Froddy

Member

- Messages

- 1,072

Hi Loz,Anyone care to explain last few days dollar shift , Ive got a few zero's to change up ...............how long is it worth holding on

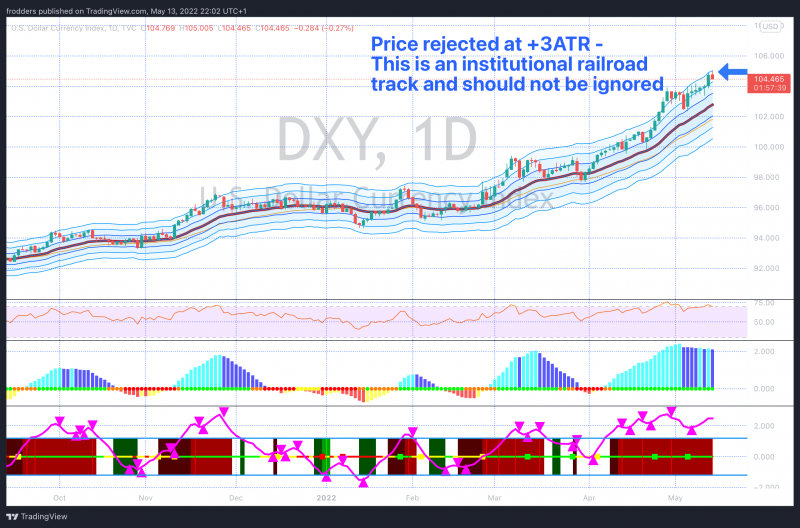

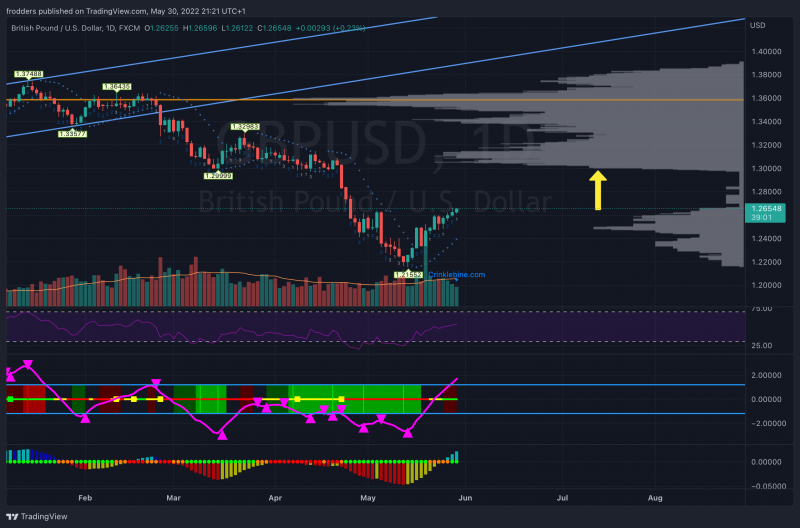

This is a difficult one to answer. Both currencies look like they're at risk of exhaustion and ripe for a correction (dollar is at +3ATR on the weekly chart, and pound is at minus 3 ATR on the weekly chart). The fly in the ointment is that the dollar index (DXY) is potentially forming a rounding bottom pattern - if this completes, it's a technically bullish pattern; on the other hand, it may fail and make a double top. We'll have to wait and see. I'd say the probabilities favour a dollar pullback rather than a continuation, over the coming weeks, but who knows? Anything can happen!