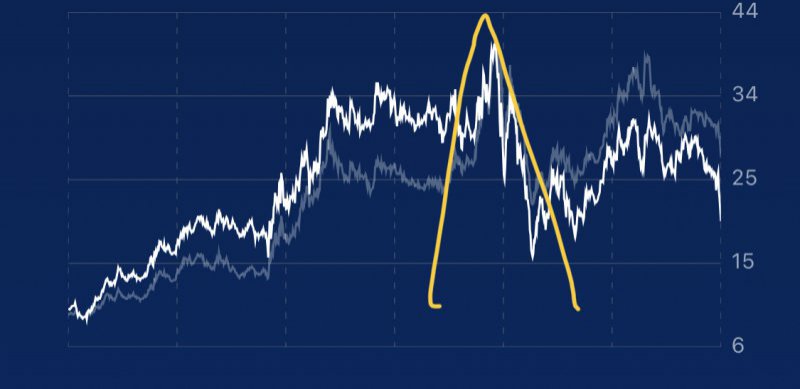

And spot gold too:

www.tradingview.com

www.tradingview.com

Textbook broadening formation:

Chart Image

And spot gold too:

Chart Image

Last edited: