You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Shares to watch

- Thread starter tan55555

- Start date

Doctor Houx

Member

- Messages

- 792

As existing AML shareholder, I’ve got offer of 4 for 1 at 30p rights issue, so I’m in. Brand willMight look at AML at 60-65p

have some goodwill and IPR value even if it has huge debt as at present. Hostile takeover possible.

daverichardson

Member

- Messages

- 6,001

AML are doomed in my opinion, matter of time

lozcb

Member

- Messages

- 12,564

As existing AML shareholder, I’ve got offer of 4 for 1 at 30p rights issue, so I’m in. Brand will

have some goodwill and IPR value even if it has huge debt as at present. Hostile takeover possible.

Chinese will be there like a shot .........................................................any other time i might have said thats a good thing ............................now on relflection of current events it has to be a big no no

Delmonte

Member

- Messages

- 878

Chinese will be there like a shot .........................................................any other time i might have said thats a good thing ............................now on relflection of current events it has to be a big no no

Geely maybe... could see that. Done a good job at Volvo...

lozcb

Member

- Messages

- 12,564

To my way of thinking this should be an ideal opportunity for certain brands Maserati included to scale back and be what they truly are a classic distinguished brand , far to many have diluted their Je ne sais quoi trying to be all and everything in all countries competing with the mass markets.( there are huge costs to that and generally means reducing quality ) ................and they will fail , they need to forget about the mass growth for growths sake market and concentrate on what they are really good at . Just perhaps they should band and pool together to produce variations of the hydrogen fuel cell engine , now that would be a sight , maserati/ferrari/AML/pagani/ etc etc you get my drift

Delmonte

Member

- Messages

- 878

To my way of thinking this should be an ideal opportunity for certain brands Maserati included to scale back and be what they truly are a classic distinguished brand , far to many have diluted their Je ne sais quoi trying to be all and everything in all countries competing with the mass markets.( there are huge costs to that and generally means reducing quality ) ................and they will fail , they need to forget about the mass growth for growths sake market and concentrate on what they are really good at . Just perhaps they should band and pool together to produce variations of the hydrogen fuel cell engine , now that would be a sight , maserati/ferrari/AML/pagani/ etc etc you get my drift

They’ve ruined the whole enigma by overproduction. When I were a lad, you never saw a Ferrari, just never, I mean there just weren’t any. Not even for a car mad kid who would have spotted a tail light from one at half a mile. Lambos and Masser even less, and saw my first Aston only about age 12. They only existed in the pages of magazines. Coupled with the reality of 200 mph taxis that do sub 4 second to 60, they’re in a really strange position. Exclusivity and scaling back the only way. Coupled with way out dynamics. Hence Pagani....

Wattie

Member

- Messages

- 8,640

Basic rules, there isI agree. Its more and more like roulette by the day

1.No true price discovery

2.Everything is being manipulated by the Fed and central banks.

Froddy

Member

- Messages

- 1,072

In the case of the DOW, price is testing the VWAP (volume weighted average price) of the Feb high:Dow and FTSE up 4% today wow! Shorts might have to be closed for a bit. WTF is going on?

DIA,Daily Candlestick chart published by froddy

Dow Industrials SPDR Candlestick chart created with TrendSpider

In the case of the S&P, price is not yet at the VWAP of the Feb high so may rise further, particularly as there is a volume gap (taken from the Feb high):

SPY,Daily Candlestick chart published by froddy

S&P 500 SPDR Candlestick chart created with TrendSpider

We have a Fibonacci timing cycle tomorrow/Weds in the S&P:

Last edited:

Wattie

Member

- Messages

- 8,640

Welcome back Froddy.In the case of the DOW, price is testing the VWAP (volume weighted average price) of the Feb high:

DIA,Daily Candlestick chart published by froddy

Dow Industrials SPDR Candlestick chart created with TrendSpiderchrt.biz

In the case of the S&P, price is not yet at the VWAP of the Feb high so may rise further, particularly as there is a volume gap (taken from the Feb high):

SPY,Daily Candlestick chart published by froddy

S&P 500 SPDR Candlestick chart created with TrendSpiderchrt.biz

We have a Fibonacci timing cycle tomorrow/Weds in the S&P:

Happy memories.

Froddy

Member

- Messages

- 1,072

I really wish I could tell you! It's just not safe to do anything ATM ...Froddy let me know when to open the short!!!

At times like this, Heiken Ashi chart candles can help to smooth out the noise, but I really think it's best to stay away whilst the market is in distribution (violent swings not going anywhere) ...

Wattie

Member

- Messages

- 8,640

I agree with Froddy. Nothing is what it seems in these markets.I really wish I could tell you! It's just not safe to do anything ATM ...

At times like this, Heiken Ashi chart candles can help to smooth out the noise, but I really think it's best to stay away whilst the market is in distribution (violent swings not going anywhere) ...

Shorting is fighting the Fed.

What’s clear, on fundamentals (no longer relevant) is that this is really no time for the majority of equities to be going up.

On what? future guidance, earnings, economic outlook and business sentiment!

Most market upswings are “short squeezes”- tells you something.

The long term trend here is down. This situation is not going away anytime soon.

Investors should prepare for a coronavirus-induced ‘vicious spiral’ more than twice as bad as the financial crisis, says J.P. Morgan

There is a significant chance the global economy experiences “a vicious spiral, which is typical of recessions, between weak final demand, weaker labor...

That means a deteriorating social health, welfare, moral/ civil order problems and massive debt defaults

A worsening economic situation as corporate businesses collapse with even bigger debt defaults.

Countries will probably default too......Now Argentina for a 9th time (another IMF feck up eh Lagarde!......Italy next?)

Nothing printing money out of thin air can do replaces supply chains and human interaction.

Last edited:

Wattie

Member

- Messages

- 8,640

Here's a share tip.

JP Morgan

If the share price drops like a stone buy it as it will 100% be bailed out.

www.zerohedge.com

www.zerohedge.com

Also keep an eye on Moderna MRNA

“U.S. health officials have been fast-tracking work with biotech company Moderna to develop a vaccine to prevent COVID-19. They began their first human trials on a potential vaccine March 16”

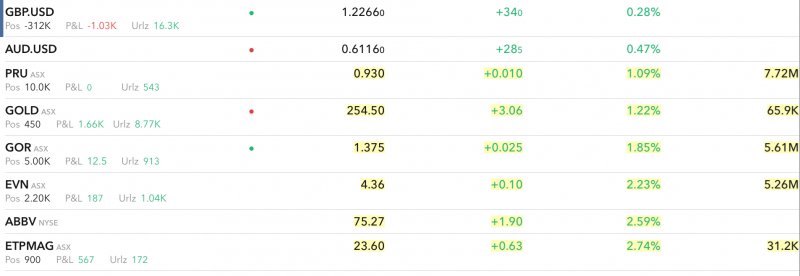

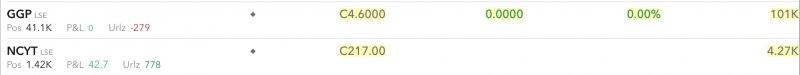

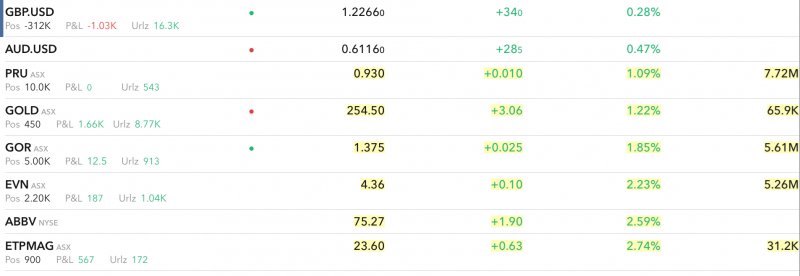

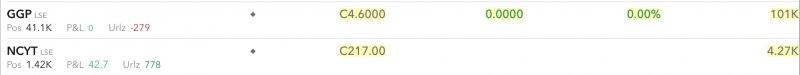

Beyond physical here’s my current,

Mainly miners for my Aud, USD balance in physical gold and silver, cash at home, small balance in bank, €and £ bricks n mortar.

Y

Y

JP Morgan

JPMorgan Chase Has $2.9 Trillion Exposure in Off-Balance Sheet Items Vs $2.3 Trillion on Its Balance Sheet

By Pam Martens and Russ Martens: April 5, 2020 ~ According to the Uniform Bank Performance Report for December 31, 2019 at the Federal Financial

wallstreetonparade.com

If the share price drops like a stone buy it as it will 100% be bailed out.

Gold Futures Extend Gains To 8 Year Highs After Pelosi's Trillion-Dollar Promise | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Also keep an eye on Moderna MRNA

“U.S. health officials have been fast-tracking work with biotech company Moderna to develop a vaccine to prevent COVID-19. They began their first human trials on a potential vaccine March 16”

Beyond physical here’s my current,

Mainly miners for my Aud, USD balance in physical gold and silver, cash at home, small balance in bank, €and £ bricks n mortar.

Y

Y

Last edited:

rockits

Member

- Messages

- 9,172

Dumped all 3 banks this morning and nicked another nett 12%. Also closed my SOLG long bet and sold Elementis holding for 13% nett.

Greatland looking very strong at the moment. Thinking off adding as takeover or selloff of part could be a potential option. I'm sitting on average of 3.5 ish but might have some room way north of 5p possibly.

Again not setting the work on fire but I'm happy nicking 10% nett each time. Over a year I'll take a 100% return as a little better than 1% in a bank account!

Greatland looking very strong at the moment. Thinking off adding as takeover or selloff of part could be a potential option. I'm sitting on average of 3.5 ish but might have some room way north of 5p possibly.

Again not setting the work on fire but I'm happy nicking 10% nett each time. Over a year I'll take a 100% return as a little better than 1% in a bank account!

rockits

Member

- Messages

- 9,172

The market is sure very strange at the moment and either has a slightly offset timeline......or has lot the plot!

When you see statements like this something isn't right is it?

"In corporate news, Boeing shares were 19.47% higher after the firm extended the shutdown of its Seattle production operations indefinitely."

When you see statements like this something isn't right is it?

"In corporate news, Boeing shares were 19.47% higher after the firm extended the shutdown of its Seattle production operations indefinitely."

Delmonte

Member

- Messages

- 878

The market is sure very strange at the moment and either has a slightly offset timeline......or has lot the plot!

When you see statements like this something isn't right is it?

"In corporate news, Boeing shares were 19.47% higher after the firm extended the shutdown of its Seattle production operations indefinitely."

Jesus. That is completely insane