You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Shares to watch

- Thread starter tan55555

- Start date

Wattie

Member

- Messages

- 8,640

Funny init.

I think more and more are gradually waking up to this total farce we call “stock markets”.

I get stick for calling the whole global thing a Ponzi scheme.

Don’t care, that’s exactly what it is.

Markets are a part of the Ponzi jigsaw. They cannot be allowed to fall and everything will be done to protect the “institutions” that call the shots.

I think more and more are gradually waking up to this total farce we call “stock markets”.

I get stick for calling the whole global thing a Ponzi scheme.

Don’t care, that’s exactly what it is.

Markets are a part of the Ponzi jigsaw. They cannot be allowed to fall and everything will be done to protect the “institutions” that call the shots.

Funny init.

I think more and more are gradually waking up to this total farce we call “stock markets”.

I get stick for calling the whole global thing a Ponzi scheme.

Don’t care, that’s exactly what it is.

Markets are a part of the Ponzi jigsaw. They cannot be allowed to fall and everything will be done to protect the “institutions” that call the shots.

I think this has been a real eye opener to many, myself included about the lengths and plays that can be made.

There's another thread started on another forum where a long term trader is going in to some of the ways the markets are skewed against retail which I'm sure will have a few more examples wholesale sticking it to the man.

Ewan

Member

- Messages

- 6,815

Buying shares in rubbish companies just because amateurs on the internet talk themselves and each other into doing so is fraught with danger. It’s all very well, unless you get caught holding the baby at the crucial moment. Which by definition, many will.

How many people get rich on get-rich-quick schemes? Virtually none. So while some will walk away with a tidy profit from GameStock etc, plenty will get very burnt.

On a different note, clearing some old paperwork last week I depressingly found an old statement showing my shareholding in Quadrise Fuels being worth about a quarter of a million. I still have that same holding, but now it’s worth less than £10k. No point in selling now - just have to hang on and hope for some form of recovery. Anyway, you win some, you lose some. Life goes on.

How many people get rich on get-rich-quick schemes? Virtually none. So while some will walk away with a tidy profit from GameStock etc, plenty will get very burnt.

On a different note, clearing some old paperwork last week I depressingly found an old statement showing my shareholding in Quadrise Fuels being worth about a quarter of a million. I still have that same holding, but now it’s worth less than £10k. No point in selling now - just have to hang on and hope for some form of recovery. Anyway, you win some, you lose some. Life goes on.

Nayf

Member

- Messages

- 2,751

One imagines he makes more mWhere does he fit into his chart though also being an "educator"? I guess he's positioning himself as providing "smart money" education? And he has no COI?

Eb

This is why I haven't opened my wallet.Buying shares in rubbish companies just because amateurs on the internet talk themselves and each other into doing so is fraught with danger. It’s all very well, unless you get caught holding the baby at the crucial moment. Which by definition, many will.

How many people get rich on get-rich-quick schemes? Virtually none. So while some will walk away with a tidy profit from GameStock etc, plenty will get very burnt.

On a different note, clearing some old paperwork last week I depressingly found an old statement showing my shareholding in Quadrise Fuels being worth about a quarter of a million. I still have that same holding, but now it’s worth less than £10k. No point in selling now - just have to hang on and hope for some form of recovery. Anyway, you win some, you lose some. Life goes on.

That and I got caught up in the crypto hype and burned £300 about 18 months ago.

Small change to many on here I well imagine, but not when you're well below national average PAYE (as I was at the time)

RobinL

Member

- Messages

- 456

So assuming you bought in or 'played' with BTC around mid July 2019 spike. Had you hung in there you would be 200% up at today's price!One imagines he makes more m

This is why I haven't opened my wallet.

That and I got caught up in the crypto hype and burned £300 about 18 months ago.

Small change to many on here I well imagine, but not when you're well below national average PAYE (as I was at the time)

I did the same back in 2017 but sold half at a small loss and just cashed in last week for a 100% profit (lucky guess is all)

As usual story is don't bet the family jewels unless you are really good.

Those that make money treat trading as 'work' and spend alot of time at it.

I treat it as a 'hobby'....maybe I should get serious?

Has anyone read or comment on

Sent from my ONEPLUS A5010 using Tapatalk

Wattie

Member

- Messages

- 8,640

That’s an expensive lesson.Buying shares in rubbish companies just because amateurs on the internet talk themselves and each other into doing so is fraught with danger. It’s all very well, unless you get caught holding the baby at the crucial moment. Which by definition, many will.

How many people get rich on get-rich-quick schemes? Virtually none. So while some will walk away with a tidy profit from GameStock etc, plenty will get very burnt.

On a different note, clearing some old paperwork last week I depressingly found an old statement showing my shareholding in Quadrise Fuels being worth about a quarter of a million. I still have that same holding, but now it’s worth less than £10k. No point in selling now - just have to hang on and hope for some form of recovery. Anyway, you win some, you lose some. Life goes on.

If you’re going to play the game, you’d best pay attention to it.

Ewan

Member

- Messages

- 6,815

I’m not a day trader, more a long term investor. For example, I’ve mentioned Ideagen on here before. A few years back (maybe 8 or so) these were 25p, and I’ve just sold a bunch at £3. A very healthy return by investing in a properly run business, and all at very little risk. That’s far more “me” than the current chaos some people seem keen to jump in on.

But then again, if it’s just a few hundred quid (or a “virtual” account), who cares?!

Anyway, I thought it good to post a story about losses (e.g. Quadrise) as it’s all too easy for us to all only boast of our good days (e.g. Ideagen). A bit of reality is required from time to time.

But then again, if it’s just a few hundred quid (or a “virtual” account), who cares?!

Anyway, I thought it good to post a story about losses (e.g. Quadrise) as it’s all too easy for us to all only boast of our good days (e.g. Ideagen). A bit of reality is required from time to time.

Would be interesting to hear people's longs too. Less exciting for sure, but like you Ewan the lower risk and sensible stocks have their place.

For me, UK portfolio wise I'm thinking Lloyd's Bank, Rolls Royce, gsk. All seem very undervalued even with their respective Financial positions at the moment and have to be pretty secure given their size and importance in UK economy...?

Amazon is expensive but still lots of growth potential imo. Tesla I like idea of but seem overpriced even with growth potential, beyond meat i also like the idea of with growth potential.

For me, UK portfolio wise I'm thinking Lloyd's Bank, Rolls Royce, gsk. All seem very undervalued even with their respective Financial positions at the moment and have to be pretty secure given their size and importance in UK economy...?

Amazon is expensive but still lots of growth potential imo. Tesla I like idea of but seem overpriced even with growth potential, beyond meat i also like the idea of with growth potential.

Froddy

Member

- Messages

- 1,072

If you’re considering buying and holding any US stocks, you should consider opening a US options account and selling options contracts against those stocks.

You would need to hold at least 100 shares as one options contract is derived from 100 shares.

By way of example, Beyond Meat (BYND) is currently trading at $178 per share; you would need to spend $17,800 to purchase 100 shares.

If you sold the $180 strike call option expiring at the February monthly expiration date (19th Feb) against your 100 shares, you would receive $1,235 unless you decided to buy the option back prior to expiration. You would only buy it back if you were worried that your option was going to be assigned i.e. that the person to whom you sold the option was going to purchase your shares off you at the strike price. If they chose to do so, they would be paying you $18,000 (the $180 strike price x 100) plus the option price ($1,235) = $19,235. Clearly this would only make sense if the stock was above $192.35.

If the stock were assigned, it wouldn’t matter - you’d surrender the 100 shares (having collected $19,235) and then buy another 100. The point is that, over time, your shares begin to pay for themselves OR you have an income stream.

I’ve used the example of the next monthly expiration date and the “at the money” strike price, however you could sell the option at any price and over any period (next week, next month, next year).

I‘m currently doing this with Kodak (KODK). The reason I’ve chosen this stock is because it’s a cheap stock (lower risk) and is range-bound, yet it has relatively expensive options due to juicy “implied volatility” (good if you’re selling options).

This strategy is called a “covered call” if you’d like to do some internet research ...

You would need to hold at least 100 shares as one options contract is derived from 100 shares.

By way of example, Beyond Meat (BYND) is currently trading at $178 per share; you would need to spend $17,800 to purchase 100 shares.

If you sold the $180 strike call option expiring at the February monthly expiration date (19th Feb) against your 100 shares, you would receive $1,235 unless you decided to buy the option back prior to expiration. You would only buy it back if you were worried that your option was going to be assigned i.e. that the person to whom you sold the option was going to purchase your shares off you at the strike price. If they chose to do so, they would be paying you $18,000 (the $180 strike price x 100) plus the option price ($1,235) = $19,235. Clearly this would only make sense if the stock was above $192.35.

If the stock were assigned, it wouldn’t matter - you’d surrender the 100 shares (having collected $19,235) and then buy another 100. The point is that, over time, your shares begin to pay for themselves OR you have an income stream.

I’ve used the example of the next monthly expiration date and the “at the money” strike price, however you could sell the option at any price and over any period (next week, next month, next year).

I‘m currently doing this with Kodak (KODK). The reason I’ve chosen this stock is because it’s a cheap stock (lower risk) and is range-bound, yet it has relatively expensive options due to juicy “implied volatility” (good if you’re selling options).

This strategy is called a “covered call” if you’d like to do some internet research ...

Wattie

Member

- Messages

- 8,640

I’m not convinced the buy and hold strategy works anymore.Would be interesting to hear people's longs too. Less exciting for sure, but like you Ewan the lower risk and sensible stocks have their place.

For me, UK portfolio wise I'm thinking Lloyd's Bank, Rolls Royce, gsk. All seem very undervalued even with their respective Financial positions at the moment and have to be pretty secure given their size and importance in UK economy...?

Amazon is expensive but still lots of growth potential imo. Tesla I like idea of but seem overpriced even with growth potential, beyond meat i also like the idea of with growth potential.

Markets are massively overvalued/distorted.

Sticking something in a portfolio and forgetting about it no longer seems appropriate- to me at least.

Lozzer

Member

- Messages

- 2,285

Happened to mineFroddy what happened today was pure and simply a crime. Suspending trading on individual accounts whilst allowing institutions to fully trade was a blatent manipulation of stock prices.

Everything is now laid bare for those who couldn't see it before.

Wattie

Member

- Messages

- 8,640

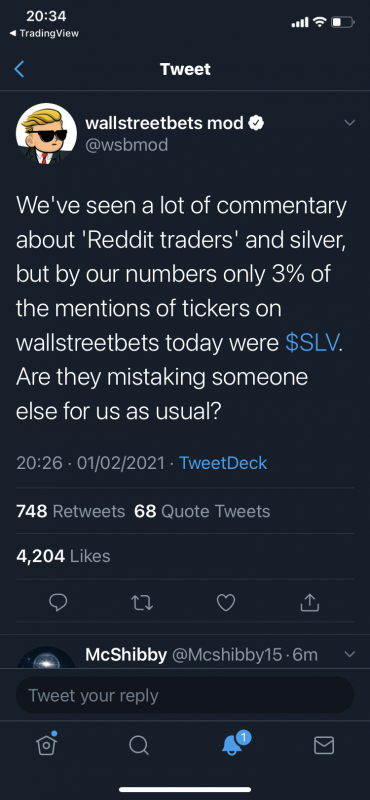

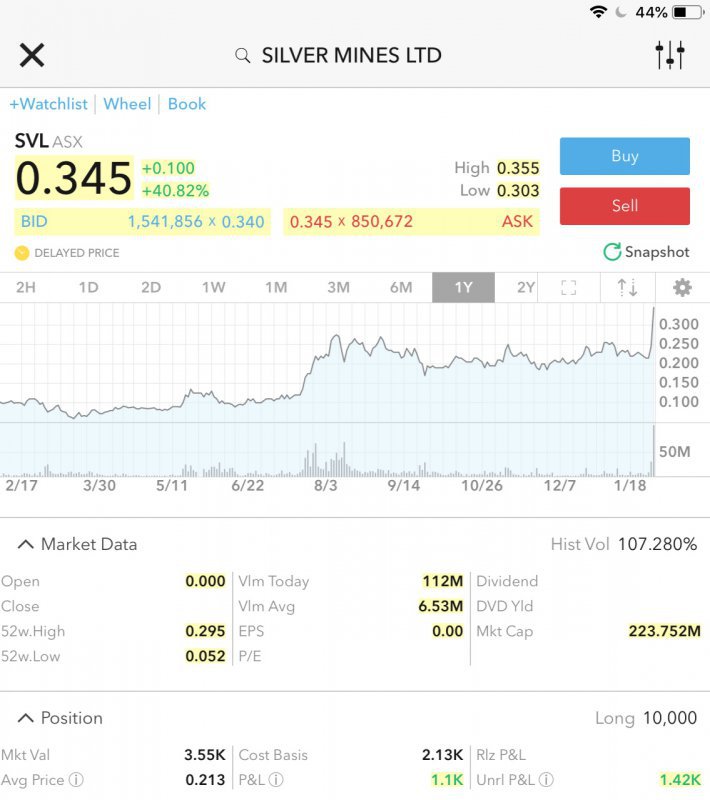

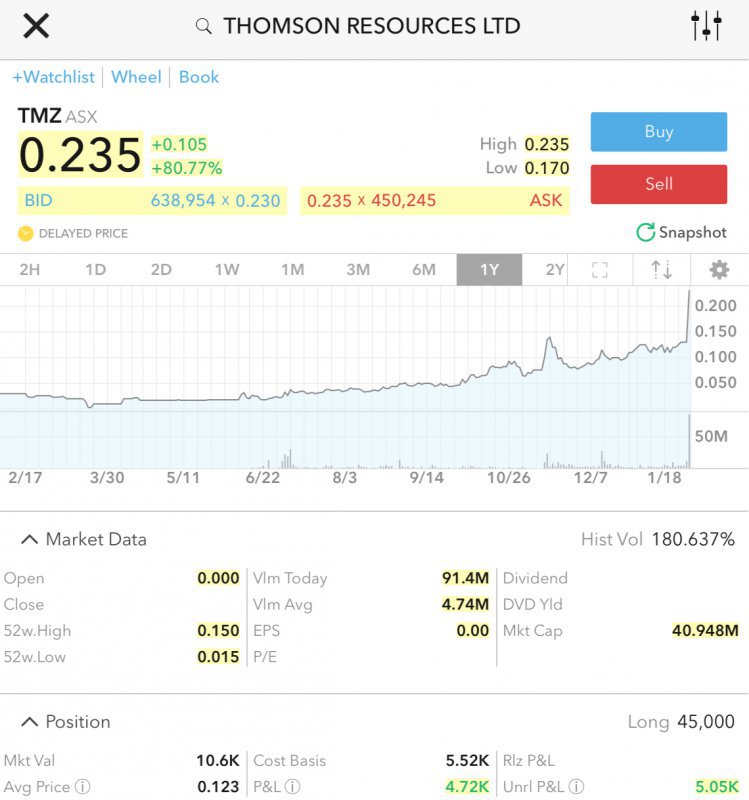

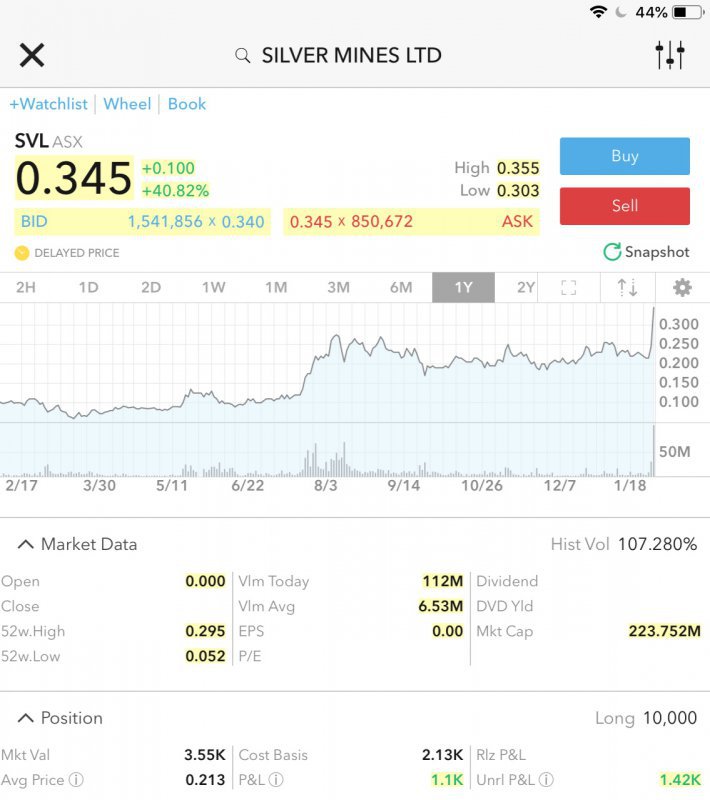

Silvers on the move!

Some of my stock holdings going berserk!

Silver Futures Price Today - Investing.com

Explore real-time Silver Futures price data and key metrics crucial for understanding and navigating the Silver Futures market.

www.investing.com

Some of my stock holdings going berserk!

Last edited:

Wattie

Member

- Messages

- 8,640

Who knows?

Seems there’s very little physical silver around.....

stindig

Member

- Messages

- 450

For those of you with as strong stomach, big cahunas and an optimistic outlook, there is always crypto. It’s ridiculously volatile but I believe that there is huge potential (not a recommendation, do your own research). I’ve taken out my original investment so feel relaxed if it crashes - I’ll just ride it out. What I have in there now is a long term bet that it’s going to multiply by x%.

The institutions are now coming into Bitcoin and Ethereum is booming - although personally, I don’t see ETH working properly until 2022/3. Cardano is run by seriously clever people and have some juicy announcements in Feb/March. Billionaire Michael Saylor, who has >$500M in crypto likes Polkadot in 2021.

Just sayin’

The institutions are now coming into Bitcoin and Ethereum is booming - although personally, I don’t see ETH working properly until 2022/3. Cardano is run by seriously clever people and have some juicy announcements in Feb/March. Billionaire Michael Saylor, who has >$500M in crypto likes Polkadot in 2021.

Just sayin’

Froddy

Member

- Messages

- 1,072

Will be interesting to see what happens tomorrow, across all instruments and asset classes.

Tomorrow is the second day of the week (“Turnaround Tuesday”); it’s also the second day of the month.

Today‘s price candles represented the price action of both the new week and the new month. Tomorrow there will be a “decoupling” as the daily chart separates from what was the weekly and monthly chart. And next week the weekly chart will decouple again.

It’s always sensible to pay particular attention into (and through) Tuesdays as they are technically significant ...

Tomorrow is the second day of the week (“Turnaround Tuesday”); it’s also the second day of the month.

Today‘s price candles represented the price action of both the new week and the new month. Tomorrow there will be a “decoupling” as the daily chart separates from what was the weekly and monthly chart. And next week the weekly chart will decouple again.

It’s always sensible to pay particular attention into (and through) Tuesdays as they are technically significant ...

Last edited: