dgmx5

Member

- Messages

- 1,142

All eyes on UEX and ODX today.

Phil, is UEX in respect of UEX Corp or Urban Explorer?

ODX has certainly moved today.

All eyes on UEX and ODX today.

UEX urban explorer yeah, it's been dropped by MM's to take cheap shares.

Yup market manipulation by central banks is bad- it ought to be designated as a crime as it deliberately distorts asset prices and will often wrongly, adversely affect small investors over the larger ones it’s favouring. A lot of it is also front run.So “market manipulation” by central banks is bad.....but by advertising revenue driven click bait blog and Russian Trojan Horse is fine

But fake news that does the same is OK?

I have been dipping into for a bit of balance but it is so obviously a front for Russian intervention in markets and politics, particularly when you look at the background

Not fixated at all, just observing you seem extraordinarily keen to promote the views of a blog run by a Bulgarian trader found guilty of insider trading, and with proven links to the Russian political machine that, on both counts, would just love to see the financial markets crash. Oh, and guess what, also has an overwhelming bias towards gold investment.

First rule of....

I'll be surprised but very happy if it breaks $2300 this side of xmas , but i doubt we will see the $3000 mark untill june at the earliest 2021Just buying up some physical Gold and Silver. Stocks getting low, means one thing. $3000 per oz very possible for Au!

Nice one Delmonte. Does ODX have further to go in your view or will you be selling up?Just hit +100% on ODX lads

I was sent this on ODX by way of background.Nice one Delmonte. Does ODX have further to go in your view or will you be selling up?

I would have thought you guys would have been more interested in the GBP or Eur prices- which hit all time highs last week.I'll be surprised but very happy if it breaks $2300 this side of xmas , but i doubt we will see the $3000 mark untill june at the earliest 2021

Made for the Breaking from Adrian Ash Director of Research, BullionVault IMAGINE buying 4 grams of gold for just £7.29 per gram... ...a mere €10.65 for Euro investors... ...equal to just $425 per Troy ounce in US Dollars. That was how much BullionVault's first public customer paid in mid-April 2005... ...testing our service with what turned out to be a small deposit, before transferring more cash to buy more gold. That looks a very smart move today. Compared to 15 years ago, the yellow metal has now risen 4 times over in US Dollar terms... ...5 times higher in the Euro... ...and a massive 7 times higher for UK investors and savers. BullionVault has meantime become the No.1 service for private investors wanting to own securely stored precious metals... ...enabling more than 83,000 people from 175 countries to enjoy the savings, security and deep liquidity of the professional bullion market from as little as 1 gram at a time. We were supposed to be hosting a small party this coming Thursday to mark BullionVault's 15th birthday. But no one outside West London can get anywhere near Hammersmith, we can't meet or greet each other anyway, and no one feels much like celebrating. Postponing our party 'til happier times, we will have make do with a team-chat on Zoom...gawping no doubt at the choice of wallpaper and junk piled up in each other's spare rooms. Gold also keeps raising eyebrows. Last week it marked St.George's Day by topping €1600 an ounce for Euro investors... ...and it topped £1400 an ounce for UK investors... ...a massive 20% higher for 2020 so far. Too much, too fast? Or way too much across far too long?

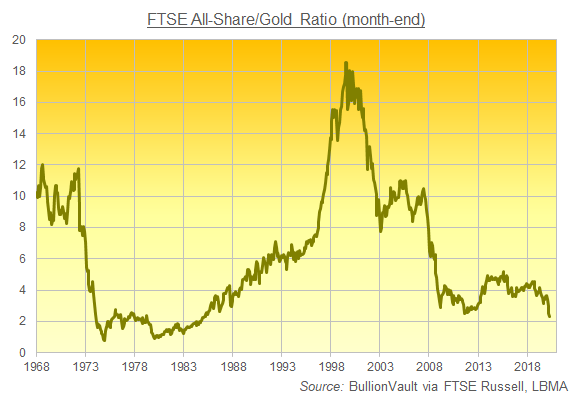

The best-performing asset of the 21st Century so far, gold has outrun stock markets across the world since April 2005. New York's Dow Jones Industrial Average, for instance, has lost almost half its valuewhen you price it in gold. And as our chart shows, gold has really crushed the value of UK equities... ...squashing the price of the FTSE All Share index by four-fifths. Clearly, any new investor buying gold today will wish they bought sooner. Some of those already in gold might think it's time to get out. I mean, how much lower can the stock market drop when priced in gold? Isn't this time to swap back...selling metal and buying shares? Very possibly, yes. Dividing one by the other, the FTSE All-Share index has sunk from 8.6 ounces of gold in April 2005 to just 2.3 ounces today. Put another way, gold has become nearly 4 times more valuable in terms of listed corporate assets. So if you sold shares and bought gold in April 2005, then good for you. Because you can now buy almost 4 times as much UK equity with your metal. But what if you miss the final move? What if the UK stock market sinks to its record low against gold... ...dropping to just 0.75 ounces... ...as it did amid the Oil Crisis collapse of 1973-74...? That would see gold rise almost 3-fold further in terms of UK equity. And from there, nothing says the historic low can't blow out either. I mean, just look at oil.

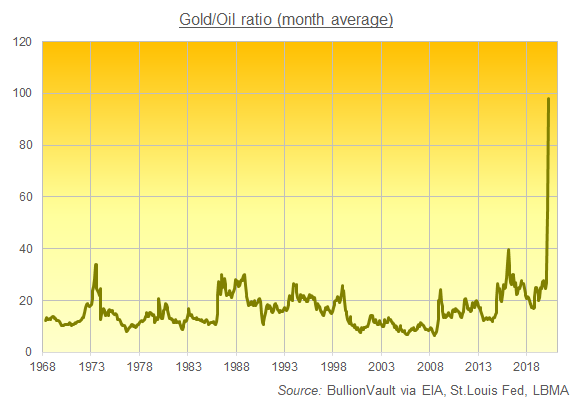

Priced in cash, US crude oil actually went negative last week. Yes, producers were paying people to take the stuff away, albeit for a few hours. Partly that was because of how the futures market works. But mostly it was because crude oil is highly useful, vital indeed to our commercial and economic life. And that life is on pause right now. Hence the collapse in oil demand. Hence the glut of crude...the lack of spare storagespace...and the dozens of massive tankers floating off Southern California, stock full of oil with nowhere to go. Gold, in contrast, is pretty much useless for anything but storing wealth. And while London and Zurich's vaults are also filling up, that's because people actually want and are buying the stuff...not because they are refusing it. Quite the opposite. Tracking this move from useful to useless, how many barrels of crude oil could you get for 1 ounce of gold? Prior to March 2020, the Gold/Oil Ratio averaged 14 barrels per ounce. Over the last 5 decades or so, it moved between 7 at gold's lowest to 40 at its dearest. Then all of a sudden it jumped to new highs. Last month it averaged 55... ...and so far in April the Gold/Oil ratio stands at 98. Last Monday's negative values confuse things a bit. But all-time highs and lows exist to be broken. Who ever thought crude oil would go negative? Who ever imagined a catastrophe quite like Covid-19...? BullionVault wasn't built on any such foresight. Not specifically. But bad things do happen, awful and terrible things which...besides destroying livelihoods and lives...can leave savers poorer by crushing the value of what they've put aside. That's why, back in 2005, it simply seemed that adding a little gold to your investments looked a wise move. We think it still does. Because by spreading your risk...and by rebalancing your assets every so often...you don't have to try so hard to guess what the future will bring. |

Well done you guys! Fantastic news ...Just hit +100% on ODX lads

Contigo what % if any above spot are you being asked to pay? It would give others a guide and are you taking immediate possession or being asked to wait a week or two for delivery?Just buying up some physical Gold and Silver. Stocks getting low, means one thing. $3000 per oz very possible for Au!

Wait a day or two! This is going to the wire ...Just buying up some physical Gold and Silver. Stocks getting low, means one thing. $3000 per oz very possible for Au!

Target one quid which is about 200%... But will take profit by end of week if stopped goin upNice one Delmonte. Does ODX have further to go in your view or will you be selling up?

Agreed, the Fed will jawbone higher which will set the price down a bit this week.....wait and buy more after the Fed meeting. any dip is a buying opportunity.Wait a day or two! This is going to the wire ...