Froddy

Member

- Messages

- 1,072

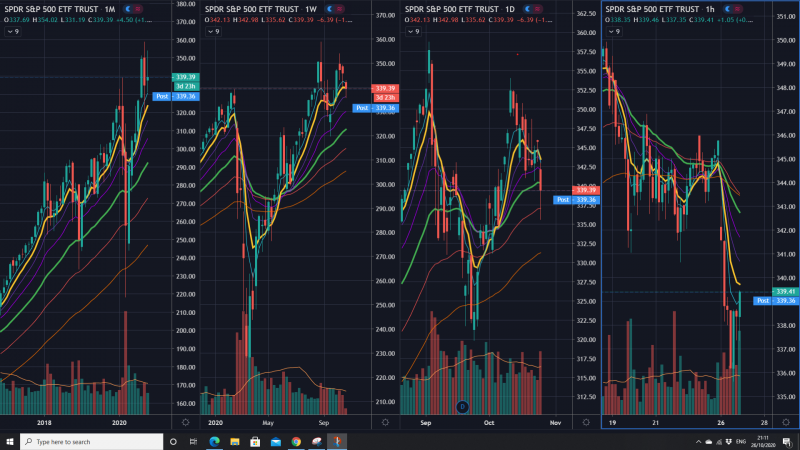

Watch gold (spot) too.

It's in a volatility squeeze on both the daily and the 4 hour charts, and yesterday was an "inside candle" day which represents indecision.

The price has today broken above yesterday's high, which suggests upward continuation (see chart below).

There are two caveats to be aware of: first, US retail sales data will impact the US$ at 13.30 today; secondly, today is monthly and weekly options expiration day and the markets will be heavily manipulated.

It's in a volatility squeeze on both the daily and the 4 hour charts, and yesterday was an "inside candle" day which represents indecision.

The price has today broken above yesterday's high, which suggests upward continuation (see chart below).

There are two caveats to be aware of: first, US retail sales data will impact the US$ at 13.30 today; secondly, today is monthly and weekly options expiration day and the markets will be heavily manipulated.