You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

MORTGAGE RATES STICK OR TWIST ?

- Thread starter Spartacus

- Start date

GeoffCapes

Member

- Messages

- 14,000

I still say take the fixed mortgage. They reckon inflation could hit 15% next year so more rises will inevitably on the way.

But what do I know?

But what do I know?

MarkMas

Chief pedant

- Messages

- 8,899

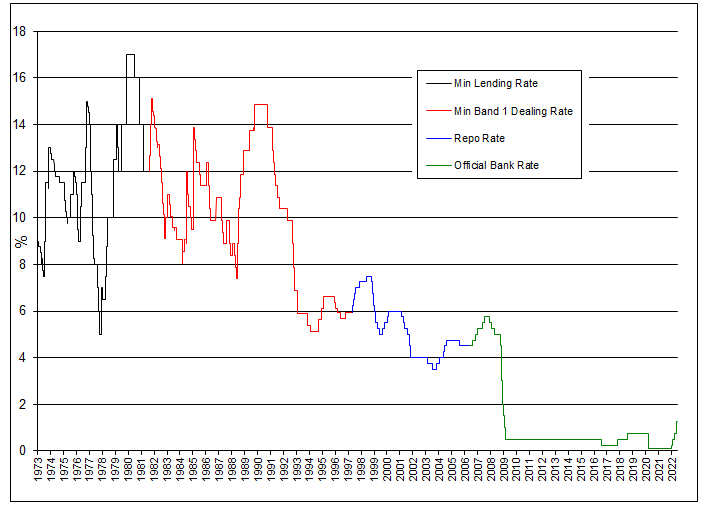

So it looks like the interest rate is going up by 0.5% today. Should I still take out a 5 year fixed mortgage if I can get it in today ? Or is this a rise before they come down again ?

Depends a bit on your ability to survive a big rate increase. Fix asap if a big hike would be a big problem. But if you have more financial flexibility / resilience, you could delay and take a chance on rates coming down a bit (I think they might) or going up a lot (which is always a risk).

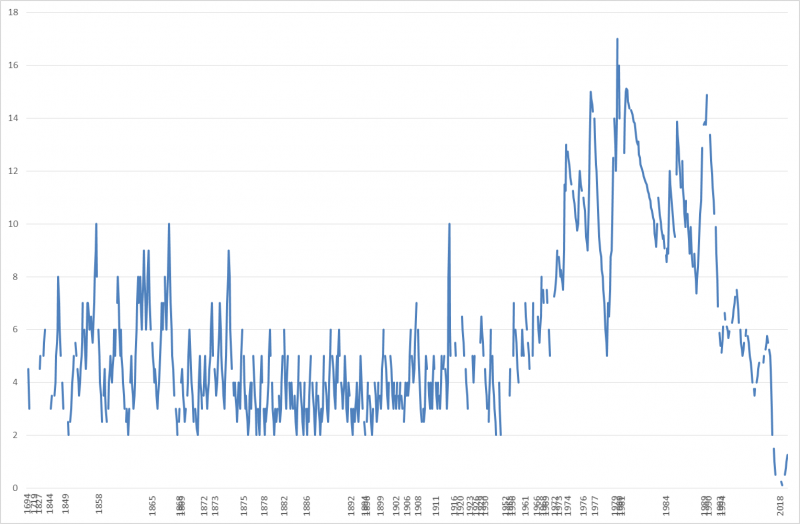

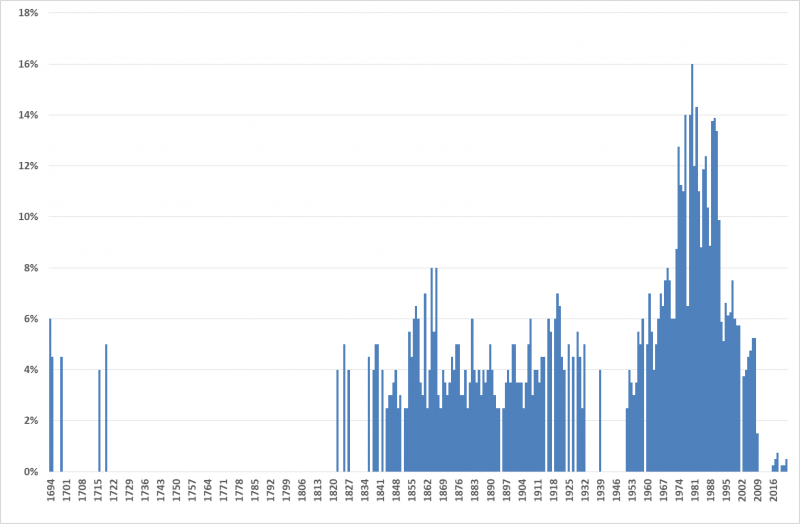

UK Bank Rate:

ravingfool

Junior Member

- Messages

- 52

Surely fix for as long as you can justify in your current circumstances (considering risk of needing to change mortgage deal to increase borrowing or move).

Seems somewhat unlikely that rates will go lower again but even if they do the reduction in your mortgage interest is likely to be trivial whereas an increase in rates could lead to significant increase in monthly cost of a mortgage.

I'm seeing corporates agreeing 10+ year fixed terms on borrowing at the moment to protect against interest cost rises.

Seems somewhat unlikely that rates will go lower again but even if they do the reduction in your mortgage interest is likely to be trivial whereas an increase in rates could lead to significant increase in monthly cost of a mortgage.

I'm seeing corporates agreeing 10+ year fixed terms on borrowing at the moment to protect against interest cost rises.

damnawivdaplan

Member

- Messages

- 322

mines fixed for 5 years at 1.58% got that deal two years ago

Wattie

Member

- Messages

- 8,640

What’s the difference monthly between variable and fixed in terms of payments to you each month?

Theres usually a higher cost for fixing…..what is it monthly?

My gut feeling on this is that central banks are trapped. If they continue to raise interest rates more and more are gonna default……they will avoid this.

Do banks wanna repossess houses during a recession? No.

There’s is so much unaffordable (at normal interest rates) debt out there that I can see banks introducing “mortgage forgiveness” plans where people can pay what they can afford…(like Covid relief) to avoid default (and repossession)……until rates fall.

Can kicked down the road once more.

I’ve a variable rate.

They always bail out debtors.

Theres usually a higher cost for fixing…..what is it monthly?

My gut feeling on this is that central banks are trapped. If they continue to raise interest rates more and more are gonna default……they will avoid this.

Do banks wanna repossess houses during a recession? No.

There’s is so much unaffordable (at normal interest rates) debt out there that I can see banks introducing “mortgage forgiveness” plans where people can pay what they can afford…(like Covid relief) to avoid default (and repossession)……until rates fall.

Can kicked down the road once more.

I’ve a variable rate.

They always bail out debtors.

Last edited:

Wattie

Member

- Messages

- 8,640

Au contraire.You are so refreshingly contrarily nonconformist Wattie! As @MarkMas says, depends on your risk appetite, and yours it definitely higher than most!

Eb

I’ve been in capital preservation mode for years.

central bankers always bail out the indebted. If they don’t the Ponzi scheme falls apart.

They rely on those with money continuing to pay whilst they bail out those that can’t.

it’s not risk appetite.

They lent “risk” to those that can’t afford it.

They always bail them out or it collapses.

Wattie

Member

- Messages

- 8,640

Depends on your bank.Out of interest, how long after the rate rise announcement do the actual rates go up ?

By the way, I think it’s worthwhile asking your bank/bs now what sort of leaway they will give you as you’re concerned about rising rates.

What can they do for for you?

Last edited:

GeoffCapes

Member

- Messages

- 14,000

Out of interest, how long after the rate rise announcement do the actual rates go up ?

That day.

GeoffCapes

Member

- Messages

- 14,000

3.4% is the best I can get on a fixed 5 year . Is that good or bad?

I'd say pretty good. I think our 5 year which we signed 2 years ago was 3.3%