You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Be honest please.

- Thread starter FF1078

- Start date

Nothing wrong with either approach. I don’t hold with the ‘rent it if it depreciates’ argument as funders understand cost of capital and depreciation better than we do so finance only makes sense if your own return on investment is higher and/or you get better prices for taking finance as is often the case on new cars these days. Of course there is nothing to stop you paying off the finance once you have received the incentives (deposit contribution, free services etc).As you say each to their own. No it doesn't matter. I was just asking if people buy their cars anymore as there seems to be a lot that just pay monthly fees. I may be old fashioned but I like to own my car and not pay for it monthly.

The main reason people go PCP or leasing is that it gets them into a car that they may not be able to afford for cash or on HP. The manufacturers know this and, as it means people change their cars more often when acquired this way, do all they can to promote it - notice how many new car adverts these days don’t actually mention what the capital cost of the car is they purely mention the headline predatory price per month with a tiny * taking you to the hugely variable deposit you need to make. There is a lot of mis-leading advertising in this regard and this will be regulated much more strongly in the aftermath of the financial crisis which is gently brewing.

Last edited:

CatmanV2

Member

- Messages

- 52,721

Christ I'm in the wrong job......Buying a Maserati outright...You lot must be sh1tting money......Fare play to you if you can do that.....Note to self should have worked harder at school....

I don't think its much to do with that, Andy. It's more about careers, good decisions (especially in the early days). I was lazy as **** at school. I now have by most people's lights a good career and certainly in the top 5% if memory serves. But that's all kicked off in the last 19 years or so and even then only really started making progress in 2006. Everything up until then was more about learning lessons. Including how to deal with money (which I still really struggle with) . When Mrs C and I bought our first flat (1996) I had to sign that I would make no claim on the flat or anything in event of me getting into *more* debt........

They wouldn't let my name on the mortgage.

C

allandwf

Member

- Messages

- 11,550

You'll need to wait for one of the easily upset younger generation lolOh, of course! - I'd forgotten that. Well, I'm sure someone will be along to be offended soon. Not Navcorr, though.

GeoffCapes

Member

- Messages

- 14,000

I've only ever bought one car on finance (an Alfa 147) and I had to pay to give it back. Ever since I've bought all my cars in cash.

The other reason if (like now) I need to raise finances for something (work in this case) I can sell a car or two and do what needs to be done.

I don't understand the financial concept of leasing, although I do see the benefits of having a new car in some respects.

But then I don't buy cars brand new so leasing a used car makes zero sense to me.

The other reason if (like now) I need to raise finances for something (work in this case) I can sell a car or two and do what needs to be done.

I don't understand the financial concept of leasing, although I do see the benefits of having a new car in some respects.

But then I don't buy cars brand new so leasing a used car makes zero sense to me.

GeoffCapes

Member

- Messages

- 14,000

What brings it home to me is the sheer number of 17/18 plate cars on people's drives even here in Wakefield, some have four cars on there, all new or nearly new. OK they're Euro-boxes but when I think back to the shiiite my dad had to drive in 70's, 6 year old Maxi's and Princesses that were bolloxed at 50k miles but we were so poor back then we didn't have one penny to rub together.

In fact, I didn't have any clothes at all until I was nine, then my dad bought me a cap so I could look out of the window.....

I look at some of the cars that people have where I live and you can walk past and say "financed, financed, financed, financed, financed, paid for, financed" etc etc etc.

One house near me they have a brand new Range Rover Sport, a 6 Series Convertible, a brand new Polo and a year old Golf.

So mum, dad and two kids all have cars with a value I would guess at somewhere (new) of circa £200k. The house is probably worth £250k.

So I'm guessing (maybe wrong) that they are all on finance. What happens next year (if expected) there is another recession?

I'm guessing those cars will be the first to go, and with no cash put by to buy something new, the car finance family will be left getting the bus.

Defaulting on your finance will leave you with a **** credit history, meaning that they won't be borrowing any time soon, a story which is likely to be repeated all over the country.

The end of the world is nigh! Financial world anyway.

zagatoes30

Member

- Messages

- 23,440

It's a cultural as well as a financial shift. I don't own records or cassettes or CDs any more either. I use Spotify or the stuff that somehow seems to land on my phone etc etc, using a big magical cloud thing. I do, however, own my house. Well, most of it.

Now I know I’m strange but despite me listening to lots of my playlists on cloud based platforms I still have to own the CD.

rockits

Member

- Messages

- 9,294

Snap. Only ever bought one new car ever & that was cash. Not likely to buy another new one again unless I become obseenly rich....unlikely!Haven't financed or leased a car in over 25 years, we buy what we can afford. I have only ever bought one new car and short of winning the lottery I can't see that happening again.

We do have a Motorbility car which is in fact a lease car funded from ours sons disability allowance.

All cars are bought cash & owned outright from day one. Can't get in any trouble that way. Mine don't depreciate often though so some make a smidge, some lose a smidge & some stay even. On balance I may lose a 1-2K per year on depreciation in total mainly due to wife's car.

I think you are either a monthly person or not.....two different ways to gear up your finances. I'm not a monthly person.

FF1078

Member

- Messages

- 1,123

This is all too popular even after the last financial crisis. It still seems too easy to borrow money or get things on "the never never".I look at some of the cars that people have where I live and you can walk past and say "financed, financed, financed, financed, financed, paid for, financed" etc etc etc.

One house near me they have a brand new Range Rover Sport, a 6 Series Convertible, a brand new Polo and a year old Golf.

So mum, dad and two kids all have cars with a value I would guess at somewhere (new) of circa £200k. The house is probably worth £250k.

So I'm guessing (maybe wrong) that they are all on finance. What happens next year (if expected) there is another recession?

I'm guessing those cars will be the first to go, and with no cash put by to buy something new, the car finance family will be left getting the bus.

Defaulting on your finance will leave you with a **** credit history, meaning that they won't be borrowing any time soon, a story which is likely to be repeated all over the country.

The end of the world is nigh! Financial world anyway.

For just that reason that is why I only buy what I can afford.

I'd hate to think what savings young people have nowadays.

I can remember when I was a kid my mum used to take me to the local building society to bank my pocket money or earnt money from doing little jobs. How many youngsters would do that now?

Contigo

Sponsor

- Messages

- 18,376

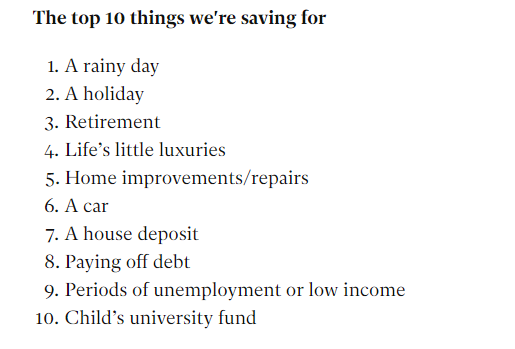

This probably answers it.

https://www.independent.co.uk/news/...ving-emergencies-survey-results-a8265111.html

Whilst I agree it's good to have savings for any emergency there is also no point being the richest man in the grave yard too so enjoy it!

https://www.independent.co.uk/news/...ving-emergencies-survey-results-a8265111.html

Whilst I agree it's good to have savings for any emergency there is also no point being the richest man in the grave yard too so enjoy it!

Contigo

Sponsor

- Messages

- 18,376

Horses for courses.

Mum does c 2.5k miles pa in her car.

Next one is likly to be a £99.00 per month Citroën or similar with servic, tyres and insurance inc.

probably her last car so it makes sence rather than investing £10k in somthing she will hardly use.

Exactly! How many people are in a position to spunk £80k on a motor? Or even spend £20k on a new Ford Fiesta when you can lease one for £99 per month with a £800 deposit. When you add up the total cost for the monthlies the money spent is actually less than the depreciation in most cases so lease is a much more sensible option. Plus many emplyers now give car allowances instead of a company car so leasing is perfect for fixed monthly costing and budgeting etc.. mine gives it so I run what I can with those monthlies in this case the GTS.

Sommi

Member

- Messages

- 430

Very insightful thread, this.

I have had over 15 used cars in past 20 years. Mostly very small budget and in a few cases sold them off for more than I got them a year on.

I took part finance to get the QP but paid it off in 6 months rather than the initially agreed 24 months.

I am buying the new Atom 4 - my first new car + the most expensive by far.

Master plan is to pay half cash when spec'ing it and the rest on a 0% credit card which will give me a couple of years to pay it off.

I agree cars should be owned outright as depreciating assets but there is nothing wrong in using interest free finance where available.

I also think Atom will not depreciate too much.

Sent from my Moto G (4) using Tapatalk

I have had over 15 used cars in past 20 years. Mostly very small budget and in a few cases sold them off for more than I got them a year on.

I took part finance to get the QP but paid it off in 6 months rather than the initially agreed 24 months.

I am buying the new Atom 4 - my first new car + the most expensive by far.

Master plan is to pay half cash when spec'ing it and the rest on a 0% credit card which will give me a couple of years to pay it off.

I agree cars should be owned outright as depreciating assets but there is nothing wrong in using interest free finance where available.

I also think Atom will not depreciate too much.

Sent from my Moto G (4) using Tapatalk

DaveT

Member

- Messages

- 2,894

Nothing wrong with either approach. I don’t hold with the ‘rent it if it depreciates’ argument as funders understand cost of capital and depreciation better than we do so finance only makes sense if your own return on investment is higher and/or you get better prices for taking finance as is often the case on new cars these days. Of course there is nothing to stop you paying off the finance once you have received the incentives (deposit contribution, free services etc).

The main reason people go PCP or leasing is that it gets them into a car that they may not be able to afford for cash or on HP. The manufacturers know this and, as it means people change their cars more often when acquired this way, do all they can to promote it - notice how many new car adverts these days don’t actually mention what the capital cost of the car is they purely mention the headline predatory price per month with a tiny * taking you to the hugely variable deposit you need to make. There is a lot of mis-leading advertising in this regard and this will be regulated much more strongly in the aftermath of the financial crisis which is gently brewing.

THIS.

If I'd ever worked at VW the ad I'd have loved to have made:

UP! Yours for £99

Vampyrebat

Member

- Messages

- 3,230

The only think we have never bought outright was the house (for obvious reasons) and that will be paid off in 3 years. To me it's just like renting a property you wouldn't care for it as much and want to look after it!

rockits

Member

- Messages

- 9,294

I don't think I have ever had a car that would have been more cost effective if I had financed or leased it. If I take our worst depreciating asset as my wife's car. It is a 2011 Freelander 2 SD4 HSE. We bought it just under 3 years old with 60k miles with 1 month left on the manufacturer warranty. New price circa £45k with spec and options ballpark. Paid £17k for it May 2014. We have had it for just over 4 years and it is worth about £10k private with 89k miles 1 Previous owner and full history. So it has depreciated by about £7k over say 4 years for ease so £1750 per year. Divide that by 12 and we have £145 per month.

I can't see that we would have been able to lease a 1-3 year old Freelander 2 SD4 HSE for the same or less at the time. Most other cars I have had have depreciated less if at all. I think if you had bought a new Freelander @ £45k or even £40k less discount then I suspect leasing or renting would be more viable or cost neutral in comparison so might make sense. In our example I can't see how it would make more sense to have leased or rented.

I can't see that we would have been able to lease a 1-3 year old Freelander 2 SD4 HSE for the same or less at the time. Most other cars I have had have depreciated less if at all. I think if you had bought a new Freelander @ £45k or even £40k less discount then I suspect leasing or renting would be more viable or cost neutral in comparison so might make sense. In our example I can't see how it would make more sense to have leased or rented.

Contigo

Sponsor

- Messages

- 18,376

that’s on a used car. Talking new... do the maths on a new one and then see..I don't think I have ever had a car that would have been more cost effective if I had financed or leased it. If I take our worst depreciating asset as my wife's car. It is a 2011 Freelander 2 SD4 HSE. We bought it just under 3 years old with 60k miles with 1 month left on the manufacturer warranty. New price circa £45k with spec and options ballpark. Paid £17k for it May 2014. We have had it for just over 4 years and it is worth about £10k private with 89k miles 1 Previous owner and full history. So it has depreciated by about £7k over say 4 years for ease so £1750 per year. Divide that by 12 and we have £145 per month.

I can't see that we would have been able to lease a 1-3 year old Freelander 2 SD4 HSE for the same or less at the time. Most other cars I have had have depreciated less if at all. I think if you had bought a new Freelander @ £45k or even £40k less discount then I suspect leasing or renting would be more viable or cost neutral in comparison so might make sense. In our example I can't see how it would make more sense to have leased or rented.

Goodfella

Member

- Messages

- 745

Me and you then...

and me

And me....