You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Shares to watch

- Thread starter tan55555

- Start date

Froddy

Member

- Messages

- 1,072

Chaps,

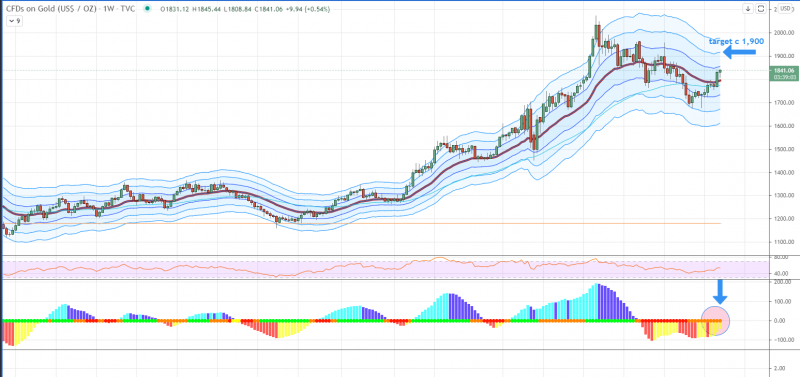

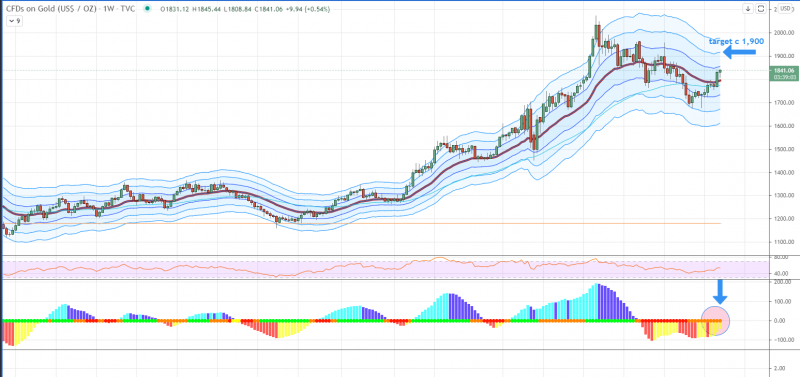

I've taken profits on AUD/USD and am now buying spot gold, with a first target of c. US$1,900.

It has multiple volatility squeezes setting up, and looks ready to go higher. Daily chart below:

https://www.tradingview.com/x/CKEygqed/

I've taken profits on AUD/USD and am now buying spot gold, with a first target of c. US$1,900.

It has multiple volatility squeezes setting up, and looks ready to go higher. Daily chart below:

https://www.tradingview.com/x/CKEygqed/

Wattie

Member

- Messages

- 8,640

Worthwhile newbie investor crypto info.

www.zerohedge.com

www.zerohedge.com

Proof-Of-Stake Coins Surge After Musk Trashes Power-Hungry Bitcoin | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Wattie

Member

- Messages

- 8,640

You’re younger than me so get lost!OMG it’s mind-boggling - I feel so old! ...

Wattie

Member

- Messages

- 8,640

It's a great entry point!

Only if it goes up.

Froddy

Member

- Messages

- 1,072

This is how it looks on the Ichimoku Cloud daily chart - totally flat - move on, nothing to see:

https://www.tradingview.com/x/zTDsaGVU/

On the plus side, here’s how it looks on the Keltner Channels weekly chart - you can see that price defended the mean (the 21EMA, the thick purple line) like a cat on a hot tin roof:

https://www.tradingview.com/x/G7WECDOY/

Big Money is rotating out of Bitcoin - for now - price is probably just chilling ...

In this game it’s a constant battle trying to identify where the money is going - if you can follow it successfully, you’re laughing.

https://www.tradingview.com/x/zTDsaGVU/

On the plus side, here’s how it looks on the Keltner Channels weekly chart - you can see that price defended the mean (the 21EMA, the thick purple line) like a cat on a hot tin roof:

https://www.tradingview.com/x/G7WECDOY/

Big Money is rotating out of Bitcoin - for now - price is probably just chilling ...

In this game it’s a constant battle trying to identify where the money is going - if you can follow it successfully, you’re laughing.

Froddy

Member

- Messages

- 1,072

Bitcoin looking oversold here on the daily chart at minus 3 ATR- there may be a bounce back to the mean but, at the moment, the sellers appear to be in control.

www.tradingview.com

www.tradingview.com

We are now below the 21 EMA (the mean) on the weekly chart, but it's only Monday - will tomorrow be "turn-around Tuesday"? Who knows ...

www.tradingview.com

www.tradingview.com

Chart Image

We are now below the 21 EMA (the mean) on the weekly chart, but it's only Monday - will tomorrow be "turn-around Tuesday"? Who knows ...

Chart Image

stindig

Member

- Messages

- 450

Not worried yet, but how big a **** is Elon! However, I love this story:Bitcoin looking oversold here on the daily chart at minus 3 ATR- there may be a bounce back to the mean but, at the moment, the sellers appear to be in control.

Chart Image

www.tradingview.com

We are now below the 21 EMA (the mean) on the weekly chart, but it's only Monday - will tomorrow be "turn-around Tuesday"? Who knows ...

Chart Image

www.tradingview.com

STOPELON Coin Explodes Through the Roof as It Aims To Wrest Control of Tesla (TSLA) Away From Elon Musk

STOPELON coin seems to be a manifestation of the anger festering in the wider crypto community against Elon Musk's recent moves

Wattie

Member

- Messages

- 8,640

When I read stuff like this it makes me think I should stick to eating and drinking them.Mental! When I read stuff like this it makes me think I should just trade corn, wheat and orange juice futures!

Last edited:

Wattie

Member

- Messages

- 8,640

Musk needs to be censored. He’s manipulated markets before (including Tesla) and seems intent in doing it again.Not worried yet, but how big a **** is Elon! However, I love this story:

STOPELON Coin Explodes Through the Roof as It Aims To Wrest Control of Tesla (TSLA) Away From Elon Musk

STOPELON coin seems to be a manifestation of the anger festering in the wider crypto community against Elon Musk's recent moveswww.google.co.uk

Contigo

Sponsor

- Messages

- 18,376

The best performer for me in the last 6 weeks has been FOR. It has gone from 0.685 to 7.5p and shows no signs of abating! 800% since first mentioned on the Sunday Roast.

Check out EME.

Empyrean is a London AIM listed oil and gas explorer currently focused on three cornerstone assets, The Duyung PSC offshore Indonesia, Block 29/11 offshore China, and a multi project participating interest in the Sacramento Basin, California.

Mcap currently £32m, shares in issue 489m

Indonesia – EME have an 8.5% share of a gas find offshore Indonesia that has been drilled, proven and is now being prepared for development, Gas Sale Agreement is due to be signed off at any time. EME are expected to get a return of around $35m.

China - Block 29/11 is huge, EME is the operator with 100% exploration rights. In the event of a commercial discovery CNOOC will have a back in right of 51%.

As per 5th May RNS. After extensive review of offset wells in the vicinity Aker have finalised well design and planning for the drilling of the jade prospect, the first of 3 prospects targeting 1 bln bbls. Update due once the drilling rig has been confirmed, drilling campaign expected to commence in November.

What Could China Be Worth?

Cenkos released a broker note on 11th May giving a current valuation (oil in place) of 25.4p for the three prospects.

They give a fully unrisked valuation of £2.63 (on completion of extended well tests)

Valuations are calculated on an average between best (P10) and worst (P90) oil in place estimates, however all but one of the adjacent CNOOC discoveries are “filled to spill”, with in place volumes close to their P10 estimates. Cenkos state that there is a distinct possibility that the Empyrean prospects are in reality closer to the P10 volumes this increases the unrisked valuation to £4.98

Jade is not the largest prospect, however it's by far the easiest / least complex drill hence the reason it's the first target. Exploration by nature is high risk however Jade and Topaz's GCoS (geological chance of success) are amongst the highest of any current prospect globally at 41% and 35%.

The valuations consider CNOOC’s 51% back in right. The Jade drill is expected to cost around 15-20m, so funding will be required, this could be a JV with a big player or some dilution from a capital raise.

it's worth noting that Tom Kelly CEO holds 88m shares, his last purchase was £440k @9p last year pre covid, So it's obviously hugely in his interest to get the best deal possible.

News flow has already increased with more updates due once drill rig and funding are finalised, and the sale of Duyung. Tom has also scheduled some PR in the coming weeks so I'd guess he must have something interesting to say.

This is not an overnight multi-bagger, however the potential here is absolutely staggering even going with the most conservative valuations

Check out EME.

Empyrean is a London AIM listed oil and gas explorer currently focused on three cornerstone assets, The Duyung PSC offshore Indonesia, Block 29/11 offshore China, and a multi project participating interest in the Sacramento Basin, California.

Mcap currently £32m, shares in issue 489m

Indonesia – EME have an 8.5% share of a gas find offshore Indonesia that has been drilled, proven and is now being prepared for development, Gas Sale Agreement is due to be signed off at any time. EME are expected to get a return of around $35m.

China - Block 29/11 is huge, EME is the operator with 100% exploration rights. In the event of a commercial discovery CNOOC will have a back in right of 51%.

As per 5th May RNS. After extensive review of offset wells in the vicinity Aker have finalised well design and planning for the drilling of the jade prospect, the first of 3 prospects targeting 1 bln bbls. Update due once the drilling rig has been confirmed, drilling campaign expected to commence in November.

What Could China Be Worth?

Cenkos released a broker note on 11th May giving a current valuation (oil in place) of 25.4p for the three prospects.

They give a fully unrisked valuation of £2.63 (on completion of extended well tests)

Valuations are calculated on an average between best (P10) and worst (P90) oil in place estimates, however all but one of the adjacent CNOOC discoveries are “filled to spill”, with in place volumes close to their P10 estimates. Cenkos state that there is a distinct possibility that the Empyrean prospects are in reality closer to the P10 volumes this increases the unrisked valuation to £4.98

Jade is not the largest prospect, however it's by far the easiest / least complex drill hence the reason it's the first target. Exploration by nature is high risk however Jade and Topaz's GCoS (geological chance of success) are amongst the highest of any current prospect globally at 41% and 35%.

The valuations consider CNOOC’s 51% back in right. The Jade drill is expected to cost around 15-20m, so funding will be required, this could be a JV with a big player or some dilution from a capital raise.

it's worth noting that Tom Kelly CEO holds 88m shares, his last purchase was £440k @9p last year pre covid, So it's obviously hugely in his interest to get the best deal possible.

News flow has already increased with more updates due once drill rig and funding are finalised, and the sale of Duyung. Tom has also scheduled some PR in the coming weeks so I'd guess he must have something interesting to say.

This is not an overnight multi-bagger, however the potential here is absolutely staggering even going with the most conservative valuations

philw696

Member

- Messages

- 25,651

Classic Car Prices Increasing More Quickly Than Gold

Is this where you should be investing your savings?

rockits

Member

- Messages

- 9,184

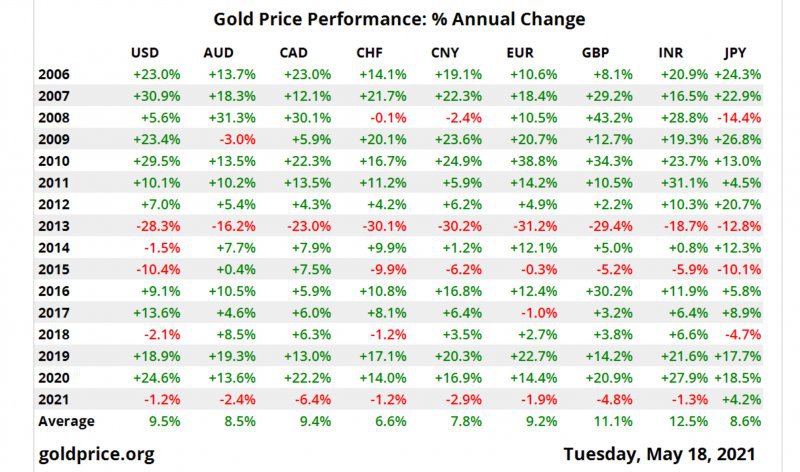

Gold has certainly not been a great performer of late compared to other alternative assets/investments but not sure classic cars aren't just as much as a bubble as pretty much any other asset/investment on the planet.

Most of the world seems to be in an inflated bubbled these days.

Most of the world seems to be in an inflated bubbled these days.

Wattie

Member

- Messages

- 8,640

Well it depends upon your definition “of late”Gold has certainly not been a great performer of late compared to other alternative assets/investments but not sure classic cars aren't just as much as a bubble as pretty much any other asset/investment on the planet.

Most of the world seems to be in an inflated bubbled these days.

If you invest in Gold you’re not trying to hit market highs......it’s because you wanna hold something that no-one else has when the shtf and all those that believe the central bank message that covid has been good for the economy, wake (woke) up.

Bank deposits pay what?

Inflation?

Just watch this fake scenario unfold........

Wattie

Member

- Messages

- 8,640

Well that’s interesting.

Classic Car Prices Increasing More Quickly Than Gold

Is this where you should be investing your savings?www.motorious.com

Clearly you’ve been checking Velar prices recently......good to know.

safrane

Member

- Messages

- 16,913

You will break Whatties heart.Gold has certainly not been a great performer of late compared to other alternative assets/investments but not sure classic cars aren't just as much as a bubble as pretty much any other asset/investment on the planet.

Most of the world seems to be in an inflated bubbled these days.