You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Shares to watch

- Thread starter tan55555

- Start date

I have to agree, every single expert out there also does.. which generally means the opposite! I think I'll be opening a small position tomorrow , if the US indicies retreat slightly it should give more room to a rise.

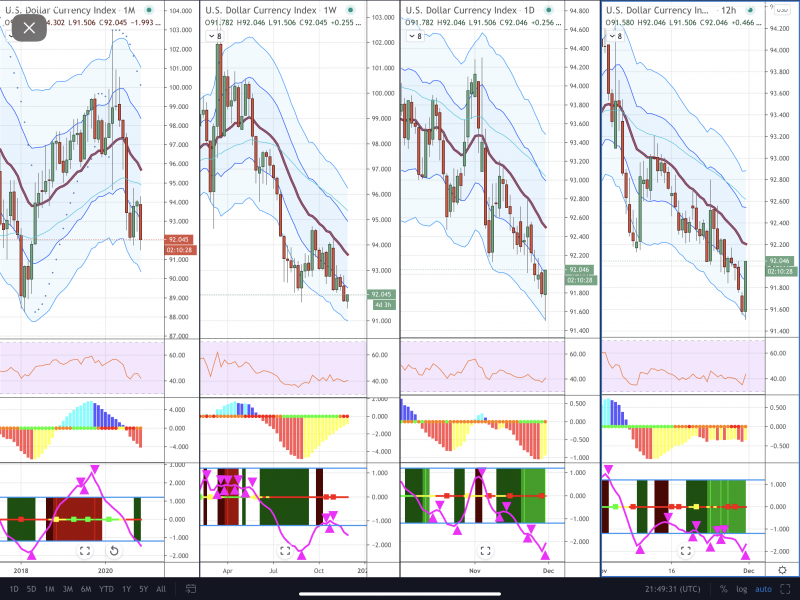

US$ looks ready to rip higher, methinks - oversold on nearly every timeframe ...

View attachment 78415

Wattie

Member

- Messages

- 8,640

I’m not so sure on that Froddy. Possibly short term but as the US is totally reliant on unlimited “stimulus” and Yellen will happily oblige this course of action I can only see it going down the tubes in future.US$ looks ready to rip higher, methinks - oversold on nearly every timeframe ...

View attachment 78415

Froddy

Member

- Messages

- 1,072

That's a bad sign for the bulls!I have to agree, every single expert out there also does.. which generally means the opposite!

Wattie, you're right and I'm talking short-term - perhaps a bounce back to the mean (the thick red line on the charts, where price always reverts periodically).

Perhaps we will see further falls over the coming days, to establish the lower wick of the monthly candle, and then a move higher? Pure guesswork on my part.

I've had a look at forex seasonality over the last 20 years, and the two best pairs are EUR/USD and NZD/USD at 67% and 70% positive Decembers respectively. Gold (spot) sits at 62% and silver at 57%. But of course this is no ordinary year!

Both Powell and Lagarde will be speaking today - expect fun and games!

Last edited:

Froddy

Member

- Messages

- 1,072

As for the S&P, we are at the very top of the broadening formation on the monthly chart (danger danger!):

For now, I'm holding my long positions but nearly every position is covered, and I have a longer-term hedge in place too (which saved my bacon in February!)

The S&P has today poked its head above the top broadening formation trendline (see chart above), and has fallen back within the range - watching this very closely. If history is anything to go by, it should have hit a ceiling (15 min chart below shows the line marked in purple) which it may continue to trace for a while before falling ...

Last edited:

Froddy

Member

- Messages

- 1,072

Chaps,

I think we're edging ever closer to a major correction - please be careful. Not saying the markets won't go higher - they probably will - just be on high alert.

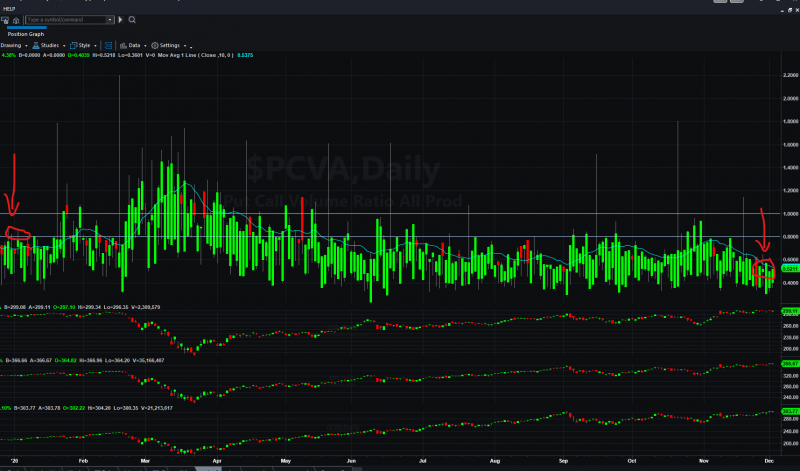

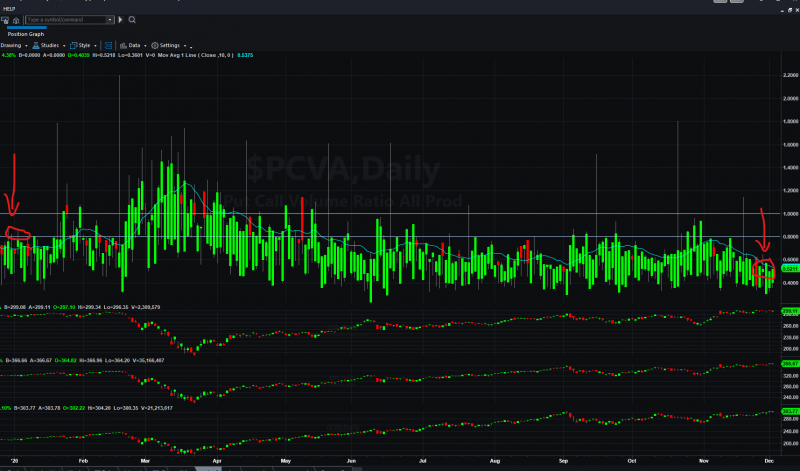

The 10 period moving average of the put:call ratio is lower than I've ever seen it at almost 50:50 - there are surely no buyers left, and it's now lower than the reading before the Feb crash; the first arrow below marks the start of 2020, and the second is today.

I could be wrong - probably am - but tightening those stops won't do you any harm ...

I think we're edging ever closer to a major correction - please be careful. Not saying the markets won't go higher - they probably will - just be on high alert.

The 10 period moving average of the put:call ratio is lower than I've ever seen it at almost 50:50 - there are surely no buyers left, and it's now lower than the reading before the Feb crash; the first arrow below marks the start of 2020, and the second is today.

I could be wrong - probably am - but tightening those stops won't do you any harm ...

Wattie

Member

- Messages

- 8,640

Markets are in the stratosphere compared to reality.Chaps,

I think we're edging ever closer to a major correction - please be careful. Not saying the markets won't go higher - they probably will - just be on high alert.

The 10 period moving average of the put:call ratio is lower than I've ever seen it at almost 50:50 - there are surely no buyers left, and it's now lower than the reading before the Feb crash; the first arrow below marks the start of 2020, and the second is today.

I could be wrong - probably am - but tightening those stops won't do you any harm ...

View attachment 78521

Thanks for making laymen's like myself aware of this. I've been keeping an eye on this thread even though I don't understand 90% of it haha. Having done a few bits over the summer I cashed out of everything last week bar a couple of positions and this helps me remember why I did it and not to get back in yet. I cashed out a bit early and have missed some additional rises in HSBC and BARC but my gut tells me something is about to happen and seems to correlate with what you are seeing in the charts.

Thanks gents

Thanks gents

Wattie

Member

- Messages

- 8,640

Seems the US politicians have suddenly realised that around 12million Americans will lose their unemployment benefits at the year end.US$ index has today tested the lower trendline of this broadening formation on the weekly chart.

Decision time! Will this end badly???

View attachment 78575

Ponzi schemes don’t react well when the money runs out so they are trying to put in place a peacemeal “stimulus” package ( quite how $1200 odd dollars rectifies anyone’s situation is beyond me) until a far bigger package can be passed by Biden - if and when he ever manages to prise the keys to the Whitehouse from Trump......not guaranteed.

$ declines on the way in general, ( as trillions more are on the way) unless perhaps this all blows up again and it’s considered a flight to safety at some point.

Froddy

Member

- Messages

- 1,072

It really is unbelievable - the US is nuts ...

Unfortunately, their decisions impact the rest of the world.

I think the question is whether that well-established US$ lower trendline will be defended (as it was today), and whether we see a dollar surge from here. If it does, the very fragile toppy stock market may fall hard - and fast ...

Here’s what happened into the close of the S&P cash session (1 minute candles) - very edgy indeed ...

The two (USD and S&P) are inversely correlated.

Where is @MaseratiGent? We need his expertise!

Unfortunately, their decisions impact the rest of the world.

I think the question is whether that well-established US$ lower trendline will be defended (as it was today), and whether we see a dollar surge from here. If it does, the very fragile toppy stock market may fall hard - and fast ...

Here’s what happened into the close of the S&P cash session (1 minute candles) - very edgy indeed ...

The two (USD and S&P) are inversely correlated.

Where is @MaseratiGent? We need his expertise!

Last edited:

Wattie

Member

- Messages

- 8,640

A

Bad news is normally good for markets however (more stimulus will be needed) so expect a Friday soar.

The twitchy Close was attributed to Pfizer distribution concerns.........supply chain issues.It really is unbelievable - the US is nuts ...

Unfortunately, their decisions impact the rest of the world.

I think the question is whether that well-established US$ lower trendline will be defended (as it was today), and whether we see a dollar surge from here. If it does, the very fragile toppy stock market may fall hard - and fast ...

Here’s what happened into the close of the S&P cash session (1 minute candles) - very edgy indeed ...

The two (USD and S&P) are inversely correlated.

Where is @MaseratiGent? We need his expertise!

View attachment 78581

Bad news is normally good for markets however (more stimulus will be needed) so expect a Friday soar.

Froddy

Member

- Messages

- 1,072

Ohhhh! Thanks Wattie!A

The twitchy Close was attributed to Pfizer distribution concerns.........supply chain issues.

Bad news is normally good for markets however (more stimulus will be needed) so expect a Friday soar.

Froddy

Member

- Messages

- 1,072

Boom!US$ index has today tested the lower trendline of this broadening formation on the weekly chart.

Decision time! Will this end badly???

View attachment 78575

Wattie

Member

- Messages

- 8,640

A

The twitchy Close was attributed to Pfizer distribution concerns.........supply chain issues.

Bad news is normally good for markets however (more stimulus will be needed) so expect a Friday soar.

More bad news (Jobs) sent markets up (more stimulus needed).

When will reality catch up?

Wattie

Member

- Messages

- 8,640

I’ll read the tea leaves Froddy and let u know what they sayYou were absolutely right, Wattie - markets rose on terrible news ...

Is the dollar ready to rebound? Crazy as it may seem, I think it is!

Froddy

Member

- Messages

- 1,072

Chaps,Adobe (ADBE) has caught my eye.

It's successfully tested long-term trendline support (going back to March low), it rose above Tuesday's "inside candle" day (thereby resolving indecision), it's in a volatility squeeze after two weeks of consolidation, and it has upcoming earnings to rally into.

I think I'll have a punt, with stop loss being one cent below the low of Tuesdays inside candle ($456.67); profit target one will be $499; profit target two will be $519 (being the preceding two swing highs).

Fingers crossed!

Daily chart below:

View attachment 78236

Adobe (ADBE) has hit $499.29 as its high (so far) today, so if you are in this trade you should be thinking about getting out ...

Last edited:

daverichardson

Member

- Messages

- 6,001

Don't we know any UK shares?

Froddy

Member

- Messages

- 1,072

No, sorry - I don't trade UK shares as I principally trade US options (derivatives) contracts, and my scanning software is US-based.Don't we know any UK shares?

It's possible to trade US stocks from the UK through CFD brokers at up to 30:1 leverage.

I use FXPro to trade forex, indices and commodities and I know that they also offer many of the US stocks (including Adobe); you just need to be careful with the spreads during times of volatility.

Maybe set up a CFD brokerage demo account and give it a whirl to see whether it suits?