MarkMas

Chief pedant

- Messages

- 8,934

The good part is the new rule that when they tell you your renewal number, they MUST tell you last year's number as well. Previously they would have just written and said "Great news! You can renew for only £937!" and you might have fallen for it.

So it seems that Admiral have come up with a new rip-off scheme.

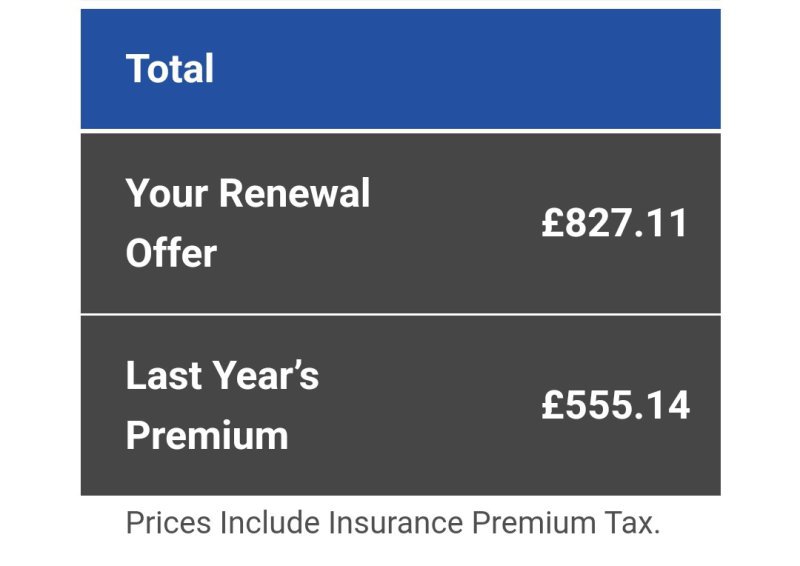

My insurance auto-renewed in July - They sent me a quote that looked fairly reasonable:

Your Renewal Offer £754.63

Last Year’s Premium £683.33

So I took the 'do nothing' option, and it renewed.

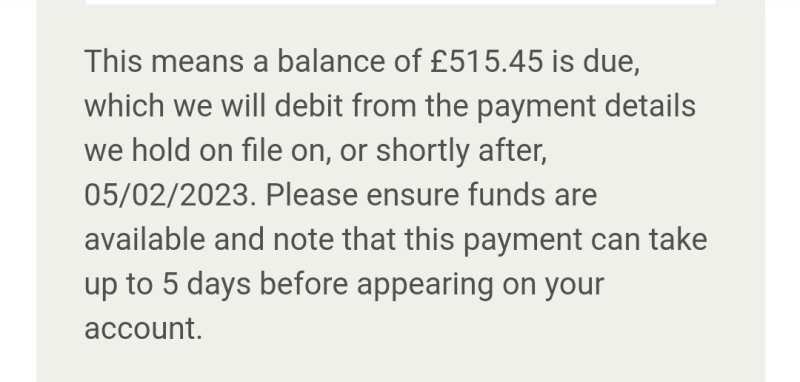

Now they have emailed me and said, "Ah-ha!! We see from our DVLA checks that you did not declare your SP30 speeding conviction from last September, so we are going to charge you an extra £233.85."

So when they issued the renewal quote they had the ability to load the premium with whatever they wanted based on this information, but they chose not to do so at renewal, and waited a month to hit me with the extra.

I shall speak to them today and see what happens....