The decimation of other asset classes is only being delayed by constant and HUGE central bank intervention. In terms of “true price discovery” that decimation has already taken place.

Surely you can see that.

Anyone invested in this market on a “long basis” is hanging their hat on successful central bank manipulation- forever. That’s fine if they get it right.

If the Fed and other Central banks hadn’t intervened the entire bond and stock market would have collapsed into the financial Abys about a month ago.

You ( and many analysts/ “experts”) seem unable to comprehend that reality and fundamentals are totally dislocated from today’s “rigged markets”.

I’m gonna call out BS analysis that ignores the obvious- I note you ignored the debt and unemployment woes question, just like they did.

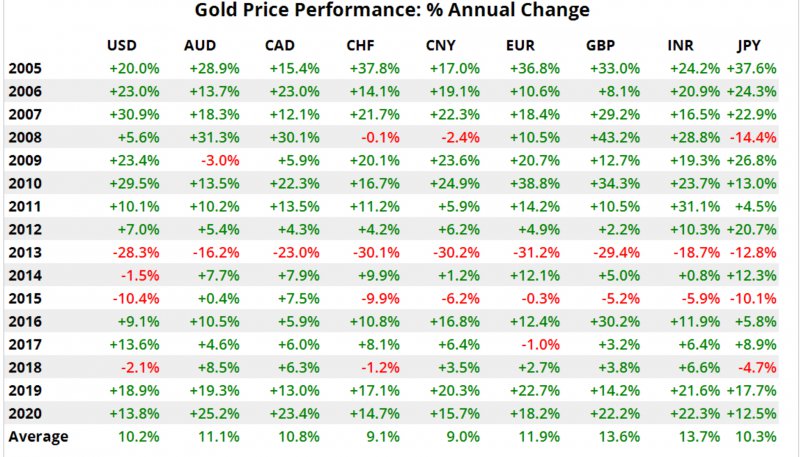

Re precious metals, this thread is for people interested in making money. Funnily enough precious metals have done just that which is why I will continue to tout them here.

View attachment 69053

Are you Daniel Ivandjiiski in disguise?