You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Shares to watch

- Thread starter tan55555

- Start date

Froddy

Member

- Messages

- 1,128

So what MG is saying is that this move up is a "short squeeze". This happens when the market moves against heavily short traders who become trapped, so they buy too to "cover" their short positions. This in turn fuels the rally, and it can all happen very violently and quickly with big (emotional) moves.Can you explain that in Scottish?

Now I know why I didn’t retire at 35.

In terms of his trades (and I hope he'll correct me if I'm wrong), he's exited many of his deep ITM puts and instead bought a smaller number of deep ITM calls. He's taken profits on some of his positions. As the market rises, he's snapping up some more puts, ready for the next crazy move down. A pro!!

Last edited:

Wattie

Member

- Messages

- 8,640

So are you suggesting the markets going up?So what MG is saying is that this move up is a "short squeeze". This happens when the market moves against heavily short traders who become trapped, so they buy too to "cover" their short positions. This in turn fuels the rally, and it can all happen very violently and quickly with big (emotional) moves.

In terms of his trades (and I hope he'll correct me if I'm wrong), he's exited many of his deep ITM shorts and instead bought (a smaller number) of deep ITM longs. He's taken profits on some of his positions. As the market rises, he's snapping up some more puts, ready for the next crazy move down. A pro!!

Bad news is good news.

But will then track down?

Actually, I’ve just looked and most of my stopped our are +ve.

You’d have to be ******* mental to invest long in this scenario.

they are looking for fools to buy.....until it hits the fan.

Froddy

Member

- Messages

- 1,128

We don't know what it will do. Nor can we impose our "will" upon the market - it won't listen!So are you suggesting the markets going up?

Bad news is good news.

But will then track down?

All we know is that price doesn't go straight up or straight down, and that it will retrace upwards on the way down - I know it sounds bonkers. So to make as much money as possible, we need to ride that rollercoaster. Problem is that we can't know for sure whether a retracement is just that, or whether it's actually a reversal; so we have to take steps to avoid the situation in which our hard work (and stress) has been for nothing ...

Last edited:

Wattie

Member

- Messages

- 8,640

Wattie

Member

- Messages

- 8,640

Good result! Keep them coming....I’m interested.Hope you lot got into Eddie Stobart earlier, signalled at 8p buy hit 13.5 closed at 11.9..... More to come tomorrow. Do we have any investors/traders on here?

Froddy

Member

- Messages

- 1,128

Just got into NFLX as my hedge against all my shorts - looking menacing on 195 mins chart! Will update you in 15 mins after US close:How’d you get on Froddy?

Froddy

Member

- Messages

- 1,128

Hi Wattie,How’d you get on Froddy?

Today has been a bit of a rollercoaster, not helped by the fact that I was on a train for most of the afternoon, trying to work out WTF was going on from my laptop with intermittent wi-fi and no access to my charting platform(!)

Once home, I've run some analysis and modified my positions. I've taken profits on BA (put) and ALGN (put). I've re-entered BA (put) at a lower delta to reduce risk. I've gone short PH at 70 delta, and gone short V (visa) at 70 delta; as a hedge, I've gone long NFLX at 60 delta. I'm out of gold for now. I retain my deep ITM S&P shorts, my OTM S&P put butterfly, and I now have an OTM TSLA (put) butterfly at 700.

So why have I gone long NFLX as a hedge? It was bought with conviction today, and has held the 8EMA. It also has momentum and, on the daily chart, the OBV (on balance volume) has crossed its 21 day EMA. I've not shown this type of chart before, but here it is:

The risk with this stock is that it's a momentum stock, and very susceptible to any panic. However, it's held up well, and what else will the quarantined western world do if they don't watch Netflix? If the market rips over the next day or two, this should keep my head above water ...

Last edited:

Froddy

Member

- Messages

- 1,128

As regards gold, this still looks good. Today, price tested (and held) not only the 1.618 Fibonacci extension of a prior swing, but also the 8EMA - this is technically good news.Just got into NFLX as my hedge against all my shorts - looking menacing on 195 mins chart! Will update you in 15 mins after US close:

So why am I out? Because gold is losing momentum (for now), and I'm a momentum trader (not an investor). I'll be straight back in when she picks up:

Next (minor) timing decision is Friday:

Hope this helps!

Last edited:

Wattie

Member

- Messages

- 8,640

Excellent stuff Froddy as always and I like your outlook re Netflix......an isolated population has to do something.

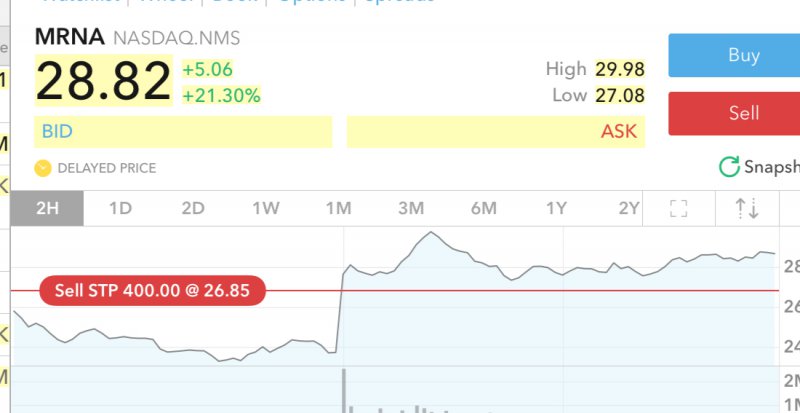

I’m out for now....my stops were all triggered (cut them to 2%) and my portfolio now looks like this!

I’m gonna Pile back into Miners as Gold is on the March again after 2 days of

nonsense .....the Us cannot hide it’s virus exposure forever. Sooner or later it will reveal itself and then the dominos will start toppling again.

I’m finding that instantaneous trading just isn’t possible on my Interactive Brokers Platform. Virtually every trade is on a delayed price so I have to pick carefully and go long.

I’ve Netflx on my radar and will watch its progress.

Good luck!

I’m out for now....my stops were all triggered (cut them to 2%) and my portfolio now looks like this!

I’m gonna Pile back into Miners as Gold is on the March again after 2 days of

nonsense .....the Us cannot hide it’s virus exposure forever. Sooner or later it will reveal itself and then the dominos will start toppling again.

I’m finding that instantaneous trading just isn’t possible on my Interactive Brokers Platform. Virtually every trade is on a delayed price so I have to pick carefully and go long.

I’ve Netflx on my radar and will watch its progress.

Good luck!

Last edited:

Wattie

Member

- Messages

- 8,640

UlstermanAbroad

Member

- Messages

- 1,687

Morning all.

I haven't bought shares directly in years. When I was investing, it was in four or five figure lumps.

Into businesses that I knew well, perhaps as a consumer and where I had some understanding of

the market, looking out several months. I was also much less risk averse then, than I am now

Right now, I'd be looking at the US drug companies that are running early trials of a potential cure

to COVID19. Risky obviously. But there are only a few companies and I'd suggest that the U.S. government

will be under heavy pressure to back at least one U.S. company, because of the massive imbalance in where

pharmaceuticals are produced. Mostly China. This imbalance has been flagged as a national security issue

by the US govt. Belatedly.

To balance the above, if I was holding gold, bought at its low point over the past year or so, I might take

some profits, but I'd mostly stay with gold and perhaps one or two other rare metals used in telecoms and/or

defence for example and whose risky supply chains end in China or other countries in Asia / Africa, where

the response to COVID19 is likely to be poor. I watched part of Trump's press conference late last night until

I had to switch off. A few things became clear to me, in the course of the press conference.

Trump is distancing himself from the issue, in appointing his VP to take charge. This is poor leadership and shows that Trump wants to get as far away from this issue, as fast as he can, despite the limitations to do so, because of the necessity of being seen to be 'in charge'.

What does this mean? Based on his own briefings from the CDC etc, Trump sees no upside in this issue.

It was obvious that Trump had only the barest grasp of the issue, in comparison to the other items on his

agenda. Like terrorism and national security, or getting reelected, for instance. This is saying a lot, because he has

only surface deep knowledge in his most pressing other issues, except reelection.

Surrounding yourself with experts in their field only gets you so far. Trump's White House has had the highest turnover of senior staff in history. Obviously, he does not play well with others.

I have no confidence in his leadership ability to deal with COVID19 effectively. Nor to direct, or offer aid to other countries, of strategic importance to the U.S., to deal with COVID19 effectively.

For the above reasons and many more, I would get into or stay invested in gold or other very rare and high demand metals and stay invested. Possibly until this pandemic has run its course and that is at least a year out from now. Possibly longer. If this pandemic spreads everywhere as I expect it to, a doubling of the gold price wouldn't surprise me at all.

I heard an expert on epidemics interviewed on Radio 4's Today programme this morning. His absolute belief was that self quarantines, like what is happening in China currently, will only buy time. The virus won't pass us by, if we 'hunker down' for a few weeks. If I understood him correctly, his belief was that our fate is predetermined regarding COVID19. Our only hope is if a cure is found, before we contract it. Given the likely time frame to produce a cure, its unlikely we'll get it in time. Health workers, the police and armed forces and other essential workers will be prioritised. I find this highly depressing, because the expert I'm referring to had absolute conviction in what he was saying and it gels with what I'm hearing other experts of similar standing say.

But, all of the above relating to investing is highly speculative and of worthless value, as even my limited understanding of the markets I knew best, has evaporated over time. These are my gut feelings only

Apologies if the conversation has moved on. Two finger typing and only one coffee this morning so far, are very inhibiting

I haven't bought shares directly in years. When I was investing, it was in four or five figure lumps.

Into businesses that I knew well, perhaps as a consumer and where I had some understanding of

the market, looking out several months. I was also much less risk averse then, than I am now

Right now, I'd be looking at the US drug companies that are running early trials of a potential cure

to COVID19. Risky obviously. But there are only a few companies and I'd suggest that the U.S. government

will be under heavy pressure to back at least one U.S. company, because of the massive imbalance in where

pharmaceuticals are produced. Mostly China. This imbalance has been flagged as a national security issue

by the US govt. Belatedly.

To balance the above, if I was holding gold, bought at its low point over the past year or so, I might take

some profits, but I'd mostly stay with gold and perhaps one or two other rare metals used in telecoms and/or

defence for example and whose risky supply chains end in China or other countries in Asia / Africa, where

the response to COVID19 is likely to be poor. I watched part of Trump's press conference late last night until

I had to switch off. A few things became clear to me, in the course of the press conference.

Trump is distancing himself from the issue, in appointing his VP to take charge. This is poor leadership and shows that Trump wants to get as far away from this issue, as fast as he can, despite the limitations to do so, because of the necessity of being seen to be 'in charge'.

What does this mean? Based on his own briefings from the CDC etc, Trump sees no upside in this issue.

It was obvious that Trump had only the barest grasp of the issue, in comparison to the other items on his

agenda. Like terrorism and national security, or getting reelected, for instance. This is saying a lot, because he has

only surface deep knowledge in his most pressing other issues, except reelection.

Surrounding yourself with experts in their field only gets you so far. Trump's White House has had the highest turnover of senior staff in history. Obviously, he does not play well with others.

I have no confidence in his leadership ability to deal with COVID19 effectively. Nor to direct, or offer aid to other countries, of strategic importance to the U.S., to deal with COVID19 effectively.

For the above reasons and many more, I would get into or stay invested in gold or other very rare and high demand metals and stay invested. Possibly until this pandemic has run its course and that is at least a year out from now. Possibly longer. If this pandemic spreads everywhere as I expect it to, a doubling of the gold price wouldn't surprise me at all.

I heard an expert on epidemics interviewed on Radio 4's Today programme this morning. His absolute belief was that self quarantines, like what is happening in China currently, will only buy time. The virus won't pass us by, if we 'hunker down' for a few weeks. If I understood him correctly, his belief was that our fate is predetermined regarding COVID19. Our only hope is if a cure is found, before we contract it. Given the likely time frame to produce a cure, its unlikely we'll get it in time. Health workers, the police and armed forces and other essential workers will be prioritised. I find this highly depressing, because the expert I'm referring to had absolute conviction in what he was saying and it gels with what I'm hearing other experts of similar standing say.

But, all of the above relating to investing is highly speculative and of worthless value, as even my limited understanding of the markets I knew best, has evaporated over time. These are my gut feelings only

Apologies if the conversation has moved on. Two finger typing and only one coffee this morning so far, are very inhibiting

Last edited:

Wattie

Member

- Messages

- 8,640

[

Dominos. Don’t trust your bank.

oh and expect negative interest rates.

i agree with much of this and the only thing I would add is that the global financial/banking system will be under severe strain moving forward, particularly if stock losses etc mount up as businesses begin to fail due to supply chain issues, or indeed the lack of a workforce as ‘isolation cases’ mount up and as businesses/workers begin to default on loans etc etc.Morning all.

I haven't bought shares directly in years. When I was investing, it was in four or five figure lumps.

Into businesses that I knew well, perhaps as a consumer and where I had some understanding of

the market, looking out several months. I was also much less risk averse then, than I am now

Right now, I'd be looking at the US drug companies that are running early trials of a potential cure

to COVID19. Risky obviously. But there are only a few companies and I'd suggest that the U.S. government

will be under heavy pressure to back at least one U.S. company, because of the massive imbalance in where

pharmaceuticals are produced. Mostly China. This imbalance has been flagged as a national security issue

by the US govt. Belatedly.

To balance the above, if I was holding gold, bought at its low point over the past year or so, I might take

some profits, but I'd mostly stay with gold and perhaps one or two other rare metals used in telecoms and/or

defence for example and whose risky supply chains end in China or other countries in Asia / Africa, where

the response to COVID19 is likely to be poor. I watched part of Trump's press conference late last night until

I had to switch off. A few things became clear to me, in the course of the press conference.

Trump is distancing himself from the issue, in appointing his VP to take charge. This is poor leadership and shows that Trump wants to get as far away from this issue, as fast as he can, despite the limitations to do so, because of the necessity of being seen to be 'in charge'.

What does this mean? Based on his own briefings from the CDC etc, Trump sees no upside in this issue.

It was obvious that Trump had only the barest grasp of the issue, in comparison to the other items on his

agenda. Like terrorism and national security, or getting reelected, for instance. This is saying a lot, because he has

only surface deep knowledge in his most pressing other issues, except reelection.

Surrounding yourself with experts in their field only gets you so far. Trump's White House has had the highest turnover of senior staff in history. Obviously, he does not play well with others.

I have no confidence in his leadership ability to deal with COVID19 effectively. Nor to direct, or offer aid to other countries, of strategic importance to the U.S., to deal with COVID19 effectively.

For the above reasons and many more, I would get into or stay invested in gold or other very rare and high demand metals and stay invested. Possibly until this pandemic has run its course and that is at least a year out from now. Possibly longer. If this pandemic spreads everywhere as I expect it to, a doubling of the gold price wouldn't surprise me at all.

I heard an expert on epidemics interviewed on Radio 4's Today programme this morning. His absolute belief was that self quarantines, like what is happening in China currently, will only buy time. The virus won't pass us by, if we 'hunker down' for a few weeks. If I understood him correctly, his belief was that our fate is predetermined regarding COVID19. Our only hope is if a cure is found, before we contract it. Given the likely time frame to produce a cure, its unlikely we'll get it in time. Health workers, the police and armed forces and other essential workers will be prioritised. I find this highly depressing, because the expert I'm referring to had absolute conviction in what he was saying and it gels with what I'm hearing other experts of similar standing say.

But, all of the above relating to investing is highly speculative and of worthless value, as even my limited understanding of the markets I knew best, has evaporated over time. These are my gut feelings only

Apologies if the conversation has moved on. Two finger typing and only one coffee this morning so far, are very inhibiting

Dominos. Don’t trust your bank.

oh and expect negative interest rates.

Last edited:

Wattie

Member

- Messages

- 8,640

Can’t sleep.

Zm expected to do well too, business conference call co........businesses isolating staff can still maintain contact through such conferencing facilities.

Dow, 900 down to far lower levels. The plunge protection team is in action today. Wonder what the Fed created out of thin air....

I’ve been watching CNBC and it is quite incredible to see the utter sh1te coming out of these pundits mouths...encouraging people to buy the dip.......greater fool theory.

They’re already pleading for the Fed to cut rates.....more stimulus!

WTF is that gonna do, stop people testing +ve for the virus, stop it’s spread! Will that produce all the missing supply line products?

They seem to have forgotten that stocks go down as well as up, as for 10years their Ponzi system has only enabled up!

Anyone long in this totally fake market they created is going to get handed their ar5e over the coming months.

The Ponzi scheme is officially in trouble.

Tomorrow is Friday, how much bad news will there be by Monday!!!!! Would you be invested long over the weekend?

Sit back and watch the biggest financial collapse in history materialise in front of your very eyes in the coming weeks.

Zm expected to do well too, business conference call co........businesses isolating staff can still maintain contact through such conferencing facilities.

Dow, 900 down to far lower levels. The plunge protection team is in action today. Wonder what the Fed created out of thin air....

I’ve been watching CNBC and it is quite incredible to see the utter sh1te coming out of these pundits mouths...encouraging people to buy the dip.......greater fool theory.

They’re already pleading for the Fed to cut rates.....more stimulus!

WTF is that gonna do, stop people testing +ve for the virus, stop it’s spread! Will that produce all the missing supply line products?

They seem to have forgotten that stocks go down as well as up, as for 10years their Ponzi system has only enabled up!

Anyone long in this totally fake market they created is going to get handed their ar5e over the coming months.

The Ponzi scheme is officially in trouble.

Tomorrow is Friday, how much bad news will there be by Monday!!!!! Would you be invested long over the weekend?

Sit back and watch the biggest financial collapse in history materialise in front of your very eyes in the coming weeks.