I’m not entirely convinced I’m grabbing a massive tax handout, it doesn’t feel like it, I am paying 2% BIK to the treasury, the treasury isn’t paying me.

But perhaps you are right and now I feel bad about my life choices, if I hadn’t taken the Tesla I would be running my own private dirty diesel and my cash alternative would go towards the cost of my fuel at £1.70 per litre with 53p on duty and 28p on vat. so not only am I robbing the treasury of the well-deserved additional PAYE and national insurance on the cash alternative, I’m stealing the tax from the lovely diesel too.

It’s a good job I also run a treasury friendly V8 then and part with over £600 road fund license for the pleasure.

Don’t get me wrong, I don’t blame people for doing it at all ! To be honest I should do it, it makes for a cheap car either to buy or lease as a runabout, if I wanted a new runabout.

It’s the political aspect I don’t like, suggesting there’s a big boom in ev sales because that’s what the people want. Maybe it is, they are good as urban runabouts but what they won’t say is that most of them are only bought because the taxpayer is funding a large part of their cost.

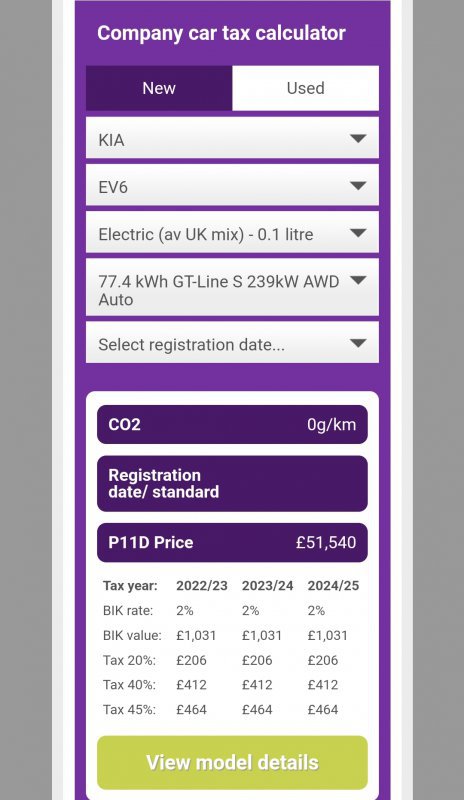

A rough example below, anyone feel free to debunk my numbers.

Mr X earns £60k/year.

Currently leases mid range golf as family runabout for £399/month (deposit included).

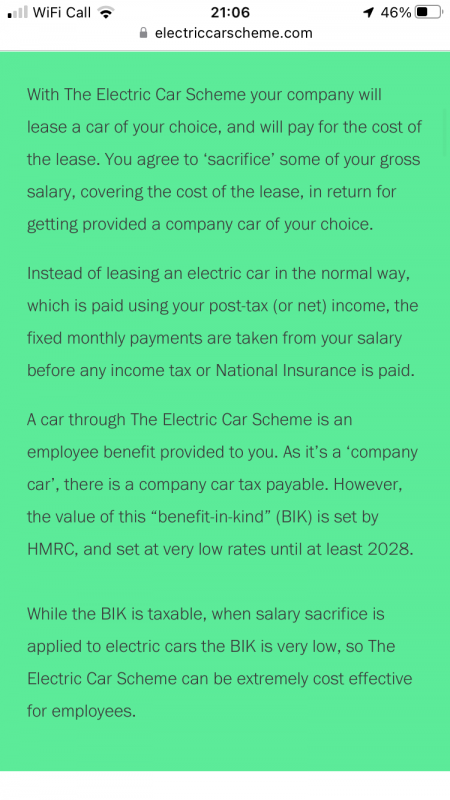

Company has salary sacrifice scheme for EV’s.

Annual lease cost of Tesla model 3 £8k/year.

This is offset against tax at 40%, NI at 3.5% .

Tax saved 43.5% of £8k = £3460/year

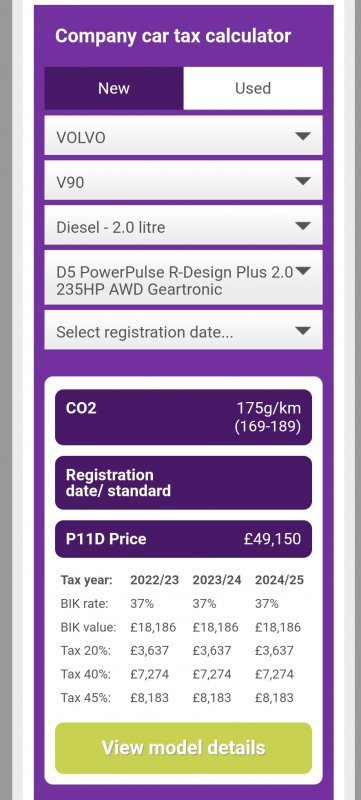

BIK at 2 % of value of car circa £55k = £1100.

£1100 tax bill at 40% so cost to employee is just £440/year

Therefore tax subsidy on car is £3020 compared to if leased personally out of taxed income.

Effective lease cost is now £4980/year, £415/month, instead of £665/month if you just leased one personally, which at that price you probably wouldn’t do.

Only £15/month more than a mid range golf! Plus no fuel to buy! It’s a no brainier.

Just seems to me in a ‘cost of living crisis’ governments using tax receipts to fund £50k plus EV’s is a tad odd.

But if course it help the people on the scheme with their costs!