CatmanV2

Member

- Messages

- 48,836

2019. Cheques still take 3 days to process,

Really? Last time I paid one in (with my phone) it took about 10 minutes.

And the fraud? That came along very much at the same time

C

2019. Cheques still take 3 days to process,

Bloody hard to do a dd from the mattress ITYF

C

"2-4-6 is a clearing system brought in by the Cheque and Credit Clearing Company who carry out cheque clearing for UK Banks. 2-4-6 indicates the two days until the money is earning interest, the 4 days until you can withdraw, and the 6 days until you can be sure that the cheque funds have been applied to your account." (Quote from Santander)Really? Last time I paid one in (with my phone) it took about 10 minutes.

And the fraud? That came along very much at the same time

C

Really? Last time I paid one in (with my phone) it took about 10 minutes.

C

If you can pay in a cheque from your phone can you do a DD from your phone as well?

Didn't know you could do that. How do you pay a cheque in from your phone?

"2-4-6 is a clearing system brought in by the Cheque and Credit Clearing Company who carry out cheque clearing for UK Banks. 2-4-6 indicates the two days until the money is earning interest, the 4 days until you can withdraw, and the 6 days until you can be sure that the cheque funds have been applied to your account." (Quote from Santander)

So the act of paying in is quick enough. But availability is slower!

Sent from my ONEPLUS A5010 using Tapatalk

News to me. In any event, I didn't have to go to a branch and the money appeared to be there immediately. <shrug>

C

Same with Lloyd's, it's an easy way to pay in a cheque, just take a photo from the app.I can't set up new DDs but can transfer to either existing or new payees. With the cheque you take a photo with the app (at least with the HSBC)

C

Wattie will be along to tell you to buy gold but seriously banks are a close second to politicians in my list of untrustworthy groups. They seem to apply rules that always suit themselves but cry foul as soon as they caught out. A lot of the financial issues over the last few years seem to be down to banks questionable actions.

I think I may know somewhere that delivers 86.6% of the timeI think 2.75% is pretty good, try getting a decent rate on a lump sum investment!

Can you please compare the return of the stock market over the same period? Just for the benefit of the public...I will indeed, (thank you for the fabulous introduction) and seeing as how you're 'pound cost averaging' your savings the risk is reduced even more.

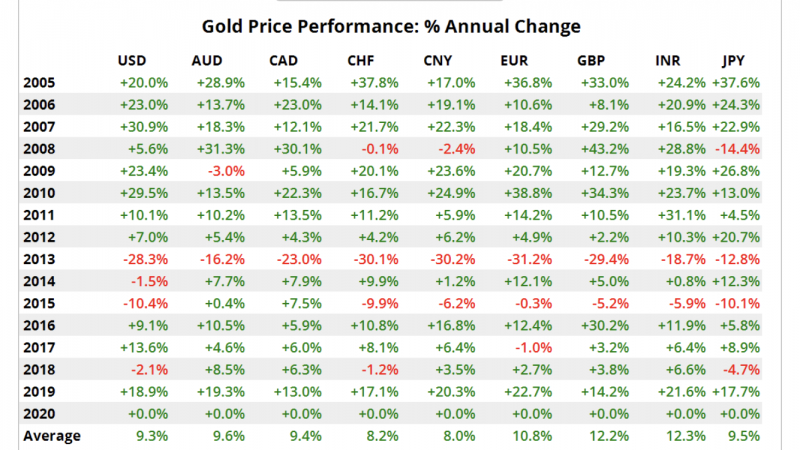

GBP.

2 down years in the last 15- so 86.6% upside (so almost a 9/10 historically) with an average return of 12.2%pa. Last year 14.2%

Oh, and Gold is legally yours whereas a bank can immediately refuse to give you your money back or indeed restrict your access.View attachment 63995

No, you can do that if you want.Can you please compare the return of the stock market over the same period? Just for the benefit of the public...

also please adjust both the gold and stock market appreciation from FX, and commission/cost of ownership/insurance.

That will be a fairer comparison

Interesting thread...

So what’s the collective view on the best place to put some “spare” money?

When I say “spare” I mean money you wouldn’t want to lose, but stuff that is left over once you’ve done the sensible things like top up your pension, pay down the mortgage, stick some to one side for contingencies, etc...