daverichardson

Member

- Messages

- 6,001

We were just talking about Marie Ann Faithful yesterday. She would be able to take 3 or 4 nowadays

We were just talking about Marie Ann Faithful yesterday. She would be able to take 3 or 4 nowadays

Even if the size hadn't changed I would think! LolWe were just talking about Marie Ann Faithful yesterday. She would be able to take 3 or 4 nowadays

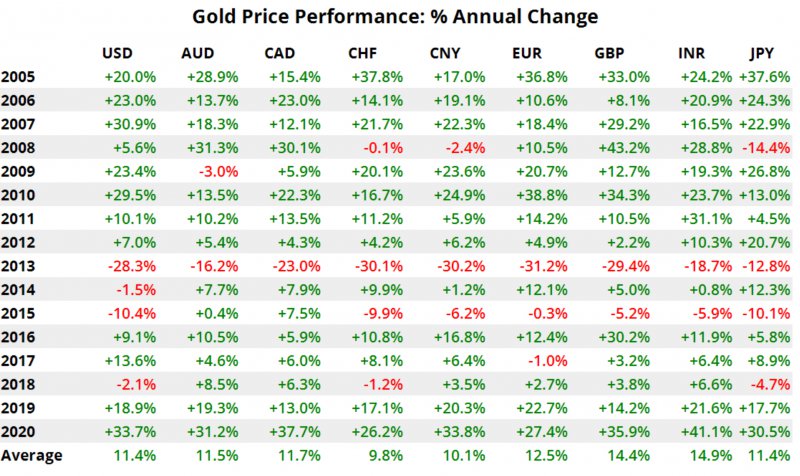

Have you also noticed chocolate bars, loo rolls, toothpaste, less fish fingers in a pack etc etc, certain goods are a lot smaller than they were years ago. Shrinkflation....Price is the same but you get less a lot less......your purchasing power is going down.View attachment 73807 The

Tyre lever?I know....a screwdriver was close to hand and nearly chosen but the laziness abated so a conventional tea spoon was sourced!

Even if the size hadn't changed I would think! Lol

Didn't have one of those unfortunately. Did have a small paint scraper but it looked a little oxidisedTyre lever?

Sent from my ONEPLUS A5010 using Tapatalk

The confiscation aspect is an interesting one- as it happened before, but only in certain jurisdictions. ie the US.Cool, good plays I believe. SOLG is certainly worth looking at.

As mentioned before I am 100% open minded to each and all possibilities. This was my concern and apprehension to invest/commit to gold/silver as what happened in 1933 with confiscation is not beyond the realms of possibility to play out again.

It is unlikely but certainly possible. Not sure if it would just by confiscation at agreed value or via making it illegal to sell or sell with added taxes but I don't see the US and the powers that be taking what's on the table laying down.

It seems gold/silver will still increase so I may dip my toe in a little and spread the investments maybe even get some crypto.

One thing is for sure that free and easy untracked movement is now virtually impossible. Also the ability to do things outside the controlled world will become much harder to achieve and these closed down quicker then ever before.

Behind the scenes this is all happening with hidden changing legislation all being sneaked in under many people's radars with Covid and terrorism allowing this all to be introduced. It is only in a few.years time most will realise when it is too late that this has all happened.

I'm not sure what we can do about it but I'll do all I can to protect us against the effects with any current control or man's I have.

Strange times.

Interestingly, the US gold in Fort Knox hasn't been audited since 1953.

We are asked to believe it is still there.

Alarm bells?

Re the deposit g’tee scheme, the money to give everyone their money back doesn’t exist.Agreed Wattie it is unlikely but everything is in my open mind at the moment and nothing is off the tablle..

Interesting you say about bank deposits and the FSCS regulations. These could even be revoked with no guarantees for depositors. So we will have bail ins and nothing is safe or guaranteed any more. As always two things will always remain guaranteed.....death and taxes!

With potential bank bail ins and lots of other batsh1t ideas, possible a and playlists it is almost back to the wild west again!

Been watching some stuff from E B Tucker and George Gammon on YT amongts others. Mind blowing thoughts and ideas for the conventional thinkers but like you you have to think outside the box and be unconventional to preserve your wealth I believe now.

Shame about the gold being lossed in the boating accident

Yes, it is a concern. Already I've experienced it as has taken months to transfer an ISA out of Barclay's to IG. Then weeks to get the already added bank account re-verfired on the remaining Barclays account to be able to withdraw the cash I have there.Re the deposit g’tee scheme, the money to give everyone their money back doesn’t exist.

It would therefore need to be printed.....devaluing such.

There is also nothing to stop your banking organisation saying that as from tomorrow you can only withdraw £50 per day, and transfers are restricted too.

It’s already happened.it’ll happen again.

For feck all % of feck all a year, I keep mine at home- unless it’s needed to pay bills.

That guarantees I can get it.

Feck them.

Sounds like you’re like me. (Do a search on “wealth” and Wattie you’ll get the picture).Really interested in the discussion on security of where cash is held - I've put reliance in FSCS, and have spread money across various lenders staying under the FSCS limit of each, but it does makes me a bit nervous. I've got it across various ISAs and instant access savings accounts, and then some in government bonds which is supposedly protected/underwritten. Everything else is in NYSE shares, cars, and property (I've currently got less in cars than I usually would have as I was nervous about what was going to happen to luxury/discretionary spend.....doesnt seem to be suffering so far!), but we're also selling two rented properties so there will be a period when there is additional that needs squirreling away.

Would be interested to what wattie, rockits, FC and others would suggest in terms of the spread of where to keep savings at the moment. Rightly or wrongly, I'm less concerned by high risk returns, more by security and ease of access.