Wattie

Member

- Messages

- 8,640

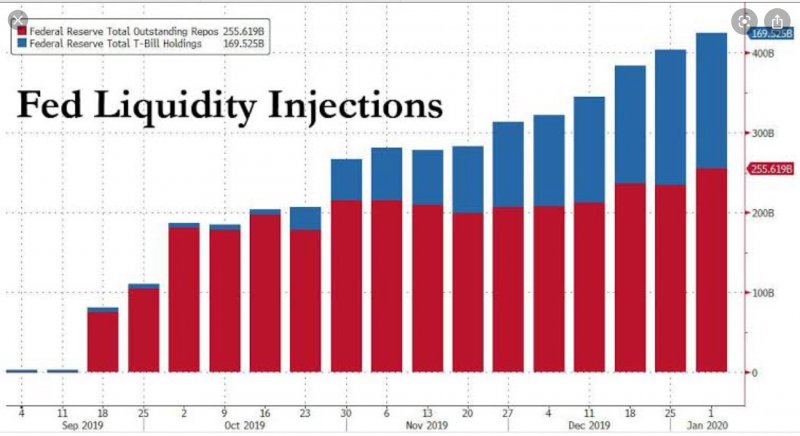

At home, 100%.I have asked this before but let's try again......... Can you tell me where I can put my money where I can have instant access and there is no risk that I will lose my initial deposit.

This exists but if it ever is required it could take months or years to kick in...,and your money will be worth less because of inflation.

Banks work on a “fractional reserve” system. This means there isn’t the money in existence to give everyone their money back in the event of a crisis.

Money in a bank no longer belongs to you. You become a creditor of the bank and it is in their powers to refuse or limit your access to it.

Last edited:

/AIG_Headquarters-ccecafa814e1491e8caef2b5309f52e0.jpg)