You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CHURCHILL INSURANCE RENEWAL PREMIUM UP 40%

- Thread starter williamsmix

- Start date

zagatoes30

Member

- Messages

- 20,945

The main issue here is scale, services required need to be as complex as in the UK but the population and hence number of customers is less than 10% of the UK and therefore suppliers ROI is much less.It seems that there is a huge opportunity to provide a better service in Ireland for so many service orientated things. Why is it so backward compared with the UK?

Eb

Italiano

Member

- Messages

- 246

So that my comments are not bannedMy car insurance renewal with Churchill arrived this morning. The premium is up 40% on last year! No explanation for this exponential rise has been offered by them. I've been with them for a few years and I haven't made any claims, so I've no idea why this is. Perhaps I will ask?!

Is this happening elsewhere, and if so, why?

I shall just say

They are ( can't find the appropriate emoji )

Sam McGoo

Member

- Messages

- 1,773

You have to shop around and be prepared to change company every year if you want the cheapest premiums.

I can only think of one time in the last 10 years or so, that I've stayed with the same company two consecutive years. (admiral Multicar at that time)

As said above, with the comparison sites saving your details, it literally takes 10-20mins to update and take a new policy. I do it with all insurances every year. Must have saved thousands over the years compared to those that just renew.

Also, take Martin Lewis' advice and get your quote and renew 23 days prior to renewal date for the cheapest prices.

I can only think of one time in the last 10 years or so, that I've stayed with the same company two consecutive years. (admiral Multicar at that time)

As said above, with the comparison sites saving your details, it literally takes 10-20mins to update and take a new policy. I do it with all insurances every year. Must have saved thousands over the years compared to those that just renew.

Also, take Martin Lewis' advice and get your quote and renew 23 days prior to renewal date for the cheapest prices.

Ewan

Member

- Messages

- 6,812

True in general.brokers are great for commercial and residential investment properties but cant really compete with all these comparison sites out there now for normal car insurance and owner/occupier residential

But the companies on the comparison sites can't cope with anything "complicated" such as collections of rare classic cars, art, wine, jewellery, guns, etc.

When ones insurance requirements fall outside the average, that is the time a broker becomes useful.

lifes2short

Member

- Messages

- 5,834

agreed, i'm with home and legacy and footman james, but for the normal daily motors, van and other residential, the comparison sites are brilliantTrue in general.

But the companies on the comparison sites can't cope with anything "complicated" such as collections of rare classic cars, art, wine, jewellery, guns, etc.

When ones insurance requirements fall outside the average, that is the time a broker becomes useful.

jasst

Member

- Messages

- 2,317

You can buy stand alone legal cover, costs much less than if included with policy,can't remember name of Co but will look it up, I think @midloriginally recommended itYes, I had a look at that on my policy with Churchill. It reduced the premium by about 5%. However, because of the way they’ve structured the levels of Comprehensive cover - between standard and so called Plus - switching onto standard cuts out Legal cover. If you want that then you’re better off sticking with Plus, which also includes better limits for things like Personal Accident etc. I may try running up some quotes on comparator sites but I know that - having been in the business - you tend to get quotes for poverty spec products on comparator sites due to the price competition. They want to appear to be very competitive but they’re often not, when you’ve looked into what you’re actually getting and worked out the premium with the enhancements you’d prefer …

Erlingtheyounger

Member

- Messages

- 78

It’s also included with some bank accountsYou can buy stand alone legal cover, costs much less than if included with policy,can't remember name of Co but will look it up, I think @midloriginally recommended it

CatmanV2

Member

- Messages

- 48,793

Wack61

Member

- Messages

- 8,794

Some years ago I used a local broker for commercial vehicle insurance until the premiums started rising too high so I ventured out on to the Internet, 30% cheaper

I took this figure to the broker hoping he could at least get close to it but alas not

That's when I found out insurance was like any other commodity, the more you buy the cheaper it gets

The broker specialised in young drivers where they got good rates because of the amount of policies they put with a few underwriters but weren't competitive at all on commercial policies.

I took this figure to the broker hoping he could at least get close to it but alas not

That's when I found out insurance was like any other commodity, the more you buy the cheaper it gets

The broker specialised in young drivers where they got good rates because of the amount of policies they put with a few underwriters but weren't competitive at all on commercial policies.

DLax69

Member

- Messages

- 4,297

Surprising. Would have thought Alcoholics Anonymous had higher rates.And the AA

C

CatmanV2

Member

- Messages

- 48,793

Surprising. Would have thought Alcoholics Anonymous had higher rates.

No no. Legal cover, you fule!

C

zagatoes30

Member

- Messages

- 20,945

Like all the extras on most policies you need to check they are value for money and that you don't have cover else where. We were helping the in-laws look at stuff earlier in the year and found they were getting car recovery on their Bank Account, Car Insurance and Travel Insurance none of which were a premium service. When they contacted each of these providers and a few others they ended up saving over £100 per month on a number of add-ons which was after they had taken out a single premium recovery service direct.

williamsmix

Member

- Messages

- 574

Update: I went onto Comparethemarket and found the cheapest quote was 4% more than I paid Churchill last year. However, the level of cover wasn't anywhere near as good, but it did provide me with an opportunity to go back to Churchill and negotiate a very healthy discount ... their proposed 40% increase has now been reduced to 15%. I've been with Churchill for about 5 years now and would recommend them. They never seem to show up on Comparethemarket but it’s easy to run up a quote on their website if you’re looking for a good level of cover.

Last edited:

Guy

Member

- Messages

- 2,135

Interesting article in the DT today on car insurance.

Last November, Land Rover issued a press release about its latest investment in vehicle security, calling owners of post-2018 Land Rovers and Range Rovers to bring them in to have a free enhanced security package fitted. With sales affected and cars left virtually uninsurable, things have gotten so bad that the Solihull 4x4 maker is now even offering its Range Rover customers insurance arranged through its own scheme.

At about the same time, well let’s just call him Mr X, a London barrister, decided to throw in the towel trying to get insurance on a replacement for the V8 Range Rover he’d had stolen off the street outside his house.

“No one seemed at all surprised when the original was stolen,” he says. “I told the police it was a V8 and they asked where I lived. When I said Westminster they weren’t surprised, they said it was probably in Nigeria by now. Neither was the insurance company which paid up the £70,000 value in six weeks without a question.

“It was when I found another V8 to buy that I realised why. The insurance quote was £26,000... One of our clerks had a Range Rover Sport stolen. He lives in Essex and it was exactly the same story when he came to reinsure a replacement.”

Mr X now drives a Range Rover hybrid. “It isn’t a Range Rover model I particularly like,” he says, “but the insurance is less than a third for that on a V8 and I refuse to have someone else determine what brand of car I drive. I have got a big yellow steering lock, which I hope might be a deterrent.

“It’s just ridiculous,” he adds, “this is becoming an epidemic.”

Further, he dismisses Land Rover’s update bulletins on security. “We get one a month inviting us to go to a dealer to have the software flashed, but they want you to take your car to the middle of nowhere to have it done, they take the entire day, there’s no courtesy car and you have to make your own way there and back; it’s an absolute pain.”

The villains’ sights have shifted though, with Hyundai thefts up by 144 per cent and Kia thefts up 106 per cent in the last three months compared with the same period last year.

Advertisement

“For newer makes and models, keyless car theft, or relay theft, is at an all-time high and unfortunately it shows no signs of slowing down,” says David Pearce, director of retail direct at AXA UK.

“This is particularly apparent with the rise in thefts of models like Range Rover and Lexus in recent years. Technology adds a layer of complexity to claims with many cars now including technical parts which can be more challenging to obtain and replace, as well as more expensive.”

In 2022 nearly 100,000 vehicles were stolen in the UK and it’s looking as though this year’s total will be higher. According to a FOI request on behalf of Fleet News magazine, London was the worst place in 2022, with 26,117 vehicles stolen at a rate of 291 per 100,000 people. Next was the West Midlands with 12,223 (417 per 100,000), then Greater Manchester with 7,453 (264 per 100,000). Next up was West Yorkshire with 4,621 thefts, Essex with 3,771 and South Yorkshire with 3,257.

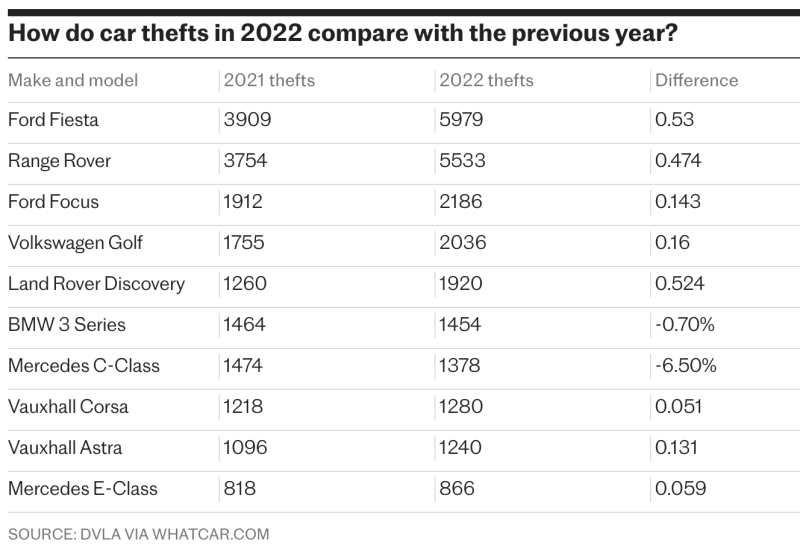

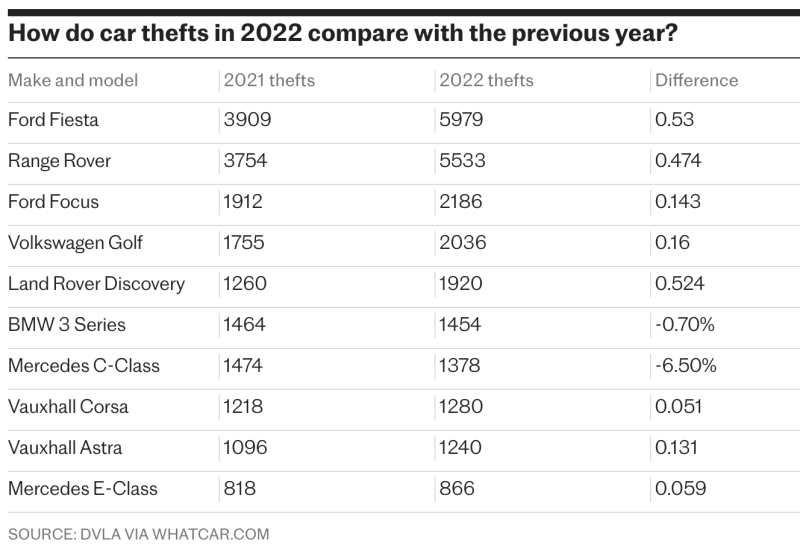

According to Octane Finance, after the Ford Fiesta, the next most stolen car was a Range Rover, followed by the Ford Focus, the VW Golf, and Land Rover Discovery.

It’s a slightly odd way of looking at it, but Land Rover also claims theft rate of new Range Rovers and Range Rover Sport models is just 0.07 per cent (0.3 per cent for Defenders) and that its vehicles “consistently exceed standards set by Thatcham, the UK’s leading automotive risk intelligence company”.

Yet stolen Range Rovers, Land Rovers and other premium SUV models are getting to be quite a talking point in the wealthy middle class, which is a key Land Rover target market. .

“We’ve started to park our Range Rover round the back of the house,” said one Berkshire motor trader. “I don’t see the increased insurance premiums so much since our cars are insured on a group policy, but I’ve had clients who’ve given up with Range Rovers.”

Indeed we spoke to one former Range Rover owner based in Essex, who was quoted an insurance premium of “well in excess of £30,000 a year”.

Cat and mouse game

Thatcham doesn’t come out of this too well, either, since it’s clear that its best efforts aren’t good enough. In a statement, the organisation points out the wide variety of causes of rising car crime, including organised criminal gangs, over-stretched police forces, the proliferation of premium cars, the internet and social media platforms which allow gangs to share vehicle vulnerabilities and digital devices which have been reverse engineered.

It adds: “When first introduced in the early 1990s, the New Vehicle Security Assessment (NVSA) was highly effective in adding layers of mechanical security to foil opportunistic criminals and reduced theft figures dramatically, from a peak of over 620,000 thefts a year.

“The standards set out by the NVSA are still the most exacting in the world. However, the process of identifying and closing down digital security vulnerabilities remains a game of cat and mouse.”

Interesting, but this doesn’t do much for Mr X or any of the other premium SUV owners wondering if their prized cars will still be there when they open the front doors and face spiralling insurance premiums.

“They’ve become uninsurable,” said one former policeman from one of the UK’s biggest car crime squads. “Land Rover spent over £10 million on updating its keyless unlocking systems a few years ago and for just about three months their vehicles were impregnable until the gangs worked out how to get past it all.”

Now that “cat-and-mouse game” of police and thieves has started a new round with criminal gangs, many from Eastern Europe, stealing high-value cars, stripping them out in what the police call “slaughter houses”, putting the parts into containers and shipping them out. Those parts are often fitted to crashed and written off versions of the same models and sold as repaired in the UK, Africa and Europe.

How Range Rovers became virtually uninsurable

Thefts of the car have risen so much that affordable insurance is just not possibleLast November, Land Rover issued a press release about its latest investment in vehicle security, calling owners of post-2018 Land Rovers and Range Rovers to bring them in to have a free enhanced security package fitted. With sales affected and cars left virtually uninsurable, things have gotten so bad that the Solihull 4x4 maker is now even offering its Range Rover customers insurance arranged through its own scheme.

At about the same time, well let’s just call him Mr X, a London barrister, decided to throw in the towel trying to get insurance on a replacement for the V8 Range Rover he’d had stolen off the street outside his house.

“No one seemed at all surprised when the original was stolen,” he says. “I told the police it was a V8 and they asked where I lived. When I said Westminster they weren’t surprised, they said it was probably in Nigeria by now. Neither was the insurance company which paid up the £70,000 value in six weeks without a question.

“It was when I found another V8 to buy that I realised why. The insurance quote was £26,000... One of our clerks had a Range Rover Sport stolen. He lives in Essex and it was exactly the same story when he came to reinsure a replacement.”

Mr X now drives a Range Rover hybrid. “It isn’t a Range Rover model I particularly like,” he says, “but the insurance is less than a third for that on a V8 and I refuse to have someone else determine what brand of car I drive. I have got a big yellow steering lock, which I hope might be a deterrent.

“It’s just ridiculous,” he adds, “this is becoming an epidemic.”

Further, he dismisses Land Rover’s update bulletins on security. “We get one a month inviting us to go to a dealer to have the software flashed, but they want you to take your car to the middle of nowhere to have it done, they take the entire day, there’s no courtesy car and you have to make your own way there and back; it’s an absolute pain.”

Premium-theft epidemic

It should be said that the issue of premium vehicle theft is far from confined to just Land Rover and Range Rover, with Lexus, Mercedes, BMW and Audi models also suffering. Motor insurer AXA UK says in the period between 2021 and 2023 it has seen Lexus thefts increase by 22 per cent with RX and NX models the most targeted. Land Rover thefts have increased by 80 per cent in the same period with Range Rovers making up 75 per cent of those thefts.The villains’ sights have shifted though, with Hyundai thefts up by 144 per cent and Kia thefts up 106 per cent in the last three months compared with the same period last year.

Advertisement

“For newer makes and models, keyless car theft, or relay theft, is at an all-time high and unfortunately it shows no signs of slowing down,” says David Pearce, director of retail direct at AXA UK.

“This is particularly apparent with the rise in thefts of models like Range Rover and Lexus in recent years. Technology adds a layer of complexity to claims with many cars now including technical parts which can be more challenging to obtain and replace, as well as more expensive.”

In 2022 nearly 100,000 vehicles were stolen in the UK and it’s looking as though this year’s total will be higher. According to a FOI request on behalf of Fleet News magazine, London was the worst place in 2022, with 26,117 vehicles stolen at a rate of 291 per 100,000 people. Next was the West Midlands with 12,223 (417 per 100,000), then Greater Manchester with 7,453 (264 per 100,000). Next up was West Yorkshire with 4,621 thefts, Essex with 3,771 and South Yorkshire with 3,257.

According to Octane Finance, after the Ford Fiesta, the next most stolen car was a Range Rover, followed by the Ford Focus, the VW Golf, and Land Rover Discovery.

A clear problem

Land Rover clearly has a problem, though one spokesperson said this was a case of supply and demand, just too many people want a Range Rover for the factory to supply so the criminal gangs move in to fill that gap.It’s a slightly odd way of looking at it, but Land Rover also claims theft rate of new Range Rovers and Range Rover Sport models is just 0.07 per cent (0.3 per cent for Defenders) and that its vehicles “consistently exceed standards set by Thatcham, the UK’s leading automotive risk intelligence company”.

Yet stolen Range Rovers, Land Rovers and other premium SUV models are getting to be quite a talking point in the wealthy middle class, which is a key Land Rover target market. .

“We’ve started to park our Range Rover round the back of the house,” said one Berkshire motor trader. “I don’t see the increased insurance premiums so much since our cars are insured on a group policy, but I’ve had clients who’ve given up with Range Rovers.”

Indeed we spoke to one former Range Rover owner based in Essex, who was quoted an insurance premium of “well in excess of £30,000 a year”.

Cat and mouse game

Thatcham doesn’t come out of this too well, either, since it’s clear that its best efforts aren’t good enough. In a statement, the organisation points out the wide variety of causes of rising car crime, including organised criminal gangs, over-stretched police forces, the proliferation of premium cars, the internet and social media platforms which allow gangs to share vehicle vulnerabilities and digital devices which have been reverse engineered.

It adds: “When first introduced in the early 1990s, the New Vehicle Security Assessment (NVSA) was highly effective in adding layers of mechanical security to foil opportunistic criminals and reduced theft figures dramatically, from a peak of over 620,000 thefts a year.

“The standards set out by the NVSA are still the most exacting in the world. However, the process of identifying and closing down digital security vulnerabilities remains a game of cat and mouse.”

Interesting, but this doesn’t do much for Mr X or any of the other premium SUV owners wondering if their prized cars will still be there when they open the front doors and face spiralling insurance premiums.

“They’ve become uninsurable,” said one former policeman from one of the UK’s biggest car crime squads. “Land Rover spent over £10 million on updating its keyless unlocking systems a few years ago and for just about three months their vehicles were impregnable until the gangs worked out how to get past it all.”

Now that “cat-and-mouse game” of police and thieves has started a new round with criminal gangs, many from Eastern Europe, stealing high-value cars, stripping them out in what the police call “slaughter houses”, putting the parts into containers and shipping them out. Those parts are often fitted to crashed and written off versions of the same models and sold as repaired in the UK, Africa and Europe.

Guy

Member

- Messages

- 2,135

How they get away with it

One of the most common methods is to exploit the vulnerabilities in the vehicles’ own locking and security systems. This takes the form of intercepting the communication between the key fob and the vehicle and spoofing the signal so the vehicle unlocks itself. There have been various generations of this sort of theft, from jamming the locking signal as the owner walks away leaving the vehicle unlocked and vulnerable, to using a big aerial hidden in the straps of a backpack to “wake up” the key and amplify its signal from your pocket or a sideboard in the house to the target vehicle, which then unlocks itself.Updates to this vulnerable technology have been introduced; building in a confirmation signal system from the vehicle to the key fob, and sophisticated calculations of the key-fob signal delay, but within weeks the thieves have engineered a sneaky work around.

The equipment to do this is widely available on the internet, with adverts for key-fob duplicators which will work with or without the key being present and remote code grabbers. Lots of these firms operate out of China and there’s another, based in Lebanon, openly advertising radio remote code grabbers, with the caveat that they are intended “for legal use only”, even though it’s difficult to think of any legal use for such products.

Another method is to gain access and reverse engineer a dealer’s emergency start key, which is designed to allow a bona fide dealer to help customers who have lost their key or locked it inside. Again, equipment is available on the internet to do this.

Yet another is to cut open the coachwork (the plastic hatchback on a Range Rover) and gain access to the vehicle’s main can-bus internal communications wiring and wire in your own key-fob replicator sourced from, guess where.

After gaining access, the villains climb in, start the engine and activate a briefcase-sized jammer which suppresses the signals from the vehicles own GPS and any third party anti-theft software and drive the car to a warehouse. Once there, the thieves activate an even bigger jamming device with about 30 aerials while they find and remove the SIM cards and GPS signal devices, which can be hidden all over the car, often in the roof or the floor.

Victimless crime?

“There had been an attitude in police forces that this is what insurance is for,” said our former police officer, “but that’s not true, car crime isn’t victimless, everyone else pays more in insurance premiums and these gangs are often into nasty other crimes as well.”So our insurance goes up, with Confused.com reporting a rise of 58 per cent in the last 12 months, with the average cost of comprehensive cover now £924 – an increase of £338 over last year.

While the Association of British Insurers gives a by rote response to the issue saying: “The cost of the insurance for any vehicle will depend on the risk factors involved,” Thatcham highlights another issue which several others mentioned and which should strike terror into the hearts of Range Rover owners.

“As they have done for the past 100 years or more, insurers typically base premiums on risk factors relating to the driver – from driving history to age and location. However, the balance of risk is beginning to shift from driver to vehicle, disrupting the existing insurance model.”

Thatcham bases this on battery cars, which are often written off after quite minor shunts because of the potential risk of a short circuit, the tendency for modern cars to be connected to the internet poses new challenges in time and cost to repair. Shortages of spare parts with concomitant price rises and increases in the price of used vehicles also play their parts. “The only way to address these issues is through concerted cross industry action focused on building sustainability into vehicle design, while adopting a vigilant approach to unexpected emerging repair and security challenges presented by new vehicle technologies.”

But for the moment, what can you do?

“If they want it, whatever it is, they will take it. But if you make yours harder to steal, they might just move on to the next one,” says our ex-policeman. “I’d recommend a big yellow steering lock.”

By coincidence, the winning steering wheel lock in Auto Express magazine’s comprehensive test, the Stoplock Pro Elite, is big and yellow and on sale for £47.99. If I owned a Range Rover, I’d take a serious look at one...

Ewan,Agreed.

As brokers, I use Footman James for my cars and Period Homes for my house and contents. I’ve had the same contacts at both for years. It’s nice to build a personal relationship and have a name in your mobile to call when needed.

Would you mind pm ing your contact at PH. I don't suppose my needs are as complex but it's still a GII house and I'm not very enamoured with the NFU with whom I've insured for years. It's increased by a crazy amount over the last 2 years.

Thanks

David

Ewan

Member

- Messages

- 6,812

New model Rangie is one of the least stolen cars on the market. Something like 20 stolen in the last 6 months. And cheap to insure (at least it is here in Dorset).Interesting article in the DT today on car insurance.

How Range Rovers became virtually uninsurable

Thefts of the car have risen so much that affordable insurance is just not possible

Last November, Land Rover issued a press release about its latest investment in vehicle security, calling owners of post-2018 Land Rovers and Range Rovers to bring them in to have a free enhanced security package fitted. With sales affected and cars left virtually uninsurable, things have gotten so bad that the Solihull 4x4 maker is now even offering its Range Rover customers insurance arranged through its own scheme.

At about the same time, well let’s just call him Mr X, a London barrister, decided to throw in the towel trying to get insurance on a replacement for the V8 Range Rover he’d had stolen off the street outside his house.

“No one seemed at all surprised when the original was stolen,” he says. “I told the police it was a V8 and they asked where I lived. When I said Westminster they weren’t surprised, they said it was probably in Nigeria by now. Neither was the insurance company which paid up the £70,000 value in six weeks without a question.

“It was when I found another V8 to buy that I realised why. The insurance quote was £26,000... One of our clerks had a Range Rover Sport stolen. He lives in Essex and it was exactly the same story when he came to reinsure a replacement.”

Mr X now drives a Range Rover hybrid. “It isn’t a Range Rover model I particularly like,” he says, “but the insurance is less than a third for that on a V8 and I refuse to have someone else determine what brand of car I drive. I have got a big yellow steering lock, which I hope might be a deterrent.

“It’s just ridiculous,” he adds, “this is becoming an epidemic.”

Further, he dismisses Land Rover’s update bulletins on security. “We get one a month inviting us to go to a dealer to have the software flashed, but they want you to take your car to the middle of nowhere to have it done, they take the entire day, there’s no courtesy car and you have to make your own way there and back; it’s an absolute pain.”

Premium-theft epidemic

It should be said that the issue of premium vehicle theft is far from confined to just Land Rover and Range Rover, with Lexus, Mercedes, BMW and Audi models also suffering. Motor insurer AXA UK says in the period between 2021 and 2023 it has seen Lexus thefts increase by 22 per cent with RX and NX models the most targeted. Land Rover thefts have increased by 80 per cent in the same period with Range Rovers making up 75 per cent of those thefts.

The villains’ sights have shifted though, with Hyundai thefts up by 144 per cent and Kia thefts up 106 per cent in the last three months compared with the same period last year.

Advertisement

“For newer makes and models, keyless car theft, or relay theft, is at an all-time high and unfortunately it shows no signs of slowing down,” says David Pearce, director of retail direct at AXA UK.

“This is particularly apparent with the rise in thefts of models like Range Rover and Lexus in recent years. Technology adds a layer of complexity to claims with many cars now including technical parts which can be more challenging to obtain and replace, as well as more expensive.”

In 2022 nearly 100,000 vehicles were stolen in the UK and it’s looking as though this year’s total will be higher. According to a FOI request on behalf of Fleet News magazine, London was the worst place in 2022, with 26,117 vehicles stolen at a rate of 291 per 100,000 people. Next was the West Midlands with 12,223 (417 per 100,000), then Greater Manchester with 7,453 (264 per 100,000). Next up was West Yorkshire with 4,621 thefts, Essex with 3,771 and South Yorkshire with 3,257.

According to Octane Finance, after the Ford Fiesta, the next most stolen car was a Range Rover, followed by the Ford Focus, the VW Golf, and Land Rover Discovery.

View attachment 122144

A clear problem

Land Rover clearly has a problem, though one spokesperson said this was a case of supply and demand, just too many people want a Range Rover for the factory to supply so the criminal gangs move in to fill that gap.

It’s a slightly odd way of looking at it, but Land Rover also claims theft rate of new Range Rovers and Range Rover Sport models is just 0.07 per cent (0.3 per cent for Defenders) and that its vehicles “consistently exceed standards set by Thatcham, the UK’s leading automotive risk intelligence company”.

Yet stolen Range Rovers, Land Rovers and other premium SUV models are getting to be quite a talking point in the wealthy middle class, which is a key Land Rover target market. .

“We’ve started to park our Range Rover round the back of the house,” said one Berkshire motor trader. “I don’t see the increased insurance premiums so much since our cars are insured on a group policy, but I’ve had clients who’ve given up with Range Rovers.”

Indeed we spoke to one former Range Rover owner based in Essex, who was quoted an insurance premium of “well in excess of £30,000 a year”.

Cat and mouse game

Thatcham doesn’t come out of this too well, either, since it’s clear that its best efforts aren’t good enough. In a statement, the organisation points out the wide variety of causes of rising car crime, including organised criminal gangs, over-stretched police forces, the proliferation of premium cars, the internet and social media platforms which allow gangs to share vehicle vulnerabilities and digital devices which have been reverse engineered.

It adds: “When first introduced in the early 1990s, the New Vehicle Security Assessment (NVSA) was highly effective in adding layers of mechanical security to foil opportunistic criminals and reduced theft figures dramatically, from a peak of over 620,000 thefts a year.

“The standards set out by the NVSA are still the most exacting in the world. However, the process of identifying and closing down digital security vulnerabilities remains a game of cat and mouse.”

Interesting, but this doesn’t do much for Mr X or any of the other premium SUV owners wondering if their prized cars will still be there when they open the front doors and face spiralling insurance premiums.

“They’ve become uninsurable,” said one former policeman from one of the UK’s biggest car crime squads. “Land Rover spent over £10 million on updating its keyless unlocking systems a few years ago and for just about three months their vehicles were impregnable until the gangs worked out how to get past it all.”

Now that “cat-and-mouse game” of police and thieves has started a new round with criminal gangs, many from Eastern Europe, stealing high-value cars, stripping them out in what the police call “slaughter houses”, putting the parts into containers and shipping them out. Those parts are often fitted to crashed and written off versions of the same models and sold as repaired in the UK, Africa and Europe.

Thefts of the slightly older model have also dropped dramatically since November and all the publicity. Presumably because thousands have now had the free upgrade, and others have simply turned off the keyless go feature.

Of all my cars, the Fiesta looks like the one most likely to be stolen. Which wouldn't particularly bother me (other than the insurance agro).

That said, the Landie has a canvas roof so can't even be locked, so that is not even insurable against theft - third party only is all I can get on that. Even though it lives in a gated compound, with 24 hour security staff and constant CCTV surveillance.

Guy

Member

- Messages

- 2,135

Ewan, I would be staggered if JLR really have solved the theft problem that significantly. I am sure the dealers are talking a good story but I would want to seem some independent data to prove it. If OC have a big business in Nigerian exports they will keep finding a way around JLR's efforts. This report was published today so shouldn't be too out of date. Let's see what the next data points provide but reading between the lines, insurance is rapidly increasing for most.New model Rangie is one of the least stolen cars on the market. Something like 20 stolen in the last 6 months. And cheap to insure (at least it is here in Dorset).

Thefts of the slightly older model have also dropped dramatically since November and all the publicity. Presumably because thousands have now had the free upgrade, and others have simply turned off the keyless go feature.

Of all my cars, the Fiesta looks like the one most likely to be stolen. Which wouldn't particularly bother me (other than the insurance agro).

That said, the Landie has a canvas roof so can't even be locked, so that is not even insurable against theft - third party only is all I can get on that. Even though it lives in a gated compound, with 24 hour security staff and constant CCTV surveillance.

Ewan

Member

- Messages

- 6,812

The new cars have different tech, so they are not subject to the same keyless-go security issue. The current Rangie is one of the most least stolen cars in the U.K.

Turning off keyless-go on the older cars takes seconds. It’s just a case of getting the news out there to the owners of the older cars.

But if insurance companies can stripe some people in the meantime, they obviously will.

Turning off keyless-go on the older cars takes seconds. It’s just a case of getting the news out there to the owners of the older cars.

But if insurance companies can stripe some people in the meantime, they obviously will.